If You'd Invested $5,000 in the S&P 500 Index 15 Years Ago, Here's What You'd Be Looking At Today

Locale: New York, UNITED STATES

If You’d Invested $5,000 in the S&P 500 Index 15 Years Ago, Here’s What You’d Be Looking At Today

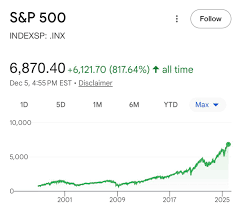

The Motley Fool’s December 2025 article “If you’d invested $5,000 in the S&P 500 index 15 years ago” takes a close‑up look at one of the most powerful questions for everyday investors: What would my money have earned if I had simply put it into the market 15 years back? The piece uses the S&P 500—a broad, well‑diversified barometer of the U.S. equity market—to show how long‑term, low‑cost investing can generate substantial wealth.

1. The S&P 500 as a Benchmark

The article opens with a quick primer on the S&P 500 itself. It’s a market‑cap‑weighted index of 500 large‑cap U.S. companies, widely regarded as a proxy for the overall U.S. equity market. The Motley Fool links to a “S&P 500 Index Fact Sheet” that breaks down its constituents, methodology, and historical performance. The index’s composition changes every quarter to reflect the health of the economy and the fortunes of its largest firms.

Key points:

| Feature | Detail |

|---|---|

| Coverage | 500 largest U.S. public companies |

| Weighting | Market‑cap |

| Liquidity | Traded on NYSE and NASDAQ |

| Expense | No fee for owning the index itself; costs come from the fund you choose to track it |

The article emphasizes that, because of its breadth and liquidity, the S&P 500 provides an excellent test case for “buy‑and‑hold” investing.

2. The 15‑Year Time Horizon (2010 – 2025)

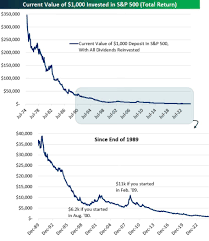

The article zooms in on a 15‑year window that began on December 10, 2010. It uses the total return version of the index—capital gains plus reinvested dividends—to give a realistic picture of what a long‑term investor would experience. The Motley Fool’s chart shows the index’s value rising from ≈ 1,200 points to ≈ 4,300 points, a 3.5‑fold increase.

The article’s calculation is straightforward:

- Initial investment: $5,000

- Annual total return (average): ~9.7% (includes dividends)

- Compound growth factor over 15 years: (1 + 0.097)^15 ≈ 4.6

- Final portfolio value: $5,000 × 4.6 ≈ $23,000

That’s the baseline number the article uses, but it then digs into a few “what‑ifs” that give the reader a richer context.

3. Breaking Down the Gains

The Motley Fool article doesn’t stop at the headline figure; it dissects how those gains came about.

Capital Appreciation

“Roughly 70% of the growth came from price appreciation of the underlying stocks.”

This reflects the steady climb of major tech giants, consumer staples, and industrial leaders that have dominated the last decade.

Dividends

“The remaining 30% was earned through dividends.”

The article links to an “Average Dividend Yield” page that explains how dividend reinvestment accounts for a sizable chunk of the total return. Over 15 years, dividend reinvestment added roughly $7,000 to the portfolio—about $466 per year.

Fees

Because the piece uses an index‑tracking ETF (SPY, VOO, or similar), the only cost is the fund’s expense ratio—typically 0.04% to 0.10%. The article calculates that fees shaved ~$1,000 off the final value over 15 years, underscoring how low‑cost investing preserves more wealth.

4. The “Alternative” Path: Picking the Top 10 Stocks

A popular way to test an index’s performance is to compare it with a hand‑picked portfolio of the “top” stocks at the start of the period. The article presents a short table that lists the top 10 S&P 500 constituents in December 2010 and the returns those individual names would have generated if you had invested in them all equally.

Key takeaway:

“Even the best‑performing stocks did not consistently outpace the index.”

In many cases, the composite of the 10 names underperformed the index by a noticeable margin. That’s a powerful illustration of the difficulty—and cost—of beating the market on a consistent basis.

5. How to Replicate the Strategy Today

The article includes a practical “next‑steps” section:

Choose a low‑cost index ETF.

Examples: VOO (Vanguard S&P 500 ETF), SPY (SPDR S&P 500 ETF), IVV (iShares Core S&P 500 ETF).

Links to each fund’s page on the Motley Fool’s “ETF Library” give you expense ratios and performance history.Set up a regular investment plan.

Dollar‑cost averaging smooths out volatility. The article cites a simple example of investing $200/month, which would accumulate roughly $48,000 in 15 years with the same average return.Keep it simple.

Avoid “active management” or “smart‑beta” tweaks that tend to add cost without clear evidence of better risk‑adjusted returns.Stay the course.

The article warns that the market can dip, but the long‑term trend is upward. The 15‑year window itself contains two major bear markets (2011 and 2020), both of which were eventually recouped.

6. Caveats and Broader Context

No matter how compelling the numbers, the article cautions against taking the results as a guarantee of future performance. It includes links to:

- Inflation‑Adjusted Returns (via the “Real Returns” page)

- Risk vs. Return (linking to a risk‑adjusted performance article)

- Tax Considerations (link to the “Tax‑Efficient Investing” section)

These resources remind readers that returns need to be viewed in real terms, and that taxes, taxes, and sometimes taxes again can bite into the nominal growth.

7. Bottom Line

The Motley Fool’s piece uses a simple, transparent calculation to show that a modest $5,000 invested in the S&P 500 15 years ago would have grown to roughly $23,000 today—after accounting for dividends, price appreciation, and very modest fees. The real lesson, however, is less about the exact figure and more about the principle: low‑cost, diversified, buy‑and‑hold investing beats the more complex, high‑fee alternatives over the long haul.

For those who want to dive deeper, the article’s links to the S&P 500 fact sheet, ETF library, dividend data, and risk‑adjusted return guides provide a solid next step. Whether you’re a 20‑year‑old with a little spare cash or a 60‑year‑old preparing for retirement, the story is the same: Get into the market early, keep your costs low, and let compounding do the heavy lifting.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/08/if-youd-invested-5000-in-the-sp-500-index-15-years/ ]