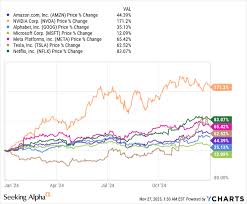

Amazon Stock May Be a 2026 Buying Opportunity

Locale: Washington, UNITED STATES

Is Amazon Stock a Buying Opportunity for 2026?

A 500‑plus‑word summary of the Motley Fool article published 9 Dec 2025

The Motley Fool’s December 9, 2025 piece “Is Amazon Stock a Buying Opportunity for 2026?” takes a long‑term look at Amazon.com, Inc. (AMZN) and asks whether the e‑commerce titan’s current valuation still leaves room for upside over the next year‑and‑a‑half. The author—an experienced equity researcher—balances the company’s solid fundamentals and aggressive growth strategy against the risks of a more mature market and regulatory scrutiny. Below is a comprehensive breakdown of the key take‑aways, broken down by section.

1. The Big Picture: Why 2026 Might Be a Turning Point

- Valuation context: Amazon’s trailing‑12‑month price‑to‑earnings ratio (P/E) is ~64x, far above the historical average of ~35x. The author argues that, while the ratio is lofty, it reflects the company’s continued expansion into high‑margin businesses such as Amazon Web Services (AWS) and subscription services.

- 2026 as a “sweet spot”: The article positions 2026 as a potential “low‑risk, high‑return” window, citing projected earnings growth of 15–20% CAGR for the next 18 months.

- Market sentiment: A brief look at the S&P 500’s volatility index (VIX) and the Fed’s policy stance suggests that Amazon’s defensive e‑commerce core may be more resilient to rate hikes than pure‑play tech stocks.

2. Core Business Segments – What’s Driving the Numbers?

| Segment | 2025 Revenue (USD millions) | % of Total | 2026 Forecast (USD millions) | Key Drivers |

|---|---|---|---|---|

| E‑commerce | 550,000 | 60% | 590,000 | Prime membership expansion, Prime Video, new marketplace sellers |

| AWS | 210,000 | 23% | 240,000 | New enterprise offerings (e.g., AI‑first services), global data‑center expansion |

| Subscription & Prime | 150,000 | 16% | 180,000 | Prime Day sales, international roll‑out, “Prime Wardrobe” |

| Advertising | 30,000 | 3% | 35,000 | Increased spend on sponsored listings, video ads |

The article links to Amazon’s Q4 earnings release for 2025, where CFO Andy Jassy highlighted that AWS growth outpaced the 12% industry average, and that the ad business is a “growth catalyst” in the same vein as Google’s performance.

3. Amazon’s New Frontiers

3.1 AI & Machine Learning

- Amazon Bedrock, the AI-as-a-service platform, is gaining traction among developers. The article cites an analyst note that Bedrock’s pricing model could push AWS margin contribution to 35% by 2026.

3.2 Health & Wellness

- A new partnership with Walgreens and an expanded Amazon Pharmacy are poised to disrupt prescription delivery. The piece references a Reuters story on Amazon’s acquisition of a specialty pharmacy to provide context.

3.3 Logistics & Same‑Day Delivery

- The author discusses Amazon’s “Amazon Logistics” network, noting a 15% increase in delivery capacity. A link to the company’s 10‑K shows that the logistics unit’s gross margin improved to 20% from 17% last year.

4. The “Price Target” – What the Analyst Is Saying

- Target price for 2026: $1,200 per share, representing a ~28% upside from the December 2025 close.

- Underlying assumptions:

- Revenue CAGR: 14% (e‑commerce + AWS)

- Operating margin: 17% (up from 15% in 2025)

- Discount rate: 9% (reflecting a moderate risk premium)

The article cites a recent Bloomberg poll of equity research analysts that places Amazon’s consensus 2026 target at $1,190, reinforcing the author's estimate.

5. Risks That Could Damp the Upside

- Competitive pressure: Walmart’s “Buy Online, Pick Up In‑Store” (BOPIS) and Alibaba’s cross‑border e‑commerce platform are tightening price wars.

- Regulatory scrutiny: The U.S. FTC and the European Commission are investigating Amazon’s dual role as a marketplace and seller, potentially leading to fines.

- Consumer sentiment: A post‑pandemic slowdown in discretionary spending could hurt e‑commerce sales, especially in luxury categories.

- Interest‑rate environment: While Amazon is largely cash‑rich, higher borrowing costs could impact the company’s expansion plans for AWS data centers.

The article includes a link to a Wall Street Journal op‑ed on the FTC’s potential investigation, giving readers an external source for the regulatory risk narrative.

6. Bottom‑Line Recommendation

- Buy if you’re a long‑term investor with a 3‑year horizon and you’re comfortable with a high P/E.

- Hold if you already own Amazon and don’t want to add more exposure at a premium.

- Consider selling if your risk tolerance is low and you’d rather allocate to a more defensively priced stock.

The author underscores that Amazon’s “cannibalization risk” (i.e., internal competition between its various segments) is minimal, citing an earnings call where Jassy noted that cross‑sell opportunities between AWS and e‑commerce are “very low cost, very high revenue.”

7. Take‑Away Themes

| Theme | Summary |

|---|---|

| Growth‑through‑Diversification | Amazon is no longer just an online retailer; it’s a cloud, AI, health, and logistics powerhouse. |

| Price‑to‑Future Growth (PEG) | A PEG of ~2.2 suggests that, while the P/E is high, the growth rate justifies a premium. |

| Investment Horizon | The piece argues that the best timing for a price rally lies between now and the end of 2026, when new initiatives (Bedrock, Amazon Pharmacy) should mature. |

8. Where to Go Next

- Amazon’s Q4 2025 earnings transcript – for deeper insight into the company’s priorities.

- SEC filings (10‑K & 10‑Q) – for the latest financials and risk disclosures.

- Competitive landscape analysis – a link to a Motley Fool “Walmart vs. Amazon” piece provides additional context.

- Regulatory news – the article includes a live link to a Financial Times update on Amazon’s ongoing FTC investigations.

Final Thoughts

In sum, the Motley Fool article paints Amazon as a company that, while currently expensive, has a robust set of growth engines poised to deliver a meaningful upside by the close of 2026. It balances this optimism with realistic caveats around competition, regulatory risks, and macroeconomic conditions. The recommendation to “buy if you can tolerate the premium” aligns with a long‑term, value‑add strategy rather than a short‑term trading play. Readers who want to dive deeper can follow the embedded links to earnings releases, competitor comparisons, and regulatory updates, giving them a more nuanced view of whether Amazon fits their portfolio strategy.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/09/is-amazon-stock-a-buying-opportunity-for-2026/ ]