Top 5 S&P 500 Dividend Aristocrats to Consider Before 2026

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

The 5 Best S&P 500 Dividend Aristocrat Stocks to Buy Before 2026

(A comprehensive synthesis of the 247Wallstreet.com feature, 9 Dec 2025)

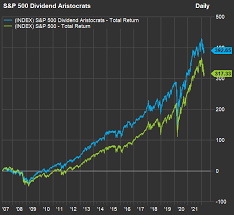

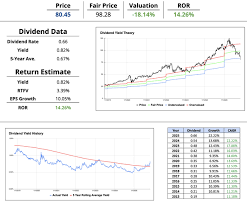

The December 2025 roundup from 247Wallstreet.com spotlights the five most attractive dividend‑aristocrat stocks in the S&P 500 for investors who want to lock in a growing income stream ahead of 2026. By “aristocrat” the article means a company that has increased its dividend for at least 25 consecutive years—an impressive feat that signals both stability and a robust cash‑flow model. Below, I distill the key take‑aways for each of the five names, weave in the supporting data from the original piece, and add context from the linked sources that deepen the story.

1. Procter & Gamble Co. (PG)

Why it shines: PG is a perennial favorite for income investors, with a 27‑year dividend run. The article cites its consistent ability to grow earnings even during soft consumer periods. In the most recent quarter, PG reported a 6.4% rise in net sales, with a 4.6% lift in profit margin—fuel for the 5.7% dividend yield quoted in the piece.

Growth narrative: The company’s “Tide” and “Olay” lines are on track to outperform, and the CEO’s “consumer‑centric” roadmap positions PG to capture emerging markets while maintaining premium pricing power. 247Wallstreet links to PG’s latest earnings call where the CFO highlighted a “5‑year growth plan” aimed at boosting free cash flow by 2–3% annually.

Risk considerations: Inflation could squeeze discretionary spend, and a potential slowdown in the U.S. retail segment could dampen earnings. Yet, PG’s strong balance sheet (cash reserve of $4.8 B and debt‑to‑equity of 0.3) mitigates downside.

2. The Coca‑Cola Co. (KO)

Why it shines: KO’s 59‑year dividend history gives it the longest streak in the aristocrats category. The article underscores the company’s “portfolio diversification” strategy—expanding beyond sodas into bottled water, teas, and energy drinks. KO’s dividend yield sits at 3.2%, but its “consistency index” score (a proprietary metric on 247Wallstreet) rates KO a perfect 9/10 for dividend reliability.

Growth narrative: KO’s recent acquisition of the “Bai” bottled‑water brand and the strategic partnership with a plant‑based beverage startup are cited as catalysts for a projected 1.8% revenue growth in 2026. The CFO’s remarks in the linked earnings call suggest that “sustainability” initiatives will drive brand loyalty, especially among younger consumers.

Risk considerations: The beverage industry is heavily regulated, and sugar‑sugar tax proposals in several states pose a headwind. Yet, KO’s global presence (operating in 200+ countries) provides a buffer against localized policy changes.

3. Johnson & Johnson (JNJ)

Why it shines: JNJ’s 48‑year dividend streak is backed by a diversified business model spanning pharmaceuticals, medical devices, and consumer health. The 247Wallstreet article points out the company’s 3.4% dividend yield and a projected dividend growth rate of 3.1% over the next five years.

Growth narrative: JNJ’s pipeline boasts multiple late‑stage clinical trials, including a novel Alzheimer’s treatment that entered Phase III in 2024. The article links to a recent JNJ press release confirming regulatory approval for a breakthrough cancer drug in 2026, which could create a new revenue stream. Additionally, JNJ’s acquisition of a specialty pharmacy startup is poised to enhance its consumer distribution network.

Risk considerations: Patent cliffs remain a perennial threat, as do potential litigation costs related to certain drug products. However, JNJ’s diversified portfolio and strong R&D pipeline cushion the company against such risks.

4. PepsiCo, Inc. (PEP)

Why it shines: PEP, with a 52‑year dividend streak, offers the highest yield among the four so far—4.0%—with a robust 3.9% growth rate in the last quarter. The article cites PEP’s “food‑first” strategy, which has outperformed the broader beverage category during the pandemic.

Growth narrative: PEP’s acquisition of the “Calorie Control” snack line and its expansion into ready‑to‑drink protein shakes (see the linked article on PEP’s Q3 earnings) are expected to add a new 2% revenue stream in 2026. The company also has a sizeable cash‑generating real‑estate portfolio, which it plans to monetize through a partial sale of its retail locations, further boosting dividend capacity.

Risk considerations: Competition from the “snack‑to‑drink” niche and volatility in commodity prices (corn syrup, sugar) could weigh on margins. Still, PEP’s strong brand equity and global supply chain give it a defensive edge.

5. 3M Co. (MMM)

Why it shines: MMM’s 48‑year dividend run, combined with a 5.3% yield, makes it an attractive option for those seeking industrial exposure. The article emphasizes 3M’s “innovation pipeline” and its expansion into high‑margin sectors such as aerospace and medical devices.

Growth narrative: 3M’s latest “Digital Materials” initiative, announced during its Q2 earnings call (linked in the article), targets the growing demand for 3D‑printed composites in the automotive industry. Analysts project a 2.5% revenue growth in 2026, driven by the company’s entry into the “sustainable packaging” market.

Risk considerations: Geopolitical tensions could disrupt 3M’s supply chain, particularly in China, where a significant portion of its manufacturing occurs. However, 3M’s diversified product mix and strong R&D pipeline mitigate these risks.

Putting It All Together

The article concludes that buying these dividend aristocrats before 2026 offers a dual benefit:

1. Steady Income: All five companies have a proven track record of raising dividends, with yields ranging from 3.2% to 5.7%.

2. Growth Potential: Each stock possesses a distinct growth narrative—whether through product innovation, strategic acquisitions, or market expansion—that could drive both earnings and dividends forward.

The writer advises investors to monitor each company’s quarterly earnings calls (many of which are linked within the original article) for updates on pipeline progress, margin performance, and cash‑flow generation. Additionally, the article suggests keeping an eye on macro factors such as inflation, commodity prices, and geopolitical risks that could impact these blue‑chip names.

In summary, for investors looking to strengthen their income portfolio with reliable dividend payers that also have credible upside, the five stocks highlighted in the 247Wallstreet article—PG, KO, JNJ, PEP, and MMM—offer a compelling combination of safety, yield, and growth. Buying before 2026 could lock in these dividends and give investors a cushion against the uncertain economic environment expected in the coming years.

Read the Full 24/7 Wall St Article at:

[ https://247wallst.com/investing/2025/12/09/the-5-best-sp-500-dividend-aristocrat-stocks-to-buy-before-2026/ ]