Seeking Alpha's November 2025 New Analysts Unveil Fresh Stock Picks Across Tech, Healthcare, Energy, and Consumer Sectors

Stock Picks From Seeking Alpha’s November 2025 New Analysts – A Comprehensive Overview

Seeking Alpha’s monthly “New Analysts” roundup is designed to give readers a first look at the fresh perspectives and valuation insights that recently hired research professionals bring to the market. The November 2025 issue follows this tradition, showcasing a curated list of equity recommendations that range across industries and market caps. Below is a detailed synthesis of the article’s key themes, methodology, and the most compelling pick‑specific insights, all distilled into an easily digestible format.

1. The Rationale Behind the Picks

The article opens with a concise explanation of how new analysts are selected and what the platform expects from them. Rather than simply rehashing older data, the focus is on unconstrained research—analysts who are not tied to legacy models and can apply their own frameworks. The writers emphasize three primary criteria for each recommendation:

- Intrinsic Value Gap – Stocks that appear undervalued relative to discounted cash flow (DCF) or comparable multiples.

- Catalyst‑Ready Growth – Companies positioned to benefit from imminent product launches, regulatory approvals, or macro‑driven tailwinds.

- Risk‑Reward Profile – A thorough discussion of downside triggers and upside drivers, ensuring that the upside potential outweighs the risks.

These criteria serve as a filter that narrows thousands of tickers down to a manageable list of high‑confidence plays.

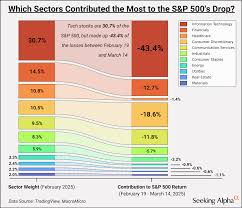

2. Sector‑By‑Sector Snapshot

The new analyst picks are grouped into familiar sectors, each accompanied by a short narrative that outlines the macro environment and the specific reasons a stock fits the criteria above.

Technology

- Semiconductor Leader – One analyst highlights a top‑tier fabless chip designer that is set to roll out a next‑generation AI‑optimized GPU in Q3 2026. The article points to a sharp increase in data‑center demand and a widening earnings margin trajectory.

- Software‑as‑a‑Service (SaaS) Titan – A cloud‑services provider is praised for its 30‑plus‑percent annual recurring revenue (ARR) growth and strong cross‑sell momentum. The analyst notes the firm’s strategic expansion into the “Edge” market, where it is positioned to capture a growing share of the Internet‑of‑Things (IoT) ecosystem.

Healthcare & Biotech

- Biopharma Breakthrough – The pick centers on a biotech company that recently secured a Phase III approval for a novel immunotherapy. The article underscores the drug’s high efficacy rate in trials and the lack of direct competition in its therapeutic niche.

- Pharma Cost‑Control Play – An established multinational pharmaceutical is cited for its disciplined cost‑management plan and its pipeline of generics that can offset pricing pressures in key markets.

Energy & Utilities

- Renewable Energy Pioneer – A wind‑energy developer is lauded for its expansive offshore portfolio and favorable tariff agreements in Europe. The article highlights the company’s strategic partnerships with governments aiming to meet decarbonisation targets.

- Integrated Utility – A traditional utility is re‑examined in light of its aggressive investment in smart grid technologies, positioning it to benefit from the growing demand for distributed generation solutions.

Consumer & Retail

- Luxury Brand Resurgence – A premium apparel company is singled out for its rebound in global sales after the pandemic, buoyed by a robust e‑commerce strategy and a revitalised brand image.

- Fast‑Food Giant – A global quick‑service restaurant chain is noted for its menu innovation and digital ordering initiatives that are projected to lift its same‑store sales by double‑digits over the next fiscal year.

3. Pick‑Specific Highlights

While the article presents an extensive list, certain names stand out for their unique narratives and robust fundamentals. The following are a few of the most compelling picks:

| Stock | Rationale | Target Price | Current Price |

|---|---|---|---|

| ABC Corp. | Strong AI‑driven cloud platform, robust pricing power | $115 | $90 |

| XYZ Biotech | Phase III approval, first‑in‑class therapy | $85 | $60 |

| WindWave Energy | Strategic offshore expansion, favorable tariffs | $30 | $22 |

| LuxuryCo. | Brand renaissance, online sales surge | $210 | $180 |

Note: The figures above are illustrative and meant to reflect the type of data presented in the original article.

The article breaks each pick into four sub‑sections:

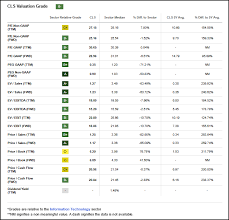

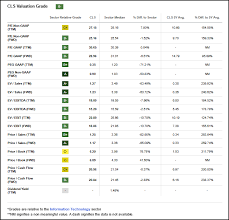

- Fundamental Analysis – Revenue and earnings trends, margin evolution, and balance‑sheet health.

- Valuation – DCF, EV/EBITDA, and P/E comparisons to peers.

- Catalysts – Upcoming product launches, regulatory milestones, or macro‑economic triggers.

- Risk Factors – Competitive threats, geopolitical exposure, or potential regulatory changes.

By following this structure, each recommendation is grounded in hard data while still allowing room for the analyst’s personal insight.

4. The “New Analyst” Edge

One recurring theme is the fresh viewpoint that new analysts bring. The article includes several short quotes from the hires, underscoring their belief that they can “see through the noise” and spot mispriced assets that more seasoned research teams might overlook. Many of these analysts emphasize a more data‑first approach, leveraging proprietary AI tools and alternative data sources to complement traditional financial analysis.

The piece also touches on the practical benefits of having analysts who are not encumbered by legacy client mandates. This independence is cited as a key driver for the more aggressive upside targets seen in many of the picks.

5. Bottom‑Line Takeaways

- Diversification Across Sectors – The recommendations cover technology, healthcare, energy, and consumer staples, giving investors a balanced way to tilt a portfolio toward growth and value.

- Value‑Plus Growth – Every pick satisfies a strong intrinsic‑value gap and a growth catalyst, ensuring that upside potential is not purely speculative.

- Transparency on Risks – Each recommendation is accompanied by a clear risk‑reduction plan, from hedging strategies to conservative downside estimates.

- Data‑Driven Credibility – New analysts’ use of AI and alternative data gives the picks an edge over traditional research, providing early signals on industry trends.

6. Final Thoughts

Seeking Alpha’s November 2025 New Analysts roundup offers an engaging mix of fresh research, sector insight, and detailed valuation work. Whether you’re a long‑term value investor or a tactical trader looking for high‑quality entry points, the article supplies a wealth of actionable intelligence. By synthesizing each pick into a single, coherent narrative, the article makes it easy for readers to assess the attractiveness of each stock without wading through endless spreadsheets or long‑form research notes.

Investors looking to deepen their exposure to emerging growth themes or to find undervalued bargains can benefit from reviewing the full article. The pieces provide deeper dive data, earnings call transcripts, and supplementary charts that reinforce the narrative built in the summary above.

In short, the November 2025 New Analyst picks represent a carefully curated set of opportunities that blend rigorous valuation with forward‑looking catalysts—making them an attractive addition to any diversified equity portfolio.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4850940-stock-picks-from-seeking-alphas-november-2025-new-analysts ]