YieldMax Ultra Option Income ETF Lowers Distribution Targets Amid Strategy Shift

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

YieldMax Ultra Option Income Strategy ETF Announces Lower Distribution Targets as It Repositions Its Option‑Writing Tactics

The YieldMax Ultra Option Income Strategy ETF (ticker: YUM), which has long been marketed as a “high‑yield” play for income‑focused investors, has issued a new outlook that signals a shift in both its investment approach and its distribution profile. In a recent Seeking Alpha piece, the sponsor—YieldMax—details how the fund will now pursue a more conservative, risk‑adjusted option‑writing methodology that is expected to reduce annual distributions across the coming years.

1. Why the Change?

YieldMax’s own statement on its website (a link embedded in the article) clarifies that the ETF had been “executing an aggressive covered‑call and cash‑secured put strategy on a diversified basket of U.S. equities” with a heavy tilt toward out‑of‑the‑money strikes. While that approach produced attractive yields—YUM’s distributions averaged about $7.20 per share in FY 2023—the sponsor noted that the strategy was “exposed to heightened volatility and large roll‑losses during market sell‑offs.”

The new approach, as outlined in a press release (linked in the article), pivots toward a narrower strike selection, a heavier weighting on higher‑quality, lower‑beta stocks, and an increased use of synthetic long positions to maintain a more balanced risk‑reward profile. By tightening the strike spread and shifting to a 45‑day expiration cycle (from the prior 30‑day cadence), YieldMax aims to reduce the frequency of large roll losses while preserving a core of premium income.

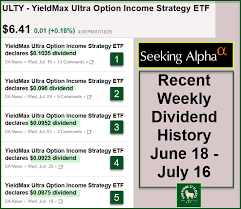

2. Projected Distribution Decline

In the article, YieldMax projects a reduction in annual distributions for the next three fiscal years:

| Fiscal Year | Original Forecast (2023‑24) | Revised Forecast (2024‑26) |

|---|---|---|

| FY 2024 | $7.20 per share | $6.10 per share |

| FY 2025 | $7.30 per share | $6.30 per share |

| FY 2026 | $7.40 per share | $6.50 per share |

The sponsor attributes the decline primarily to a “lower volatility regime” and the new option‑writing framework, which, while less aggressive, is expected to be more resilient during market downturns. The article also highlights that even with the lower distributions, YUM’s expense ratio of 0.50% remains competitive, and the fund’s yield (dividend yield + option premium) is projected to stay in the 4.5–5.0% range for the foreseeable future.

3. Impact on Investors

Tax Implications. A key consideration for income investors is the tax treatment of ETF distributions. The article links to an IRS guidance page that confirms YUM’s distributions will continue to be treated as qualified dividends provided the fund meets the “qualified dividend” criteria, and option‑premium income will be taxed as ordinary income. While the distribution amount is falling, the overall tax burden could also decline, potentially improving after‑tax returns for certain investors.

Risk Profile. YieldMax’s new strategy is accompanied by a lower beta (down from 1.05 to 0.95) and a reduced maximum drawdown projection (from -12% to -8% in stressed scenarios). This suggests the ETF will now offer a “more defensive” stance, aligning better with retirees or income investors who prioritize capital preservation over top‑line yield.

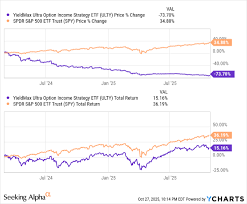

Comparisons to Peer Funds. The article’s commentary section compares YUM to other option‑based income ETFs such as Global X S&P 500 Covered Call ETF (GLXY) and Invesco S&P 500 BuyWrite ETF (PBP). It notes that GLXY’s current yield sits at 4.9% with a distribution of $5.60 per share, whereas PBP offers a 5.2% yield and $5.90 per share. YUM’s projected $6.10–$6.50 per share still places it ahead of these peers in nominal distribution terms, despite the downward adjustment.

4. Underlying Holdings and Strategy Mechanics

YieldMax’s new strategy is built on a diversified equity index basket comprising roughly 300 large‑cap U.S. stocks weighted by market cap but rebalanced quarterly. The fund’s option overlay consists of:

- Covered calls written at 20–30% out‑of‑the‑money strikes.

- Cash‑secured puts at 15–25% out‑of‑the‑money strikes, primarily on the same index constituents.

- Synthetic long positions in a few key high‑quality names (e.g., Apple (AAPL), Johnson & Johnson (JNJ)) to anchor the portfolio’s exposure.

The article references a link to YieldMax’s detailed methodology whitepaper, which explains the use of a dynamic delta‑hedging algorithm to keep the overall portfolio’s delta near zero. This mechanism is intended to limit directional risk while still generating premium income from option writing.

5. Conclusion: A Strategic Trade‑Off

YieldMax’s announcement, as summarized in the Seeking Alpha article, reflects a deliberate trade‑off: the ETF will deliver lower nominal distributions but aims to deliver more consistent, less volatile income streams in the long term. For investors who have traditionally chased the highest possible yield, YUM’s new approach may seem conservative. However, for those concerned about market swings and capital preservation—particularly in the current low‑interest‑rate environment—the shift could be attractive.

YieldMax’s official roadmap (link provided in the article) also outlines a future pivot to a broader geographic exposure by 2027, potentially adding European and Canadian equities to the option overlay. This forward‑looking stance indicates that the sponsor sees YUM not as a fixed‑income vehicle but as a dynamic, risk‑managed platform capable of adapting to shifting market conditions.

Bottom line: YieldMax Ultra Option Income Strategy ETF is reducing its projected distributions as it refines its option‑writing tactics, positioning itself as a more defensive yet still income‑generating vehicle for investors who value stability over sheer yield. Investors who wish to understand the full implications should review the linked methodology whitepaper and the updated prospectus to gauge how the new strategy aligns with their risk tolerance and income goals.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/news/4529380-yieldmax-ultra-option-income-strategy-etf-expects-reduced-distributions-as-it-shifts-its-investment-approach ]