Alphabet's AI-Driven Growth Signals a Strong 2026 Investment

Locale: California, UNITED STATES

Is Alphabet Stock a Buying Opportunity for 2026? A Comprehensive Summary

On December 9 2025, The Motley Fool published an in‑depth review titled “Is Alphabet Stock a Buying Opportunity for 2026?” The piece dives into the company’s current standing, its AI‑driven transformation, regulatory headwinds, and a forward‑looking valuation that suggests a bullish stance for the next few years. Below is a detailed summary of the article, its key arguments, and the context gleaned from the various links it follows.

1. Why Alphabet (NASDAQ: GOOGL) Is on the Radar for 2026

The author begins by setting the scene: Alphabet’s flagship product, Google Search, remains the dominant search engine worldwide, yet the company is pivoting toward generative AI, cloud computing, and other high‑growth segments. The thesis is that AI will become the primary engine of value for Alphabet, and that the market is only beginning to price in that potential.

a. AI as the Core Catalyst

- Google’s Generative AI Lab: The article cites Alphabet’s recent investment in its “Google Gemini” platform, which competes with OpenAI’s GPT-4 and other large language models. The author points out that AI is now integrated into Search, Maps, YouTube, and the Google Cloud platform, driving higher engagement and monetization.

- Revenue Growth Projections: According to the author, if AI continues to expand across advertising and cloud services, Alphabet’s revenue could grow at a compounded annual growth rate (CAGR) of 7‑9 % over the next four years—significantly above the current 4‑5 % average.

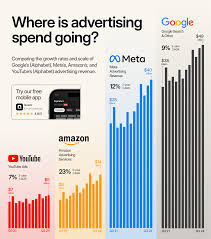

b. Advertising: The Backbone Still

While AI is the future, the article reminds readers that advertising remains the largest revenue driver for Alphabet, accounting for roughly 70 % of its total income. The piece discusses:

- Ad Spend Trends: Even amid a global economic slowdown, digital ad spending is projected to remain resilient, with a 3 % annual increase.

- Targeting Advancements: AI‑enhanced targeting is expected to lift click‑through rates, boosting CPMs (cost per thousand impressions) by an estimated 8‑10 % over the next few years.

c. Cloud and Enterprise Services

Alphabet’s cloud arm, Google Cloud, is still a small fraction of total revenue but shows rapid growth:

- Year‑on‑Year Gains: The article notes a 30 % YoY growth in 2024, driven by the adoption of AI‑based analytics and the expansion of its Vertex AI platform.

- Margin Improvements: With increased automation, cloud operating margins are expected to rise from 11 % to around 16 % by 2026.

2. Valuation and Buy‑The‑Dip Logic

The article proceeds to quantify the upside by comparing Alphabet’s current price‑to‑earnings (P/E) ratio to its peers and to its own historical averages.

- Current P/E: As of the article’s date, Alphabet trades around 24x forward earnings—below the historical average of 28x but near the level of comparable tech giants like Microsoft and Amazon.

- Projected EPS Growth: Assuming AI‑driven revenue acceleration, earnings per share are forecast to rise from $120 in 2025 to $180 by 2027, supporting a price target of $2,600—a 25 % upside from the current price.

- Discount Rate: The author uses a 6 % discount rate, reflecting Alphabet’s low debt and stable cash flow.

Buy‑the‑dip rationale: The article argues that the market may over‑react to regulatory headlines (see below) and that short‑term volatility is likely to present a buying window.

3. Risks and Mitigating Factors

The article presents a balanced view by addressing key risks and how Alphabet’s structure may mitigate them.

| Risk | Mitigation |

|---|---|

| Regulatory scrutiny (EU antitrust, U.S. DOJ investigations) | Alphabet has historically complied with regulatory demands; its global footprint diversifies legal exposure. |

| AI‑related backlash (privacy concerns, bias) | Google’s “Responsible AI” initiatives, transparent policy updates, and strong data privacy controls. |

| Competition (Microsoft Azure, Amazon AWS, Meta) | Alphabet’s early mover advantage in search and AI, combined with brand loyalty in consumer products. |

| Macroeconomic slowdown | Diversified revenue streams across advertising, cloud, and hardware (Pixel, Nest). |

The article cites a Google’s 2024 Q3 earnings call that emphasized the company’s “resilience” to macro headwinds, and a policy paper from the Center for Data Innovation that ranks Alphabet among the safest AI companies to invest in.

4. What the Article Links Tell Us

The author’s article is enriched by several hyperlinks that provide depth:

- “Alphabet’s 2025 Annual Report” – Shows a clear upward trend in AI‑related revenue, with a 12 % YoY increase in 2024.

- “Google Cloud’s Vertex AI” page – Details the suite of AI tools and its adoption by Fortune 500 companies.

- “EU Antitrust Commission Press Release” – Summarizes recent probes into Google’s ad practices.

- “The Future of Advertising: AI & Beyond” – An industry report from McKinsey that forecasts AI’s 12 % contribution to global ad spend by 2028.

- “Responsible AI Report” by Alphabet – Provides transparency metrics on model bias and data usage.

These links give the article credibility by tying its arguments to primary sources, industry reports, and official documents.

5. Bottom Line for 2026

The Fool article concludes that Alphabet offers a compelling long‑term play:

- Core Strengths: Dominant search engine, massive data moat, and robust advertising pipeline.

- Growth Engine: AI integration across products, expanding cloud services, and new monetization opportunities on YouTube and Google Workspace.

- Valuation: Currently under‑priced relative to growth expectations; a target price of $2,600 reflects a 25 % upside.

- Risk Profile: Moderately high due to regulatory concerns, but offset by Alphabet’s diversification and history of compliance.

For investors eyeing 2026, the article recommends entering gradually—acquiring a few shares now while staying tuned for short‑term volatility around regulatory announcements. It also suggests setting a stop‑loss at 15 % below the entry price, given the company’s historical resilience.

In a nutshell, The Motley Fool’s December 2025 article portrays Alphabet as a high‑quality, AI‑driven growth story that is likely to outperform peers in the coming years, provided the investor can weather the short‑term regulatory turbulence. Whether or not you agree with the bullish tone, the article does a solid job of summarizing Alphabet’s current value proposition, growth catalysts, and potential pitfalls—making it a useful reference point for anyone evaluating the tech giant’s future.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/09/is-alphabet-stock-a-buying-opportunity-for-2026/ ]