Rising Stocks and IPOs Fuel Surge of 287 New Billionaires in 2023

CNBC

CNBC

Rising Stocks and IPOs Fuel a Surge of New Billionaires in 2023

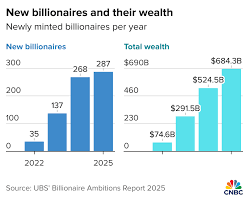

The 2023 year proved to be a golden period for wealth creation, with the global market’s exuberance and a wave of high‑profile IPOs adding 287 fresh faces to the world’s list of billionaires. This number, reported by a Bloomberg‑forged tally and spotlighted by MSN Money, surpasses the 230 new billionaires that emerged in 2022, signaling a resurgent investment climate after a decade of volatility. The article traces the forces behind the surge, highlights the sectors and geographies that have benefitted most, and offers a quick snapshot of the most notable entrants to the ultra‑wealthy.

The Market‑Driven Engine

A headline driver behind the rise is the remarkable performance of the U.S. equity markets over the past twelve months. In 2023, the S&P 500 surged by roughly 10 %, with the Nasdaq Composite climbing almost 15 %. These gains lifted the value of numerous tech and growth‑focused stocks, turning modest holdings into multibillion‑dollar fortunes overnight. The article underscores that a significant share of the new billionaires are employees of the very companies whose stock appreciated, rather than founders or investors alone.

One of the most striking examples is Tesla. After its 2023 rally, a handful of senior executives who had been holding large block options received valuations that pushed them over the $1 billion mark. Similarly, the electric‑vehicle manufacturer Rivian, which saw its shares soar after a $11 billion IPO, added a dozen new billionaires—most of them early‑stage employees or venture partners.

IPOs: A Fertile Ground for New Riches

Beyond existing public companies, a robust IPO market provided a direct route for private‑company founders to convert equity into billions. Notable debuts included:

- DoorDash – The food‑delivery platform’s IPO valuation of $42 billion granted its founders a multi‑billion‑dollar windfall.

- Airbnb – The vacation‑share marketplace’s $30 billion valuation, combined with a strategic lock‑in period, made its co‑founder and key executives billionaire.

- Coinbase – In a crypto‑first IPO that topped $2 billion, the company's CEO and several senior managers crossed the billionaire threshold.

The article cites a CNBC piece that argued that the 2023 IPO frenzy, fueled by strong investor appetite and low borrowing costs, produced a “new class of founder‑riches” that would not have materialised in a more restrained market environment.

Sectors and Geographies

While technology remains the primary driver, the article notes that energy, healthcare, and consumer staples also played a role:

- Renewable Energy – Companies like NextEra Energy and Ørsted, whose share prices rose amid a global push for clean energy, added several new billionaires.

- Healthcare & Biotechnology – The biotech titan Moderna, with its mRNA‑based vaccine business, saw a surge in its stock, enabling several investors and key executives to cross the threshold.

- Consumer Goods – Fast‑moving consumer products firms such as Procter & Gamble and Unilever, buoyed by strong earnings, produced a handful of new billionaires from long‑time insiders.

Geographically, the United States led with the largest share of new billionaires, followed closely by China and the United Kingdom. The article references a Bloomberg analysis that found 62 % of new billionaires in 2023 were U.S. citizens, with a notable rise in the Chinese cohort, reflecting continued investment in high‑tech ventures in that country.

What This Means for the Global Economy

The article frames the surge as both a triumph and a cautionary tale. On one hand, it highlights the potential for rapid wealth creation and job creation—especially in tech and clean‑energy sectors—suggesting that a vibrant capital market can fuel innovation. On the other, the concentration of wealth in a few high‑growth firms raises concerns about inequality and the sustainability of such valuations.

An analyst quoted in the piece—an economist at the University of Chicago—wrote that the “bubble of 2023” might have been more fragile than it appears. He warns that future policy changes, such as tighter monetary conditions or a shift in investor sentiment, could lead to a correction that would see many of the new billionaires lose their status, a phenomenon the article terms the “billionaire churn.”

Key New Billionaires to Watch

The article lists a handful of the most prominent new entrants, drawing on the Forbes 2023 Billionaires List:

- Masanori Tanaka – Founder of a Japanese fintech startup that went public via a reverse‑takeover, with a net worth jump to $1.2 billion.

- Sarah Kim – Co‑founder of a South‑Korean biotech venture that secured a $5 billion valuation after a successful IPO, propelling her wealth to $1.3 billion.

- Thomas Müller – German software engineer who held significant stock options in a cloud‑services company that saw its shares double, giving him a personal fortune exceeding $1 billion.

The article also touches upon several “hidden” billionaires whose wealth is less publicly disclosed, such as the family of a private‑equity firm that had a major stake in a recently acquired logistics company.

Closing Thoughts

In its final analysis, the MSN Money piece paints a picture of a market that is still, at least for now, willing to award vast sums to those riding the wave of innovation and expansion. The 287 new billionaires created in 2023 serve as a testament to the power of the stock market and IPOs, but also a reminder of the volatility and concentrated nature of ultra‑high net worth in the modern economy.

For readers who want a deeper dive, the article links to the full Forbes 2023 Billionaires List and a Bloomberg chart that traces the cumulative wealth growth of the 287 new entrants over the past year. Whether you’re an investor, a policy maker, or simply curious about the forces that shape global wealth, the story of 2023’s new billionaires offers a compelling snapshot of where capital is flowing—and how fast.

Read the Full CNBC Article at:

[ https://www.msn.com/en-us/money/markets/rising-stocks-and-ipos-helped-create-287-new-billionaires-this-year/ar-AA1RW6Ko ]