Why a TFSA Matters: Unlocking Tax-Free Growth for Canadian Investors

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

TL;DR –

The MSN article “TFSA: The perfect Canadian stocks to buy and hold forever” offers a concise guide for Canadian investors looking to grow their portfolios tax‑free. It explains why a Tax‑Free Savings Account (TFSA) is a powerful vehicle for long‑term wealth building, then lists a handful of high‑quality Canadian stocks that the author believes are ideal for a buy‑and‑hold strategy. The piece mixes fundamentals (price‑to‑earnings, dividend yield, debt levels) with a sector‑diversified lens, and it urges readers to start or rebalance a TFSA by investing in these companies, holding them for the long haul, and reaping the tax benefits on dividends and capital gains.

1. Why a TFSA Matters for Canadian Investors

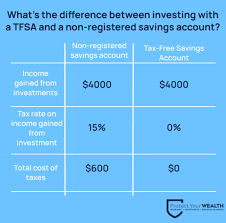

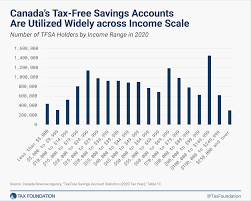

The article opens by explaining the unique tax advantages of a TFSA. Unlike a Registered Retirement Savings Plan (RRSP), a TFSA is not a retirement‑specific vehicle; you can invest in virtually any asset, from equities to bonds to real‑estate investment trusts (REITs). The key benefits highlighted are:

- Tax‑free growth – Both dividends and capital gains earned inside the account are never taxed, regardless of how often you withdraw.

- Flexibility – Withdrawals are completely tax‑free and can be recontributed in subsequent years without penalty.

- No impact on income‑based benefits – TFSA withdrawals do not affect government benefits such as the Canada Child Benefit or Old Age Security.

The author stresses that for a “buy‑and‑hold” strategy, the tax‑free feature can compound returns significantly over a 20‑to‑30‑year horizon.

2. Criteria for Choosing “Forever” Stocks

The article lists a set of criteria that define the “perfect” stocks for a TFSA buy‑and‑hold approach:

- Strong fundamentals – Low debt-to‑equity ratios, consistent earnings growth, and a solid balance sheet.

- Attractive valuations – Reasonable price‑to‑earnings (P/E) ratios relative to the sector and a history of being fairly priced.

- Dividend stability – A history of paying and increasing dividends, which offers a source of passive income that can be reinvested.

- Sector diversification – Coverage across financials, energy, technology, consumer staples, and industrials to reduce risk concentration.

- Canadian‑centric – Companies that either operate mainly in Canada or have a significant Canadian presence, thus aligning with the target demographic.

These standards are presented as a framework rather than hard and fast rules, allowing readers to adapt the list based on their risk tolerance.

3. The Recommended List of Canadian Stocks

Below is a distilled overview of the stocks highlighted in the article. Each is grouped by sector, with a short rationale that the author uses to justify the inclusion.

| Sector | Stock | Key Points |

|---|---|---|

| Financials | Royal Bank of Canada (RY) | Largest Canadian bank; robust dividend record; strong earnings resilience in a low‑interest‑rate environment. |

| Scotiabank (BNS) | Largest international exposure among Canadian banks; solid dividend; diversified income streams. | |

| Technology | Shopify (SHOP) | Rapid growth in e‑commerce; high valuation justified by strong future cash‑flow prospects; dividend‑free but attractive for growth. |

| Lightspeed Commerce (LSPD) | Niche point‑of‑sale solutions; growing customer base; solid fundamentals. | |

| Energy & Utilities | Enbridge (ENB) | Major pipeline operator; high dividend yield; steady cash flows from long‑term contracts. |

| Suncor Energy (SU) | Integrated oil‑and‑gas company; dividend growth; exposure to energy transition. | |

| Industrial & Infrastructure | Canadian National Railway (CNR) | Key freight corridor; resilient demand for shipping; dividend payer. |

| Canadian Pacific Railway (CP) | Complementary to CNR; strong earnings and dividends. | |

| Consumer Staples | Canadian Tire (CTC) | Diversified retail and automotive parts; consistent revenue streams; dividend-paying. |

| Dollarama (DOL) | Low‑price retailer with stable cash flows; growing presence in Canada and the US. | |

| Real‑Estate & Asset Management | Brookfield Asset Management (BAM) | Global asset‑management giant; diversified portfolio; dividend growth. |

| Canadian Apartment Properties REIT (CAR.UN) | Residential REIT with high occupancy rates; dividend focus. |

The article also mentions that investors can use ETFs such as the Vanguard FTSE Canada All Cap Index ETF (VFV) or iShares S&P/TSX 60 Index ETF (XIU) to achieve broad exposure if they prefer a diversified single‑purchase approach. However, the author advocates for picking individual stocks to fully leverage the TFSA’s tax‑free benefits.

4. How to Structure a TFSA Portfolio Around These Picks

The author walks through a sample allocation strategy that balances growth and income:

- 70% Growth (Non‑Dividend‑Paying) – e.g., Shopify, Lightspeed, and a small allocation to tech ETFs.

- 30% Income (Dividend‑Paying) – e.g., Enbridge, Suncor, Canadian National Railway, and a dividend ETF such as iShares Canadian Dividend Index ETF (CDZ).

Rebalancing is suggested every two years to keep the portfolio in line with long‑term goals, but the article warns against frequent trading because of the transaction costs and the potential tax implications if the assets were held outside a TFSA.

5. Practical Tips for Buying and Holding

The article provides a quick‑start checklist:

- Open a TFSA – If you haven’t already, the first step is to open a TFSA with a reputable brokerage or a major bank. The article lists a few recommended brokers that offer low fees and a wide range of Canadian stocks.

- Do your homework – Use free financial data sources (Yahoo Finance, Morningstar) to confirm the metrics the article cites. Look at debt‑to‑equity, P/E, and dividend yield for each company.

- Start small and scale up – Begin with a modest allocation to avoid over‑exposure, then increase as you become comfortable with the volatility.

- Use dollar‑cost averaging – By buying in equal increments over time, you reduce the risk of timing the market.

- Reinvest dividends – Within a TFSA, dividends can be automatically reinvested to buy more shares, amplifying the compounding effect.

- Monitor but don’t panic – The article stresses that a long‑term horizon means you can ride out short‑term volatility. A typical recommendation is to hold for at least 10–15 years.

6. Caveats and Risks

Even the best‑chosen stocks carry risks. The article reminds readers of:

- Market risk – All equities can lose value during downturns.

- Sector risk – Concentration in one sector (e.g., energy) can be problematic if that sector suffers a prolonged decline.

- Liquidity risk – Some stocks may trade at a lower volume, which can make large transactions costly.

- Currency risk – If you’re a US investor holding Canadian stocks, fluctuations between the CAD and USD can affect returns.

The author concludes that the TFSA’s tax advantages help cushion some of these risks but do not eliminate them. Therefore, diversification and disciplined investing remain essential.

7. Bottom Line

The MSN article positions the TFSA as the ultimate tool for Canadian investors who want to keep their gains tax‑free while focusing on high‑quality, long‑term growth opportunities. By selecting a curated mix of banks, energy firms, tech companies, and consumer staples, the author demonstrates how a single account can provide both dividend income and capital appreciation. The recommendation is to start now, use a disciplined buy‑and‑hold strategy, and let the tax‑free compounding work its magic over decades.

Next Steps for Readers

- Open or review your TFSA – Check your contribution room and decide how much you can invest this year.

- Research the highlighted companies – Look up the most recent earnings reports and analyst ratings.

- Decide on an allocation – Use the article’s suggested split as a starting point but adjust to your own risk tolerance.

- Set up automatic contributions – If your broker offers it, let the system pull a set amount each month into your TFSA.

- Track progress – Review your portfolio every 12–24 months to ensure you’re on track with your long‑term goals.

By following these steps, you can transform a simple savings account into a powerful engine for building Canadian‑centric wealth over the next generation.

Read the Full The Motley Fool Canada Article at:

[ https://www.msn.com/en-ca/money/top-stocks/tfsa-the-perfect-canadian-stocks-to-buy-and-hold-forever/ar-AA1RXfze ]