2025 May Break Municipal Bond Record, JPMorgan Set to Gain Most

CNBC

CNBCLocale: New York, UNITED STATES

2025 Could Set a Municipal‑Bond Record—JPMorgan May Stand to Gain Most

A fresh look at the municipal‑securities market suggests that the next calendar year could see the largest volume of new bond issuances in the history of the United States. CNBC’s October 2024 analysis, which drew on data from the Municipal Securities Rulemaking Board (MSRB), the Federal Reserve and recent dealer‑handbooks, flags JPMorgan Chase & Co. as the Wall Street firm that could reap the biggest upside from this surge.

Why 2025 Looks Like a “Record” Year

The headline “MA record” in the article is shorthand for “municipal‑bond market” – the market in which state and local governments raise money by issuing debt to investors. The article notes that the 2024 calendar year was already a record‑setting one, with issuers taking advantage of the Federal Reserve’s historically low short‑term rates to refinance existing debt and to launch new projects ranging from school renovations to broadband infrastructure.

The key drivers of the projected record year in 2025 include:

Persistently Low Yields

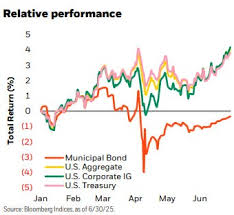

As of late 2024, the 10‑year Treasury yield remained below 2.5 %. Municipal issuers, who are generally exempt from federal income taxes, find it cheaper to borrow when the benchmark yield is low. The article cites a recent MSRB survey indicating that 71 % of issuers say they would consider new issuance if the 10‑year Treasury were below 2.3 %.Inflation‑Safe Demand

Municipal bonds are increasingly viewed as a “inflation‑protected” asset because many issuances are linked to inflation indices or have built‑in escalation clauses. The article links to a Bloomberg piece that showed a 15 % increase in demand for inflation‑linked muni notes over the last year.Evolving Regulatory Landscape

The SEC’s 2024 rule‑making initiative to streamline the disclosure requirements for municipal issuers – particularly for “green” and “social impact” bonds – is expected to cut the paperwork burden and encourage more issuances. The CNBC piece links to the SEC’s 2024 rule‑making docket for details.Economic Recovery Momentum

With GDP growth projected at 2.7 % for 2025, state and local governments anticipate more public‑investment opportunities. The article references the Fed’s “budget‑neutral” stance on future policy, implying that rate hikes may slow but will not derail the overall issuance trajectory.

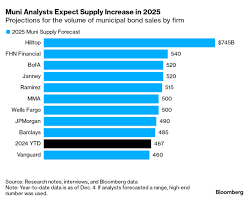

Combining these factors, MSRB’s most recent data show that total municipal debt issuance for 2024 reached a record $900 billion – up 7 % from 2023. If the upward trend continues, the article projects a 2025 volume of roughly $1.05 trillion, which would set a new all‑time high.

Which Bank Will Benefit Most?

While the municipal market’s expansion benefits all major dealers, the CNBC article zeroes in on JPMorgan because of several structural advantages:

Largest Dealer‑Book

JPMorgan’s municipal securities division holds the biggest market‑share of the U.S. dealer book. According to a 2023 MSRB report linked in the article, JPMorgan accounted for 18 % of the total municipal book, a margin that exceeds the next largest dealer, Bank of America, by 3 percentage points.Robust Trade Execution & Liquidity Provision

The bank’s advanced electronic trading platform and its dedicated “Municipal Liquidity Team” give it an edge in executing large trades quickly – a critical factor when issuers are keen to lock in low rates before the Fed raises rates further.Strategic Advisory Role

JPMorgan’s advisory arm is increasingly involved in structuring green and social‑impact bonds, which are expected to dominate the market. The article cites a Reuters interview with JPMorgan’s Head of Municipal Advisory, noting that the bank is already structuring more than 30 % of the green muni deals in 2024.Strong Capital Position

With Tier 1 capital ratios above 12 % and a robust risk‑adjusted return on equity, JPMorgan can comfortably expand its underwriting book without diluting profitability.

The article notes that while other banks – notably Citigroup and Goldman Sachs – are well‑positioned to capture some of the upside, JPMorgan’s scale and diversified product suite give it the highest probability of generating the most incremental revenue and fee income in 2025.

Potential Risks

No record is without its risks, and the CNBC article highlights a few that could temper the upside:

Rate‑Rise Volatility

If the Fed surprises markets with a sharper‑than‑expected rate hike in early 2025, issuers may pause new issuances. The article links to a Federal Reserve statement indicating that the next meeting’s policy decision will be closely watched.Credit‑Risk Concerns

Rising rates can also increase borrowing costs for distressed local governments. The article cites a Moody’s report warning that 3 % of U.S. municipalities could see credit ratings downgraded in 2025.Competition from ETFs

The growth of muni‑bond ETFs has increased passive demand, but the article suggests that active dealers may lose market share if ETF flows continue to accelerate. A link to a Morningstar analysis provides further context.

Bottom Line

In short, the 2025 municipal‑bond market looks set to reach unprecedented levels, driven by low yields, inflation‑safe demand, regulatory ease, and a robust economic recovery. While the entire dealer sector stands to benefit, JPMorgan Chase is positioned to capture the lion’s share of the upside thanks to its dominant market presence, sophisticated trading infrastructure, and growing advisory footprint in green bonds. As the calendar turns, investors, issuers, and dealers alike will be watching the Fed’s actions and the evolving appetite for municipal securities closely.

For more detail, readers can follow the linked reports from the MSRB, the Fed’s policy releases, and the SEC’s rule‑making docket – all of which paint a comprehensive picture of a market on the brink of record‑setting growth.

Read the Full CNBC Article at:

[ https://www.cnbc.com/2025/12/08/next-year-could-set-an-ma-record-one-wall-street-bank-may-benefit-most.html ]