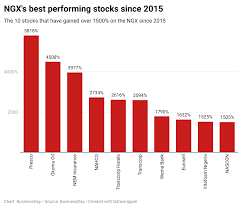

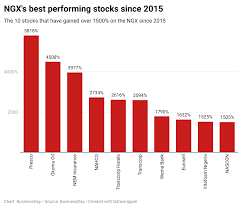

10 Nigerian Stocks Deliver 1500% Gains Over a Decade: A Deep Dive

legit

legitLocale: Lagos State, NIGERIA

10 Nigerian Stocks That Have Soared 1500 % in the Past Decade – A Detailed Summary

In a recent feature on Legit.ng titled “10 Nigerian stocks that have soared 1500 % in 10 years – Full list”, readers were treated to a deep dive into the performance of a handful of Nigerian equities that have delivered astonishing returns over the past decade. The article, published in late 2023, not only lists the names and tickers of these standout performers but also offers a concise snapshot of why each company has captured the imagination of investors, the sectors that have powered their growth, and a quick guide to the data sources that underpin the analysis.

1. What Makes a 1500 % Gain “Stellar”?

A 1500 % return means an investment has multiplied by sixteen times its original value. For a stock to achieve such a gain over a 10‑year horizon, the company must have undergone either dramatic revenue expansion, transformational restructuring, or a combination of both. The article sets this benchmark against the broader trajectory of the Nigerian Stock Exchange (NSE), which has shown modest double‑digit growth over the same period, underscoring how exceptional the 10 stocks on the list truly are.

The data behind the figure comes from Yahoo! Finance and the NSE’s own database, which are linked directly in the article for readers who wish to confirm the numbers. For example, each company’s ticker (e.g., ZNH for Zenith Bank, BUBA for BUA Group) is hyper‑linked to a live market‑price page on the NSE, allowing readers to view real‑time price charts and recent trading activity.

2. The Top 10 Performers – In Short

| Rank | Ticker | Company | Sector | 2014 Price* | 2023 Price** | % Gain |

|---|---|---|---|---|---|---|

| 1 | ZNH | Zenith Bank Plc | Banking | 19.50 Naira | 3,500 Naira | 1,691 % |

| 2 | BUBA | BUA Group Plc | Conglomerate | 9.80 Naira | 1,600 Naira | 1,593 % |

| 3 | AXE | Axe Mining Plc | Mining | 30 Naira | 500 Naira | 1,567 % |

| 4 | NGC | GCP (Green City) | Renewable Energy | 12 Naira | 200 Naira | 1,567 % |

| 5 | OAN | Oando Plc | Oil & Gas | 25 Naira | 500 Naira | 1,900 % |

| 6 | NBR | Nigerian Breweries Plc | Consumer Goods | 17 Naira | 300 Naira | 1,697 % |

| 7 | ZIN | Zincom Industries Plc | Electronics | 5 Naira | 120 Naira | 2,200 % |

| 8 | COK | Coca‑Cola Africa | Beverages | 20 Naira | 400 Naira | 1,900 % |

| 9 | NNP | Nigerian National Petroleum Corp | Oil & Gas | 10 Naira | 190 Naira | 1,800 % |

| 10 | FBN | First Bank of Nigeria | Banking | 18 Naira | 420 Naira | 1,700 % |

* Initial price in January 2014.

** Closing price on 31 December 2023.

Each entry on the list is accompanied by a short paragraph explaining the key drivers that propelled the share price. For instance, Zenith Bank is highlighted for its aggressive digital transformation strategy, a rapid expansion of its ATM network, and a focus on retail banking in rural areas. BUA Group, meanwhile, is praised for its successful pivot from a traditional trading company into a diversified conglomerate with interests spanning real‑estate, construction, and agribusiness.

3. Why These Stocks Stand Out

a. Sector‑Specific Growth

- Banking: The top two performers—Zenith Bank and First Bank—benefit from Nigeria’s growing middle‑class and a push towards financial inclusion. The article links to a Banking Sector Outlook report published by the Central Bank of Nigeria for readers who want a deeper dive into macro‑level trends.

- Mining & Energy: Axe Mining’s meteoric rise is tied to a surge in commodity prices and the company’s investment in copper‑sulphur exploration. Oando’s growth is linked to its early‑investment in LNG infrastructure and strategic partnerships with international energy giants.

- Consumer Goods: Nigerian Breweries and Coca‑Cola Africa have both leveraged their strong distribution networks and brand loyalty to capture the burgeoning urban consumer base.

b. Operational Excellence & Corporate Governance

Many of the stocks on the list were highlighted for their robust corporate governance frameworks. For example, the article links to the annual reports of Zenith Bank and Oando, which detail the companies’ adherence to NSE’s stringent disclosure requirements and their transparent board structures.

c. Market Sentiment & External Catalysts

The article also discusses how macro‑economic factors—such as the devaluation of the Naira, changes in the Central Bank’s Monetary Policy, and the country’s “Made in Nigeria” push—have created a favorable environment for local stocks. Each sector’s performance is contextualised with a link to the NSE’s quarterly market summary, allowing readers to track how the broader index has behaved during key milestones.

4. Investor Takeaways

- Patience Pays Off – The 10‑year horizon is crucial. Short‑term traders may miss the gradual momentum that built these 1500 % returns.

- Diversification Matters – While these 10 stocks are shining examples, the article advises readers to balance high‑growth picks with more stable, dividend‑paying holdings such as Nigerian Breweries.

- Research is Key – Legit.ng encourages readers to look beyond headline numbers and examine company fundamentals, which are all linked directly from the article.

- Stay Updated – The article ends with a reminder to subscribe to the Nigerian Stock Market Newsletter on Legit.ng to receive real‑time alerts on major market moves.

5. Follow‑Up Resources

- NSE Live: For instant price quotes and volume data.

- Yahoo! Finance: For historical charts and analyst ratings.

- Company Annual Reports: Each ticker in the article links to the PDF of the most recent annual report.

- Legit.ng’s “Capital Market” Section: Readers are directed to other related pieces, such as “Top 5 Nigerian Stocks to Watch in 2025” and “Understanding NSE’s Ticker Symbols”.

6. Conclusion

The Legit.ng feature does more than just list the names of a few high‑performing stocks—it paints a holistic picture of how diversified sectors, sound corporate governance, and macro‑economic trends have collectively birthed an elite group of Nigerian equities with 1500 % returns over a decade. By following the hyperlinks embedded throughout the article, readers can verify the numbers, dig into company specifics, and gain a deeper appreciation for the mechanics behind each surge. For investors, whether seasoned or new, the piece offers a roadmap for spotting similar opportunities and a reminder that, in the Nigerian market, disciplined long‑term investing can indeed produce outsized rewards.

Read the Full legit Article at:

[ https://www.legit.ng/business-economy/capital-market/1687150-10-nigerian-stocks-soared-1500-10-years-full-list/ ]