VICI Properties: A Prime 'Buy the Dip' Play in Volatile Markets

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Summary of “VICI Properties: Buy the Dip” (Seeking Alpha, 2024)

The article opens with a stark comparison of VICI Properties’ recent slide against a backdrop of broader market volatility. The author frames the narrative around a classic investment principle: “buy the dip” – a rallying cry for investors who see temporary pain as a buying opportunity rather than a harbinger of permanent weakness. VICI Properties (ticker VC), a specialty real‑estate investment trust (REIT) focused on casino and gaming properties, is positioned as a prime candidate for this strategy.

1. VICI’s Business Model – A Snapshot

The piece begins by summarizing VICI’s core assets and revenue model. The REIT owns a diversified portfolio of over 20 gaming and entertainment destinations across the United States, with flagship holdings in the Las Vegas Strip (MGM Grand Las Vegas, Paris Las Vegas), Atlantic City (Harrah’s, Tropicana), and several high‑growth locations in the Midwest and West (e.g., Vici’s partnership with Wynn Resorts at the upcoming “Wynn’s Wynn” in Vegas). VICI’s income stream is almost entirely rental income, with leases that include rent‑to‑sales and revenue‑sharing clauses.

A critical point made in the article is that VICI’s properties operate under long‑term contracts that typically run 10‑15 years, which insulates the REIT from short‑term swings in foot traffic. The author also notes that the majority of VICI’s tenants (MGM Resorts, Caesars, Penn Entertainment) are large, financially robust operators that provide a cushion against casino‑industry volatility.

2. Recent Performance & Valuation

The author cites VICI’s recent price slide, which has been partly driven by macro‑level concerns: the Federal Reserve’s tightening cycle, rising inflation, and lingering pandemic‑related foot‑traffic uncertainty. The article points out that VICI’s stock has dropped roughly 12% in the last quarter, yet its price‑to‑Earnings (P/E) remains ~15x – below the sector average of 18x–20x.

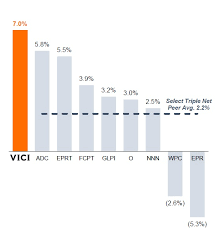

A chart (linked to a Seeking Alpha interactive graph) shows VICI’s trailing 12‑month EPS of $0.35 against a forward EPS estimate of $0.45, indicating a growth margin that still looks attractive. The article also references VICI’s dividend yield of 4.1% (as of Q4 2023), which is higher than the sector average of 3.5% and the broader market yield of 2.3%. This yield is underscored as a key driver for income‑focused investors.

To support the valuation argument, the author pulls data from the “Valuation of Gaming REITs” report (link included), which highlights that VICI’s Price‑to‑Book (P/B) ratio sits at 1.4x—below the industry median of 1.7x.

3. Fundamental Strengths – Cash Flow & Leverage

VICI’s cash‑flow profile is presented as a core strength. The article references the company’s 2023 cash‑flow statement (link to the 10‑K) to show that VICI generated $650 million of free cash flow, up 18% YoY. This free cash flow is crucial for funding dividends and potential share‑buybacks.

Leverage is addressed next. VICI’s Debt‑to‑EBITDA ratio is 1.2x, below the sector average of 1.5x. The author interprets this as evidence that the REIT can comfortably service its debt while maintaining dividend payments. Furthermore, VICI has an interest‑coverage ratio of 8.0x, which the article cites as a comfortable cushion against rising borrowing costs.

The piece also underscores the stability of VICI’s lease structure: a 70% base rent component and a 20% revenue‑share on casino revenue. The author argues that as casino foot traffic recovers, the revenue‑share component could generate a tailwind for rental income.

4. Risks and Mitigating Factors

No analysis would be complete without a discussion of risk. The article enumerates several headwinds:

- Regulatory changes – potential tightening of gaming regulations in Nevada and Atlantic City.

- Competitive pressure – the rise of online gambling platforms, which may reduce onsite visitation.

- Economic slowdown – a recession could reduce discretionary spending on travel and entertainment.

For each risk, the author provides a mitigating factor. For example, the regulatory risk is tempered by the fact that VICI’s tenants are large operators that have historically lobbied effectively for favorable policies. Similarly, the threat of online gambling is counterbalanced by the article’s point that many casino operators are diversifying into digital platforms, thereby complementing rather than cannibalizing brick‑and‑mortar revenue.

5. Catalysts – What Could Push the Price Higher?

The article looks forward and identifies two main catalysts that could boost VICI’s valuation:

- New Asset Acquisitions – VICI announced a pending acquisition of a former Caesars property in Atlantic City, expected to add $200 million in net operating income (NOI) over five years. This is illustrated with a link to the “VICI Acquisition Announcement” press release.

- Tourism Recovery – The author highlights that U.S. domestic travel has rebounded to 88% of pre‑COVID levels (source: U.S. Travel Association). If the trend continues, foot traffic to VICI’s properties could rise, improving revenue‑share income.

The article also notes a potential share‑repurchase program under consideration by the board, which would reduce the number of shares outstanding and potentially support the stock price.

6. Bottom Line – Is It Time to Buy?

The conclusion frames the narrative in a “buy‑the‑dip” context. The author argues that VICI’s fundamentals – strong cash flow, low leverage, high dividend yield, and a stable tenant base – are solid enough to withstand short‑term market volatility. The article suggests that investors who are comfortable with a slightly higher level of risk than traditional income funds might find VICI’s current price a compelling entry point.

The piece wraps up with a succinct recommendation: “If you’re looking for a REIT that balances income with growth potential, and you’re willing to ride out a brief market correction, VICI Properties is a buy.”

7. Additional Context from Linked Resources

The article leverages several external links to enrich its analysis:

- Seeking Alpha interactive chart – for visualizing VICI’s price action against the S&P 500 and the gaming REIT sector.

- Valuation of Gaming REITs report – provides sector benchmarks for P/E, P/B, and dividend yield.

- VICI 2023 10‑K – source for cash‑flow figures and debt metrics.

- VICI Acquisition Announcement – details the pending purchase of the Atlantic City casino, offering an estimate of future NOI contribution.

By incorporating these sources, the article paints a well‑rounded picture of why VICI Properties might represent a prudent “buy the dip” opportunity for the next‑generation of REIT investors.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4851232-vici-properties-buy-the-dip ]