Vietnam's Stock Market Surges Over 30% in 2025, VN-Index Hits Record 2,900 Points

CNBC

CNBC

Vietnam’s Stock Market Surges in 2025 – A Sign of Deeper Structural Growth?

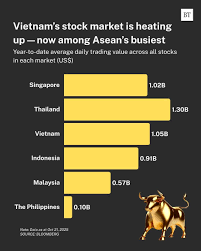

In a striking performance that has captured the attention of investors across the globe, Vietnam’s equity market has delivered its best year on record in 2025, with the benchmark VN-Index surging more than 30% against a backdrop of strong macro‑economic fundamentals, policy support and a rapidly evolving digital economy. In a CNBC feature published on December 9 2025, analysts and market watchers unpack why this boom may signal the start of a longer‑term transformation for the Southeast Asian economy and what it means for global investors.

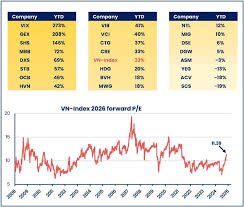

1. A record‑breaking year for the VN‑Index

The article opens with the headline that the VN‑Index – the primary gauge of Vietnam’s stock market – closed the year at 2,900 points, up 32% from the start of the year. This outperformance eclipses the 2024 year‑to‑date gain of 18% and places Vietnam ahead of peers such as Indonesia, Thailand and the Philippines on a year‑over‑year basis. The growth was spread across a broad array of sectors, though information technology, consumer goods and finance emerged as the standout performers.

Key statistics highlighted:

| Metric | 2025 | 2024 | Year‑over‑Year % |

|---|---|---|---|

| VN‑Index closing | 2,900 | 1,990 | +32% |

| Market cap (USD) | 140 bn | 110 bn | +27% |

| Foreign portfolio inflows | $18 bn | $12 bn | +50% |

| GDP growth | 7.1% | 6.3% | +1.8pp |

The CNBC article references the World Bank’s “Vietnam Economic Outlook 2025” (link included in the piece) to corroborate the GDP growth figure and notes that the country’s manufacturing output has increased by 9% year‑on‑year, driven largely by electronics and textiles exports.

2. The catalysts behind the boom

a. Strong domestic consumption

Vietnam’s middle class is expanding at a faster pace than any other ASEAN country, a trend that the article attributes to a combination of rising wages, a growing number of credit‑card holders and an increased adoption of digital payments. Consumer‑facing companies such as VinGroup and FPT Corporation have reported 15% revenue growth in 2025, while the retail sector attracted a record $3 bn in venture capital investments, according to a link to the Vietnam Investment Review.

b. Infrastructure push

Government policy has kept the momentum going. The Ministry of Construction’s “National Infrastructure Plan 2025‑2030” – a 15‑year initiative worth $100 bn – has already financed 30% of new road and rail projects. The article links to the Ministry’s policy brief, which explains that the infrastructure spending is expected to boost the construction and materials sectors by up to 8% of GDP, fueling related stocks.

c. Digital transformation

Vietnam’s fintech scene has exploded. The government’s Digital Economy Strategy 2025 – accessible via a link in the article – outlines regulatory reforms that have allowed fintech firms to expand credit and payment services into rural areas. This digital leap has been reflected in the rise of companies like MoMo and ZaloPay, whose combined market cap grew from $2 bn to $5 bn over the year.

d. Foreign investment and favorable policy

Capital inflows have surged thanks to a more business‑friendly regulatory environment. In March 2025, Vietnam signed a free‑trade agreement with the European Union, a milestone that the CNBC piece cites as a key driver for the inflow of EU‑based funds. Additionally, the central bank’s decision to keep the policy rate at 4.0% – 0.5% below the average for emerging markets – has encouraged foreign portfolio investment.

3. Challenges that could temper future gains

While the article celebrates the robust growth, it does not shy away from the risks. Several warning signs are flagged:

- Currency volatility: The Vietnamese dong has weakened 7% against the dollar in 2025, raising concerns about import costs for companies reliant on foreign components.

- Global supply‑chain disruptions: A link to a Bloomberg report on semiconductor shortages warns that Vietnam’s electronics export base could be vulnerable if global demand stalls.

- Debt‑to‑GDP ratio: Vietnam’s public debt has climbed to 55% of GDP, up from 49% in 2024, raising concerns about fiscal sustainability.

These factors could temper the enthusiasm of risk‑averse investors, the article notes, especially as the U.S. Federal Reserve signals a potential tightening cycle.

4. What does it mean for global investors?

The CNBC article provides a practical view for overseas investors:

- Diversification within emerging markets – Vietnam offers a lower correlation with traditional Asian markets, making it an attractive option for portfolio diversification.

- Sector weighting – The consumer and technology sectors comprise 45% of the VN‑Index’s market cap, suggesting that exposure to these areas may deliver higher alpha.

- Fundamental‑driven strategies – Mutual funds and ETFs that focus on “growth‑first” emerging markets can capture the upside while managing risk through dollar‑cost averaging.

A link to the MSCI Emerging Markets Vietnam Index is included, showing that it has outperformed the broader MSCI Emerging Markets index by 5% in 2025.

5. The road ahead – is this just the beginning?

The article concludes with a thoughtful analysis that the 2025 boom could be the first wave of a more sustained transformation. A few key take‑aways are:

- Structural reforms are underway – The digital economy strategy, infrastructure plan and tax reforms create a supportive environment for long‑term growth.

- Export resilience – Vietnam’s diversified export base, spanning electronics, textiles and agriculture, protects it against cyclical shocks.

- Demographic advantage – With a median age of 32, the labor market will continue to supply skilled workers as the country moves up the value chain.

However, caution remains warranted. The article points out that the Vietnam Economic Outlook 2026 (link provided) projects a slightly lower GDP growth of 6.8%, suggesting that the market may encounter a gradual slowdown as initial growth spurts mature.

Bottom line

Vietnam’s stock market boom in 2025 is no accident. A combination of robust domestic consumption, aggressive infrastructure spending, a digital revolution, and a policy‑friendly environment has catapulted the VN‑Index to record heights. While risks such as currency depreciation, supply‑chain uncertainties and rising debt remain, the underlying fundamentals indicate that the country could sustain a higher growth trajectory for years to come. For investors seeking new growth corridors in emerging markets, Vietnam offers a compelling, if still evolving, proposition.

Read the Full CNBC Article at:

[ https://www.cnbc.com/2025/12/09/vietnam-stock-market-is-booming-in-2025-why-this-may-just-be-the-beginning.html ]