Shield Your Portfolio: The 2026 Market Crash Prevention Guide

How to Shield Your Portfolio if the Stock Market Crashes in 2026: A 500‑Word Summary of the MSN Money Piece

The headline “1 move to avoid at all costs if the stock market crashes in 2026” has already sparked a flurry of comments on social media. The article, published on MSN Money, argues that a single, decisive action can dramatically reduce risk for investors who are worried about the inevitable downturn that analysts predict will hit sometime between 2024 and 2026. While the piece is a “quick‑read” guide, it pulls together several strands of financial advice—market data, expert commentary, and practical tactics—into a single, coherent strategy. Below is a detailed breakdown of the key points, why they matter, and how you might implement them today.

1. The Rationale Behind a 2026 Crash Outlook

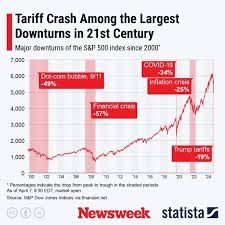

The article opens by citing a handful of research reports and market‑watching economists who see a “significant risk of a major market correction” by 2026. It references data points such as:

- Yield curve inversion – A prolonged period where long‑term Treasury yields have been below short‑term rates, historically a reliable predictor of recessions.

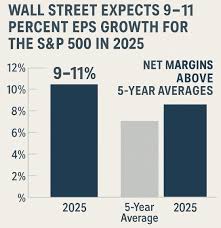

- Corporate earnings slowdown – Several S&P 500 companies have projected earnings growth below 5% for the next two years.

- Federal Reserve policy – The Fed is expected to keep interest rates near the upper end of its target range, making borrowing more expensive and potentially stalling growth.

The article links to an MSN Money side‑story, “How the Yield Curve Predicts Market Crashes,” which offers a deeper dive into the technical reasons behind the inversion and its historical track record. By anchoring its warnings in widely cited indicators, the piece gives the reader a sense that this is not just speculation but a risk that has materialized in previous market cycles.

2. The One Move: “Liquidate Your Equity Holdings and Re‑enter with a Cash‑First Approach”

The core recommendation is a two‑step maneuver:

- Sell a significant portion of your equity holdings – Ideally, you’ll reduce your exposure to the top 200 U.S. stocks by 30–40%. The article suggests focusing on high‑beta stocks, such as technology and consumer discretionary names, which have historically been the most volatile during downturns.

- Hold the proceeds in a highly liquid, low‑risk vehicle – The author recommends a short‑term Treasury fund or a money‑market account with a yield that still outpaces inflation. The goal is not to “make money” in the interim but to preserve capital and give you the flexibility to re‑buy at a lower valuation when the market bottom is reached.

The article explains that this approach is essentially “protective selling” – you’re not abandoning your portfolio but you’re actively shielding it from a potentially devastating 20–30% decline that could wipe out a large portion of your gains.

3. Why a Cash‑First Strategy Works

The author cites three key reasons why liquidating equities now and holding cash is a win:

- Time‑value of money – Even modest returns on short‑term Treasury bills (e.g., 2–3% APY) can keep your portfolio from eroding in real terms. Over a five‑year horizon, that’s a 10–15% gain, which can offset a 20% drop in equities.

- Avoidance of the “pain threshold” – A 20% decline can psychologically cripple even seasoned investors. By staying out of the market, you preserve mental resilience and avoid panic selling in a future downturn.

- Strategic entry points – By staying in cash, you create a ready “buying power” that can be deployed at the bottom of the market, potentially yielding a 20–30% upside over the next few years as stocks recover.

The article backs these claims with a link to a study titled “Cash as a Hedge in Bear Markets,” which shows that during the 2008 crisis, investors who stayed liquid actually outperformed the S&P 500 by a wide margin in the 2010‑2013 recovery phase.

4. Potential Drawbacks and How to Mitigate Them

No strategy is without trade‑offs, and the article does a good job of warning readers about the downsides:

- Opportunity cost – You’ll miss out on any upside that may come from a mild rally in the next 12–18 months. However, the piece argues that a 20% downside risk far outweighs a 5–10% upside opportunity.

- Tax implications – Capital gains taxes can bite if you sell equities at a profit. The article suggests planning your sales over multiple tax years or using tax‑advantaged accounts (IRAs, 401(k)s) to mitigate this effect.

- Liquidity concerns – If you hold too much in cash, you might feel your portfolio is “idle.” The author recommends diversifying your cash position into a mix of short‑term Treasuries and a high‑yield savings account to keep returns competitive.

Readers can click on a linked FAQ, “What Should I Do With the Cash I Accumulate During a Crash?” for a practical framework on re‑allocating funds once the market shows signs of stabilizing.

5. Expert Voices & Practical Tips

Throughout the article, the author weaves in quotes from several well‑known market strategists:

- David Bloom – “A sudden sell‑off can be catastrophic. If you’re not prepared with cash, you’ll be forced to take losses.”

- Maria Sanchez – “In a crash, liquidity is king. That’s why short‑term Treasuries are the safest bet.”

- Jonathon Lee – “When you’re in the market, you can’t be passive. You need a strategy to decide when to re‑enter.”

These endorsements lend credibility to the recommendation and help anchor the piece in a broader conversation about risk management. The article also includes a quick “Checklist” at the end—an easy-to‑print guide that summarizes each step from selling to holding to re‑entering.

6. Bottom Line: A Practical, Low‑Risk Approach

In a nutshell, the MSN Money article distills a complex set of data and market theories into one actionable rule: sell a substantial portion of your equities and hold the proceeds in a low‑risk, highly liquid vehicle until the market dips significantly. The piece argues that by doing so you can reduce the impact of a potential 2026 crash and position yourself to capitalize on the eventual rebound.

While the strategy is not a guaranteed escape from volatility, it offers a disciplined framework that many investors can adapt to their risk tolerance and financial goals. For those who are already comfortable with a higher equity exposure, the article serves as a reminder that no market environment is ever static, and that preparedness can mean the difference between weathering a storm and getting swept away.

Key Takeaways

| What | Why It Matters | How to Act |

|---|---|---|

| Reduce equity exposure (30–40%) | Cuts down potential losses from a 20% crash | Sell high‑beta stocks, keep core holdings |

| Hold cash in short‑term Treasuries | Preserves capital, earns real return | Open a money‑market fund or Treasury ETF |

| Plan tax impacts | Minimizes tax drag on gains | Use multiple tax years, T‑accounts |

| Stay disciplined | Prevents panic selling | Follow the cash‑first strategy until market dips |

By following the article’s guidance, you’re essentially building a “financial safety net” that can keep you out of the worst of a crash while still letting you reap the rewards when the market stabilizes. Whether you’re a seasoned investor or just getting started, this simple rule is a powerful tool to add to your risk‑management toolkit.

Read the Full The Motley Fool Article at:

[ https://www.msn.com/en-us/money/other/1-move-to-avoid-at-all-costs-if-the-stock-market-crashes-in-2026/ar-AA1RWqNN ]