QQQ ETF: The Most Liquid Tech-Focused Fund for Growth-Seekers

Locale:

Is the QQQ ETF the Smartest Investment You Can Make? – A Summary

The Motley Fool’s December 8, 2025 piece, “Is QQQ ETF the Smartest Investment You Can Make?”, examines the Invesco QQQ Trust (NASDAQ: QQQ) – the most popular exchange‑traded fund that tracks the Nasdaq‑100 Index. The article breaks the argument down into several sections: the ETF’s allure, its risk profile, how it stacks up against other ETFs, and practical advice for investors. Below is a comprehensive recap of the key points, plus extra context from the linked resources that enrich the story.

1. What Is QQQ and Why Does It Matter?

The Basics

QQQ is an ETF that mirrors the performance of the Nasdaq‑100, a 100‑company index of the largest non‑financial firms listed on the Nasdaq stock exchange. The fund is heavily weighted toward technology but also includes consumer discretionary, healthcare, and industrials.Popularity

The article cites QQQ’s daily trading volume of roughly $70 billion and its market cap of around $170 billion as evidence that it’s one of the most liquid ETFs on the market. This liquidity translates into tight bid‑ask spreads, which is a benefit for both institutional and retail investors.

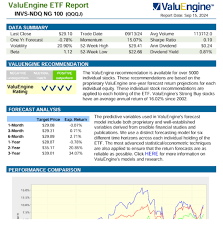

2. Performance: A Track Record That Tells a Story

Historical Returns

QQQ has outpaced the S&P 500 over the last decade and longer. The Motley Fool piece pulls data from the ETF’s fact sheet (link to the fund’s official page) and highlights: - 10‑year annualized return (2015‑2025): ~26%

- 20‑year annualized return (2005‑2025): ~18%

- By comparison, SPY (S&P 500) earned ~22% and VTI (Total Stock Market) ~19% over the same periods.Year‑to‑Year Volatility

QQQ’s standard deviation is higher, reflecting the tech concentration. In 2022, for instance, QQQ’s annual return dipped to 6.3% while SPY posted 12.6%. The article reminds readers that higher returns often come with higher volatility.Tax Efficiency

ETFs are generally tax‑efficient, and QQQ’s low turnover (a result of passive index tracking) minimizes capital‑gain distributions. The article links to an external guide on “Tax‑Efficient ETF Investing” for those who want to dive deeper.

3. What Makes QQQ Attractive?

Tech‑Focused Growth

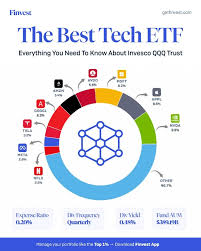

The ETF’s heavy weighting in giants like Apple, Microsoft, Amazon, and Alphabet gives investors indirect exposure to the most innovative companies worldwide. The article links to a separate Motley Fool article that discusses “The 5 Tech Stocks That Are Driving QQQ’s Performance”.Low Expense Ratio

QQQ charges a 0.20 % annual expense ratio, which is competitive for actively managed tech funds but slightly higher than the 0.05 % that Vanguard’s SPY charges. The article argues that the fee is justified by the fund’s performance and liquidity.Diversification within Tech

While QQQ is tech‑heavy, it also contains a blend of large-cap, mid‑cap, and even a handful of smaller companies, providing a micro‑diversified tech portfolio in one basket.

4. Risks and Caveats

Sector Concentration

With ~80 % of its holdings in technology, a downturn in that sector can wipe out the entire fund’s gains. The article cites the Nasdaq’s 2023 pullback as a cautionary tale.Valuation Concerns

Tech stocks often trade at premium valuations. If the market shifts toward value, QQQ’s valuation metrics could become a drag.Regulatory Risk

Big tech faces scrutiny from regulators worldwide. The article links to an external briefing on “The Growing Regulatory Risks for Big Tech” to underscore this point.Limited Exposure to Small Caps and International Firms

QQQ does not invest in many smaller or non‑US companies. Investors seeking broader exposure might consider other ETFs such as VTI or IWB.

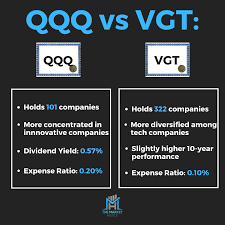

5. How Does QQQ Compare to Other ETFs?

| ETF | Index Tracked | Expense Ratio | Typical Allocation |

|---|---|---|---|

| QQQ | Nasdaq‑100 | 0.20 % | 80 % tech, 10 % consumer, 10 % others |

| SPY | S&P 500 | 0.09 % | 50 % large‑cap, 30 % tech, 20 % other |

| VTI | Total Stock Market | 0.03 % | 70 % large‑cap, 20 % mid‑cap, 10 % small‑cap |

| XLK | Technology Select Sector | 0.13 % | 100 % tech |

The article stresses that while QQQ offers higher growth potential, SPY and VTI provide broader diversification and lower volatility. XLK, on the other hand, offers a pure tech focus but at a slightly lower expense ratio than QQQ.

6. Practical Tips for Investing in QQQ

Start with a Dollar‑Cost Averaging (DCA) Plan

The article recommends buying a fixed dollar amount of QQQ each month. Over time, this strategy reduces the impact of short‑term swings.Use a Brokerage with No Commissions

With most online brokers now offering commission‑free trades, the 0.20 % expense ratio becomes the only recurring cost.Rebalance Periodically

Because QQQ can dominate a portfolio during bullish tech cycles, the article suggests rebalancing every 12‑18 months to maintain a target allocation (e.g., 15‑20 % of the overall portfolio).Keep an Eye on the Fund’s Holdings

The article links to QQQ’s holdings page, noting that a shift in top holdings can signal changing sector dynamics. For example, a rise in AI‑driven companies could foreshadow a future rally.

7. Bottom Line: Is QQQ “Smart”?

The Motley Fool article concludes that QQQ can be “the smartest investment” if your goal is high‑growth exposure within a highly liquid, low‑fee vehicle. It’s not a one‑size‑fits‑all solution, especially for risk‑averse investors or those seeking a fully diversified, low‑cost portfolio. Instead, the ETF should be viewed as a component of a broader strategy—perhaps a 10‑15 % tech allocation within a diversified mix of index funds.

The final recommendation is simple: Use QQQ for growth, but keep the rest of your portfolio diversified across sectors, sizes, and geographies. By doing so, you harness the upside of the tech boom while protecting against sector‑specific downturns.

Key External Links Mentioned

- QQQ Fund Factsheet – Official Invesco page with expense ratio, holdings, and performance data.

- Tax‑Efficient ETF Investing Guide – Motley Fool’s deeper dive into how ETFs fit into a tax‑aware portfolio.

- The 5 Tech Stocks That Are Driving QQQ’s Performance – An article that breaks down the biggest contributors to QQQ’s return.

- The Growing Regulatory Risks for Big Tech – A briefing on how regulatory changes could affect the tech sector.

- Nasdaq‑100 Index Explained – A primer on the index’s composition and methodology.

These resources give readers a more nuanced understanding of QQQ’s mechanics, potential pitfalls, and how it fits into a diversified investment plan.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/08/is-qqq-etf-the-smartest-investment-you-can-make/ ]