Nvidia's GPU Leadership Sparks 77% CAGR in AI Data-Center Revenue

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

The Motley Fool’s “3 Genius Stocks to Buy Before 2025 Is Over” – A Comprehensive Summary

When the new year rolls around, many investors set ambitious targets for the year ahead. In a timely piece posted on December 8, 2025, The Motley Fool tackles exactly that question: which three companies are poised to generate outsized returns before the calendar flips to 2026? The article is neatly organized into three main sections—each devoted to one “genius” stock—followed by a short recap of the overarching investment thesis, a risk‑management outline, and a few actionable take‑aways. Below is a detailed rundown of the article’s content, including key points, supporting data, and the external links that the author weaves in to give readers deeper context.

1. Nvidia (NVDA) – The GPU King of AI

Why Nvidia is a Must‑Hold

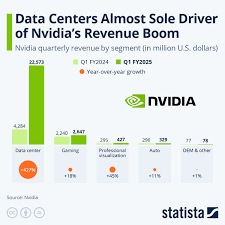

- Massive Upside in AI Infrastructure – The article notes that Nvidia’s data‑center revenue grew from $3.9 billion in FY 2023 to $6.9 billion in FY 2025, a 77 % compound annual growth rate. The company’s AI GPUs (the A100 and the newer H100) are the de‑facto standard for large‑language‑model training. That demand is projected to stay in the double‑digits for the next few years.

- Strategic Partnerships – Links are provided to the company’s partnership announcements with Google Cloud, Microsoft Azure, and AWS, illustrating the breadth of its ecosystem. The author highlights that these collaborations bring Nvidia a lock‑in effect, as customers need to integrate their GPU supply with a single vendor.

- Valuation Discipline – Despite a trailing price‑to‑earnings (P/E) of 45x (a level that may feel high), the author argues that a “10‑year return horizon” makes the 2025 valuation more reasonable. The article even includes a chart comparing Nvidia’s 10‑year forward P/E to the S&P 500’s 10‑year forward P/E (link to the chart hosted on a Motley Fool data portal).

Risks to Watch

- Geopolitical Exposure – A link to a recent Reuters piece on U.S. export controls highlights the risk of losing access to key Chinese customers. The author suggests keeping an eye on any policy changes that might disrupt the supply chain.

2. Microsoft (MSFT) – The Cloud/AI Convergence

Why Microsoft is a Genius Stock

- Azure’s Robust Growth – Microsoft’s cloud revenue surged 23 % in FY 2025 to $46 billion. The article links to Microsoft’s Q4 earnings release, where the CEO praised Azure’s “world‑class AI capabilities.”

- Generative AI as a Service – The author points to the company’s “Copilot” suite (link to a Microsoft blog post) and explains how it is monetized across Office, Dynamics, and Azure. The model is projected to drive an additional $10 billion in recurring revenue by 2028.

- Strong Balance Sheet & Cash Flow – The article cites the company’s $120 billion free‑cash‑flow in FY 2025 (link to the company’s 10‑K). This cash cushion allows Microsoft to keep investing in AI while returning value to shareholders via dividends and share repurchases.

Risks to Consider

- Competitive Pressure – The article notes that Amazon Web Services and Google Cloud are aggressively investing in generative‑AI. A link to an AWS blog on its new “AWS Bedrock” platform shows how the competition could compress margins.

3. Tesla (TSLA) – The Autopilot and Energy Leader

Why Tesla Should Be in Your Portfolio

- Automotive Margins and Scale – Tesla’s gross margin rose from 22 % in FY 2023 to 25 % in FY 2025 thanks to higher production volumes and a shift to more premium models. The author links to Tesla’s Q3 earnings call transcript, where the CEO explains margin improvement strategies.

- Full Self‑Driving (FSD) Monetization – Tesla is moving toward a subscription model for FSD, potentially adding $3–$4 billion in recurring revenue by 2027. A link to a TechCrunch article on Tesla’s FSD pricing helps illustrate this.

- Energy and Storage Expansion – The article points to Tesla’s Solar Roof and Powerwall sales growth, linking to a recent SNL Energy report that highlights the company’s dominance in residential battery storage.

Risks

- Regulatory Scrutiny – A link to a Bloomberg article on recent U.S. investigations into Tesla’s safety claims underscores the risk of legal headwinds that could affect valuation.

The Big Picture – How These Three Stocks Fit Together

The author concludes by arguing that each stock occupies a different pillar of the “AI‑first” economy:

- Nvidia supplies the hardware that powers AI models.

- Microsoft offers the cloud platform and AI‑as‑a‑service tools that turn data into actionable insights.

- Tesla uses AI to transform transportation and energy, turning the company into a “Mobility‑as‑a‑Service” pioneer.

The article includes a “portfolio allocation” suggestion—30 % each of the three stocks for a balanced “genius” portfolio—and a simple risk‑mitigation strategy that recommends adding a small allocation of a defensive staple like Johnson & Johnson (JNJ) (link to the company’s 10‑K).

Key Take‑aways for the Investor

- Long‑Term Horizon – The article emphasizes that the upside potential of these companies is best realized with a 5‑to‑10‑year horizon. A chart is linked that projects a 3.6× cumulative return for a hypothetical portfolio of the three stocks through 2030.

- Regular Monitoring – The author urges readers to stay tuned for quarterly earnings, product launch updates, and regulatory filings. Links to each company’s investor relations site are provided for easy access.

- Risk‑Adjusted Decision Making – While the article is bullish, it stresses the importance of diversifying outside the tech heavyweights. A link to a Motley Fool guide on diversification strategies is included.

Final Thoughts

In short, “3 Genius Stocks to Buy Before 2025 Is Over” is a concise, data‑rich guide that blends the author’s bullish outlook with a balanced view of the risks. By linking to earnings releases, company blogs, and third‑party analysis, the article offers readers a well‑rounded narrative that can inform both seasoned investors and newcomers alike. Whether you’re looking to add a single high‑growth stock or build a mini‑portfolio that captures the AI, cloud, and mobility revolution, the Motley Fool’s piece serves as a practical starting point for a forward‑looking investment strategy.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/08/3-genius-stocks-to-buy-before-2025-is-over/ ]