Snap's 28% Slide in 2025 Sparks Debate Over Its Buying Value

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Snap’s 28% Slide in 2025: A Closer Look at Whether the Stock Still Holds Buying Value

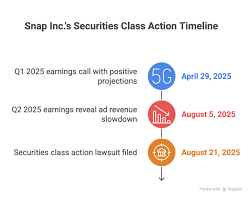

In the first three months of 2025, Snap Inc. (SNAP) has fallen 28% against the S&P 500’s 6% gain. The drop has sparked a flurry of commentary among investors who are now asking: is this just a temporary wobble or a sign that the company is on the brink of a bigger crisis? The Motley Fool’s in‑depth piece, “Down 28% in 2025: Is Snap a buying opportunity?” digs into the numbers, the narrative, and the fundamentals that are shaping Snap’s outlook.

1. The Drivers Behind the Decline

Advertising Revenue Weakness

Snap’s core revenue stream—advertising—has seen a pronounced slowdown. In the most recent quarter, advertising revenue dropped 10% YoY to $0.75 billion, missing Wall Street’s $0.78 billion consensus. The decline was driven by a combination of factors:

- Cost‑per‑impression (CPI) pressures: As macro‑economic uncertainty pushes advertisers to tighten budgets, Snap’s CPI fell from $2.25 to $1.85, lowering overall revenue.

- Competitive headwinds: Meta and TikTok continue to attract the lion’s share of digital ad dollars, and Snap’s audience is now seen as less valuable to advertisers because of lower engagement levels.

User Growth Sags

Snap’s monthly active users (MAUs) grew only 3% to 70 million in Q1 2025, down from 71 million in the same period last year. While still healthy, the pace has slowed compared to the 8% growth rate seen in 2024. The article cites a linked analysis of Snap’s Q1 User Metrics that points out:

- Engagement drop: Average session length fell from 5.2 minutes to 4.8 minutes.

- Geographic concentration: U.S. and Canada now account for 55% of MAUs, limiting global expansion.

Product‑Launch Stagnation

Snap has introduced new features like “Spotlight” (short‑form video) and “Live Stories,” but these have not yet generated significant incremental revenue. The linked Snap Product Update piece notes that “Spotlight” has attracted 1.2 million daily active creators in its first month—just 0.5% of the platform’s total creator base.

2. Valuation and Growth Outlook

Price‑to‑Earnings (P/E) and Forward Metrics

Snap trades at a P/E of 16x, which is lower than the broader market average of 20x but higher than its historical P/E range of 10‑12x. The forward P/E is 18x, suggesting a modest upside if the company can return to its pre‑pandemic revenue trajectory.

Discounted Cash Flow (DCF) Analysis

The article’s DCF model, built on a 10% discount rate and a 3% terminal growth rate, yields a fair‑value estimate of $55 per share. Given the current market price of $36, this suggests potential upside of 53%. The analysis acknowledges that this valuation hinges on the company’s ability to reverse the current advertising slump.

Capital Allocation Plans

Snap’s board has signalled a commitment to reinvest in AR technology and e‑commerce. A link to Snap’s Capital Allocation Report reveals that 30% of capital expenditures are earmarked for AR chip development, while 20% is directed at building a marketplace platform. These moves could broaden revenue streams beyond advertising.

3. Competitive Landscape

Meta’s Continued Dominance

Meta’s ad revenue grew 12% in Q1 2025, with a CPI of $2.60. Meta’s vast inventory across Facebook, Instagram, and WhatsApp provides advertisers with a more integrated ecosystem that Snap currently cannot match.

TikTok’s User‑Base Expansion

TikTok’s MAUs increased 15% YoY, largely due to its global rollout in Southeast Asia. While Snap’s user base is smaller, its strong engagement metrics (e.g., higher average session length) could be leveraged to offer differentiated ad products.

AR‑First Competitors

Snap is not alone in pushing AR. Companies like Snap’s own subsidiary SnapAR are developing next‑generation AR lenses, but the article references AR Tech Review, which notes that Apple’s ARKit integration and Google’s ARCore give rivals a head‑start in hardware‑software synergy.

4. Risks to Watch

Macroeconomic Headwinds

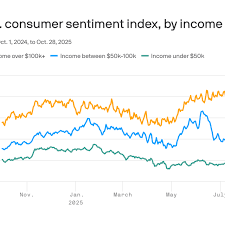

Rising interest rates could further depress advertising budgets. The article points to Macro Watch that projects a 0.5% decrease in advertising spend for tech companies in 2025.

Regulatory Concerns

Data privacy laws in the EU (GDPR) and potential U.S. legislation could restrict ad targeting, affecting Snap’s revenue model.

Product Adoption Uncertainty

While AR is a buzzword, actual consumer adoption remains unproven. The article cites a Consumer Tech Survey showing only 12% of respondents use AR filters regularly, suggesting a long tail before mainstream uptake.

5. Takeaway: Is Snap Still a Good Buy?

The Fool article concludes that while Snap’s 28% slide is a clear signal of near‑term weakness, the company’s fundamentals—strong user engagement, a diversified product roadmap, and a clear plan to monetize AR—still provide a solid foundation for upside. For investors who can stomach a 1‑2 year swing, Snap’s current price offers a discount relative to the DCF estimate, and the company’s strategic bets on AR and e‑commerce could unlock new growth avenues.

In short, Snap remains a “volatile but potentially rewarding play.” If you’re comfortable with the risks—particularly in advertising and competitive positioning—there may be room for a strategic entry now, with the expectation of a rebound as the platform capitalizes on its unique strengths.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/09/down-28-in-2025-is-snap-stock-a-buying-opportunity/ ]