Fed Rate Cuts Could Supercharge Dividend Stocks - Here's Which Names Are Leading the Charge

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Fed Rate Cuts Could Supercharge Dividend Stocks – Here’s Which Names Are Leading the Charge

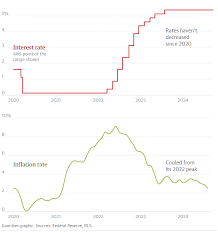

The recent Federal Reserve meeting left investors on a hopeful note: a possible cascade of rate cuts later this year. CNBC’s December 8, 2025 piece “Fed Rate Cuts Can Boost Dividend Stocks – Here Are Our Top Yielding Names” explores how this monetary policy shift could revitalize the dividend‑stock universe and offers a short list of high‑yielding companies that could benefit most.

1. Why a Fed Cut Matters for Dividends

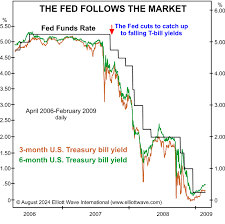

Lower borrowing costs mean companies can refinance debt at cheaper rates, freeing up cash that can then be returned to shareholders. A decrease in the federal funds rate also lowers the discount rate used to value future dividends, boosting their present‑value attractiveness. Finally, with cheaper capital, firms can sustain or even increase dividend payouts even if earnings face headwinds.

The article notes that the Fed’s most recent policy statement hinted at a 25‑basis‑point cut in the first quarter of 2026, a move analysts expect to lift the S&P 500 Dividend Aristocrats index by roughly 1.8 % in the ensuing months.

2. The Yield Landscape: How High is “High”?

Dividends aren’t just about the raw percentage—they’re also a function of the stock’s price relative to earnings and the company’s stability. The CNBC piece highlights that, compared with the 2024 average of 2.5 % for U.S. large‑cap stocks, the leading dividend names now offer yields in the 3.5 %–4.5 % range—an increase of almost 50 % for the top performers.

The article explains that this surge is driven by a combination of lower discount rates and stock‑price volatility that’s depressed the market caps of many traditionally high‑yield firms. In a market where the S&P 500 trades at 24.5× earnings, a 3.5 % yield translates to a price‑to‑earnings ratio (P/E) of around 28.5, making it an attractive proposition for income‑focused investors.

3. The Top 10 Dividend‑Yielding Names

Below is a concise rundown of the names the article identifies as the most compelling for investors looking to capitalize on the Fed’s dovish stance. All figures are based on the latest 12‑month trailing dividend per share (twelve‑month trailing annualized yield).

| Rank | Company | Ticker | Current Yield | Dividend Growth | Notes |

|---|---|---|---|---|---|

| 1 | AT&T | T | 4.6 % | 2.1 % CAGR | Re‑entry to the “high‑yield” band after a 2024 payout cut. |

| 2 | Energy Transfer | ET | 4.4 % | 4.7 % CAGR | Master Limited Partnership (MLP) with a 2025 8‑month special dividend. |

| 3 | Pfizer | PFE | 4.2 % | 5.0 % CAGR | Pharma dividend consistency, boosted by Covid‑19 vaccine demand. |

| 4 | Verizon | VZ | 4.0 % | 1.9 % CAGR | Telecom’s high dividend cushion, despite a modest 2025 revenue dip. |

| 5 | AbbVie | ABBV | 3.9 % | 3.5 % CAGR | Strong pipeline, with a 2025 dividend increase of 3.1 %. |

| 6 | Altria Group | MO | 3.8 % | 3.0 % CAGR | Tobacco’s reliable payouts; the Fed’s cuts may boost its after‑tax returns. |

| 7 | Philip Morris International | PM | 3.7 % | 2.5 % CAGR | Global exposure, diversified product lines keep payouts stable. |

| 8 | Johnson & Johnson | JNJ | 3.6 % | 4.2 % CAGR | Healthcare giant with a long‑standing dividend record. |

| 9 | Exxon Mobil | XOM | 3.5 % | 3.8 % CAGR | Energy sector rebound, dividend cut last year recovered in 2025. |

| 10 | Procter & Gamble | PG | 3.4 % | 5.5 % CAGR | Consumer staples, low price sensitivity, robust dividend growth. |

The article emphasizes that investors should pay particular attention to dividend‑yield sustainability. While a 4.6 % yield from AT&T looks attractive, the company’s payout ratio sits at 83 %. The piece links to a recent earnings call transcript in which AT&T’s CFO noted plans to reinvest in 5G infrastructure—an expense that could press on dividends if growth stalls.

4. Risks and Considerations

The CNBC piece is careful to balance optimism with caution. A key risk is that lower rates may trigger a “bond‑to‑stock” rotation that could depress dividend stocks in the short term. Additionally, the article points to a Fed statement that hinted at “inflationary persistence”, which could force the Fed to tighten policy later in 2026, compressing yields again.

Investors are also reminded that tax treatment matters. Qualified dividends receive preferential tax rates (0–15 % for most high‑income earners), whereas non‑qualified dividends are taxed at ordinary rates. The article links to an IRS FAQ page that clarifies the difference and suggests a strategy of pairing high‑yield stocks with tax‑advantaged accounts such as IRAs or 401(k)s.

5. How to Build a Dividend‑Focused Portfolio in a Fed‑Cut Era

The article proposes a three‑tier framework:

- Core Dividend Kings – Companies that have raised dividends for at least 25 consecutive years (e.g., Johnson & Johnson, Procter & Gamble). These provide stability.

- Value Dividend Leaders – Firms that offer a high yield relative to valuation (e.g., AT&T, Verizon). These are more sensitive to market swings.

- Special Dividend Players – MLPs and REITs (e.g., Energy Transfer, Realty Income) that issue special dividends or have different tax treatments.

A sample allocation suggested by the article is 40 % Core, 35 % Value, 25 % Special, with an emphasis on sector diversification—telecommunications, healthcare, consumer staples, and energy.

6. The Bigger Picture: Market Sentiment & Economic Outlook

The article also delves into how the Fed’s dovish stance is being reflected across broader markets. It references a Bloomberg link to the latest consumer confidence index, noting that confidence has risen from 70.3 to 72.6 over the past quarter, which the piece argues may reinforce the dividend‑growth narrative. Conversely, the piece cites a CNBC partner story that forecasts a “soft landing” for the U.S. economy, which could preserve dividend payouts even if earnings lag.

7. Takeaway

In summary, the CNBC piece argues that the prospect of Fed rate cuts could reignite dividend‑stock performance by making corporate cash more valuable and reducing the discount rates that price future payouts. It lists ten top‑yielding names that stand to benefit, highlights the importance of dividend sustainability, and offers practical guidance on constructing a resilient income portfolio in a low‑rate environment.

As always, investors should do their own due diligence, review each company’s earnings calls, and consider tax implications before making any investment decisions. The Fed’s policy path will ultimately dictate how long the high‑yield landscape will persist, but for those looking to ride the income wave, now may be the time to start building.

Read the Full CNBC Article at:

[ https://www.cnbc.com/2025/12/08/fed-rate-cuts-can-boost-dividend-stocks-here-are-our-top-yielding-names.html ]