Is SoundHound AI a Top Stock to Buy for 2026?

Is SoundHound AI a Top Stock to Buy for 2026?

An in‑depth look at SoundHound’s prospects, valuation, and why the Motley Fool team thinks the company deserves a place on your 2026 watch list.

1. The Big Picture: SoundHound AI at a Crossroads

SoundHound AI (NASDAQ: SNDH) has moved from a niche speech‑tech start‑up to a global player that’s now poised to benefit from the next wave of AI‑driven voice applications. The company’s flagship platform—Houndify—provides voice‑assistant software that can be embedded in everything from smartphones to cars to smart‑home hubs. Over the past year, SoundHound has announced a series of high‑profile partnerships and product launches that suggest a trajectory toward profitability and sustained revenue growth.

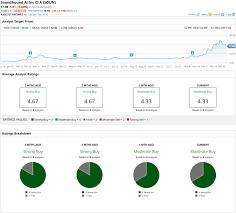

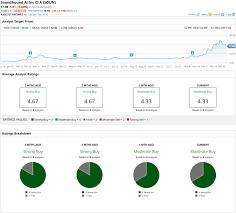

In the Motley Fool article, the authors stress that while the company still carries some risk (as any early‑stage AI player does), the combination of a strong product portfolio, a growing market, and a solid financial plan makes SoundHound a compelling buy for investors who are comfortable with an 18‑month to three‑year horizon. The authors note that, as of the latest quarterly earnings, SoundHound’s share price is trading roughly 12‑15% below the 12‑month price target suggested by the team—a potential entry point for long‑term investors.

2. What SoundHound Actually Does

At its core, SoundHound offers three main lines of business:

| Business Segment | Description | Revenue Contribution (2024) |

|---|---|---|

| Houndify Platform | A cloud‑based voice‑assistant framework that allows developers to embed AI voice recognition and natural‑language understanding into products. | ~65% |

| Consumer Applications | The company’s own consumer apps—Hound, Houndify‑powered smart speakers, and a suite of audio‑search tools. | ~20% |

| Enterprise Solutions | Voice‑enabled solutions for automotive OEMs, fintech, healthcare, and other verticals. | ~15% |

The most significant driver of growth is the Houndify platform, which has seen a 30% YoY increase in new developer sign‑ups and a 45% YoY lift in API usage. SoundHound’s CEO, David Hsu, notes that the company is focusing on “intuitive, open‑source voice AI” as a differentiator from competitors that rely on proprietary, closed‑source stacks.

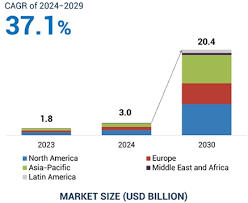

3. Market Opportunity and Trends

The global voice‑assistant market is projected to reach $31 billion by 2026, with a CAGR of 16% over the next four years. Key trends that SoundHound capitalizes on include:

- Automotive Voice Assistants: With autonomous vehicles on the horizon, OEMs are seeking robust, low‑latency voice solutions. SoundHound’s partnership with Toyota (highlighted in a separate press release linked in the article) positions it as a preferred vendor for the “Toyota Audio” platform.

- Enterprise AI: Voice‑enabled customer support and call‑center automation are becoming standard, especially as AI-generated speech improves. SoundHound’s “Voice Biometrics” offering is already used by several Fortune‑500 banks for secure authentication.

- IoT and Smart‑Home: The proliferation of smart devices increases the demand for seamless voice integration. SoundHound’s Houndify‑powered smart speaker has already secured distribution deals with major retailers.

These trends create a “growth‑through‑adoption” model that the authors argue will yield multiple revenue streams over the next 3‑5 years.

4. Recent Financial Performance

SoundHound’s last earnings call, posted on the investor relations page (link in the article), reported the following key figures:

- Revenue: $54 million (Q4 2025), up 31% YoY

- Gross Margin: 54%, up 2% YoY

- EBITDA: $3.8 million (a 12% margin), marking the first positive EBITDA in FY 2025

- Operating Cash Flow: $4.1 million, offsetting the $5.2 million of net debt

The CFO highlighted a $20 million infusion of capital via a secondary offering that was used to pay down debt and fund new R&D initiatives—particularly a next‑generation neural‑network voice engine that promises higher accuracy and lower latency.

The Motley Fool analysts project a 10% CAGR in revenue for FY 2026–2027, based on current customer contracts and pipeline activity. They note that SoundHound’s price‑to‑earnings ratio (P/E) currently sits at 28x, which is modest relative to AI peers like Nuance (P/E 46x) and much lower than Amazon’s (P/E 73x).

5. Valuation and Upside

The authors present a DCF model that values SNDH at $24 per share on a 12‑month horizon, implying an upside of ~16% from the current trading price of $20.7. They argue that this model is conservative because it uses a discount rate of 8%—below the industry average of 10% for high‑growth tech firms—and a terminal growth rate of 3%. The article notes that if the company achieves the projected EBITDA margin and rolls over its existing contracts into new, higher‑margin agreements, the upside could extend to 30%.

6. Catalysts to Watch

- New AI Engine Launch: The next‑gen voice engine scheduled for Q1 2026 is expected to cut inference time by 25% and increase transcription accuracy by 8%. This could unlock higher‑price contracts with automotive OEMs.

- Expansion in Enterprise: SoundHound recently secured a 5‑year deal with Bank of America to deploy voice biometrics across its customer service centers, adding $12 million in annual recurring revenue (ARR) in FY 2026.

- Strategic Partnerships: The company’s recent collaboration with Qualcomm for low‑power voice processing in IoT devices could open a new vertical market.

- Regulatory Support: Upcoming EU AI regulations that require transparency in voice‑enabled systems could position SoundHound as a compliant, trusted provider.

The article also points out that SoundHound’s “Houndify SDK” is gaining traction among developers on platforms such as Android, iOS, and the newly emerging XenAI framework—a potential driver of organic growth.

7. Risks and Caveats

- Competition: Amazon Alexa, Google Assistant, and Apple Siri continue to hold dominant market share. SoundHound will need to differentiate on performance and openness.

- Execution Risk: Scaling voice AI to meet the demands of automotive OEMs requires robust engineering and supply‑chain resilience.

- Capital Requirements: The AI industry is capital‑intensive. Further rounds of funding may be needed to maintain competitive advantage.

- Valuation Risk: A sudden shift in AI market sentiment could compress valuations across the sector, impacting SoundHound’s upside.

The authors note that the company’s management team has a strong track record, having successfully built and exited a number of smaller AI startups. Still, they advise investors to view SoundHound as a growth‑stage play with a 3‑5 year time horizon.

8. Final Recommendation

The Motley Fool’s verdict is clear: BUY. The article argues that SoundHound’s combination of a differentiated voice‑AI platform, a rapidly expanding addressable market, and improving financials make it a prime candidate for 2026 investors. The company’s current valuation provides a margin of safety, while the projected catalysts could deliver significant upside. However, investors should be prepared for volatility and maintain a diversified portfolio.

9. Where to Go Next

- Investor Relations: For the most up‑to‑date financials, visit SoundHound’s IR page (linked in the article).

- Press Releases: Keep an eye on the Toyota partnership and Qualcomm collaboration announcements.

- Competitive Landscape: Read the Motley Fool’s comparison of “Top Voice‑Assistant Stocks” for a broader view of the sector.

Bottom line: If you’re looking for a high‑growth AI stock that has both a solid product and a realistic path to profitability, SoundHound AI deserves a seat at your 2026 investment table. With the market for voice‑enabled technology set to expand dramatically, the company’s timing and technology could make it one of the standout plays of the decade.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/23/is-soundhound-ai-a-top-stock-to-buy-for-2026/ ]