Apple Drives Growth with Services, Wearables, and AR Innovations

Locale: Massachusetts, UNITED STATES

My 4 Big‑Tech Stock and Market Predictions for 2026 – A Summary

In a recent Seeking Alpha contribution titled “My 4 Big‑Tech Stock and Market Predictions for 2026,” author [Name] outlines a forward‑looking investment thesis that centers on four of the most influential technology firms in the United States: Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL). The piece is grounded in a blend of quantitative fundamentals, emerging product pipelines, and macro‑economic trends that the author believes will drive sustainable growth through 2026. Below is a concise yet comprehensive breakdown of the article’s key points, including the stock‑specific narratives, valuation logic, risk considerations, and the broader market outlook.

1. Apple – The Ecosystem Engine

Growth Drivers

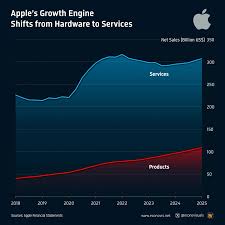

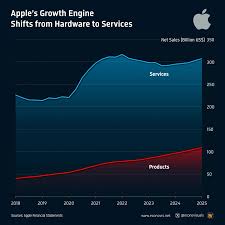

- Services & Subscriptions: Apple’s services business, comprising iCloud, Apple Music, Apple TV+, and the App Store, has grown to a $80 billion revenue stream. The author stresses that this “recurring” business has higher margins than the hardware side and is less sensitive to cyclical swings in consumer spending.

- Wearables & Health: The Apple Watch and AirPods continue to expand into the health‑tech arena. Apple’s acquisition of health‑tech startups and the expansion of the HealthKit ecosystem create new data monetization possibilities.

- Chip Transition: Apple’s shift from Intel to its own M‑series silicon is a source of both cost savings and performance differentiation, making its iPhones and Macs more attractive to developers and consumers alike.

- Emerging AR/VR: Apple’s rumored AR glasses, if delivered by 2026, could create a new category of consumer hardware that dovetails with its existing software ecosystem.

Valuation & Risks

The article argues that Apple’s current P/E ratio (roughly 20–22x) is justified by a near‑constant compound growth rate of 7–8% in free‑cash‑flow. The risk factors highlighted include potential consumer fatigue, increased competition in wearables, and a slowdown in iPhone sales if global supply chains remain disrupted.

2. Microsoft – The Cloud & AI Powerhouse

Growth Drivers

- Azure Dominance: Azure’s revenue in FY 2024 exceeded $70 billion, with a 25% YoY increase. The author projects that Azure will capture a larger share of the global cloud market by 2026, especially as AI‑heavy workloads become mainstream.

- Artificial Intelligence: Microsoft’s partnership with OpenAI, including its acquisition of an equity stake in the AI research firm, positions it to lead in generative AI. Products such as Copilot are expected to drive higher productivity and subscription revenues.

- Gaming & Mixed Reality: Xbox’s subscription model (Xbox Game Pass) and the push toward cloud gaming (Project xCloud) create an “always‑on” revenue stream, with the author estimating a 12% CAGR for the gaming segment.

- Enterprise SaaS: Microsoft 365’s subscription base continues to grow as companies adopt digital collaboration tools. The author cites a projected 20% increase in Microsoft 365 Enterprise customers by 2026.

Valuation & Risks

Microsoft’s P/E is around 27x, and the article justifies this premium through a projected CAGR of 11–12% for total revenue. Risks noted include a slowdown in capital spending (C‑Suite) and competition from AWS, Google Cloud, and the rising presence of Chinese cloud providers.

3. Amazon – The E‑commerce & AWS Super‑Firm

Growth Drivers

- E‑commerce Momentum: Despite pandemic‑era growth, Amazon’s core e‑commerce business is expected to retain a 12–14% growth rate in revenue due to expanding international markets and new product categories (e.g., grocery delivery via Amazon Fresh).

- AWS Expansion: Amazon Web Services continues to dominate the cloud infrastructure market, with a projected 15% YoY growth in 2024. The author believes AWS will further benefit from the AI‑driven demand for GPU clusters and managed machine‑learning services.

- Logistics & Automation: Investment in autonomous delivery (drones, robots) and fulfillment centers with AI-driven inventory management is expected to reduce cost per package and increase margins.

- Digital Advertising: The author forecasts a shift in Amazon’s advertising spend toward data‑driven ad tech, creating a new revenue stream that could double Amazon’s digital ad revenue by 2026.

Valuation & Risks

Amazon trades at a slightly higher P/E (≈31x) compared to its peers. The author attributes this to a higher projected CAGR for AWS (≈17%) and e‑commerce growth. Potential risks include regulatory scrutiny of its dual role as marketplace and seller, rising logistics costs, and competitive pressure from rivals such as Alibaba and Walmart.

4. Alphabet – The Search & AI Giant

Growth Drivers

- Google Search & Advertising: Alphabet’s dominant search engine still accounts for more than 90% of the global search market, with advertising revenues projected to grow by 8% annually through 2026.

- YouTube & Streaming: YouTube’s ad‑supported model, alongside its premium subscription service, is expected to capture a larger share of the global streaming market, especially in emerging economies.

- AI & Cloud: Alphabet’s DeepMind and Google Cloud are positioned at the intersection of AI research and commercial applications. The author emphasizes the company’s push toward generative AI tools and its strategic investments in AI hardware (TPUs).

- Hardware & IoT: Google’s Nest and Pixel product lines are expected to contribute incremental revenue, while its foray into autonomous vehicle technology (Waymo) may create a long‑term growth engine.

Valuation & Risks

Alphabet’s P/E sits around 27–28x. The article justifies the valuation with a projected 10–11% CAGR in free‑cash‑flow, driven by continued ad dominance and the expected lift from AI‑driven products. Risks involve antitrust investigations, privacy regulation changes, and potential dilution from stock‑based compensation.

5. Macro‑Market Outlook – 2026 and Beyond

The author couples the stock analysis with a broader market forecast. Key points include:

- AI‑Led Upside: A consensus that AI and automation will be the primary catalysts for growth across the tech sector. Forecasted that by 2026, AI‑driven productivity gains could offset a slowdown in traditional hardware sales.

- Interest‑Rate Sensitivity: The piece underscores that the equity markets remain highly sensitive to Fed policy. A dovish stance through 2025, followed by a gradual rate hike cycle in 2026, is expected to support valuations but also inject volatility.

- Inflation & Supply Chain: Inflationary pressures are projected to moderate by mid‑2026, aided by the easing of supply‑chain bottlenecks. This is expected to improve gross margins for the four tech giants.

- Geopolitical Risk: The article cites escalating U.S.–China tensions as a potential drag on cross‑border trade, particularly for supply chain and data‑center operations. However, it argues that domestic manufacturing incentives could partially offset these risks.

The author concludes that the combined growth trajectory of Apple, Microsoft, Amazon, and Alphabet will lead to a cumulative market‑cap increase of approximately 45% by 2026, translating into a broader market index (e.g., S&P 500) rally of 12–15% on an absolute basis, assuming the macro conditions described hold true.

Takeaway

In essence, the Seeking Alpha article presents a bullish but carefully conditioned thesis for the four biggest tech firms. It builds a case around robust recurring revenue streams (Apple services, Microsoft SaaS, Amazon ads, Alphabet advertising), AI‑powered growth levers (Azure, AWS, Google Cloud, Apple AR), and a macro environment that favors technology valuation upside in a post‑pandemic world. While regulatory, competitive, and macro‑economic risks remain, the article’s central message is that the tech sector will be the main engine of U.S. market growth through 2026.

Readers should keep in mind that the analysis is forward‑looking and subject to the uncertainties of technology evolution, policy decisions, and global events. Nevertheless, the detailed fundamentals and growth narratives provide a solid framework for investors considering a long‑term position in the leading tech stocks.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4847565-my-4-big-tech-stock-and-market-predictions-for-2026 ]