Top 5 S&P 500 Dividend Aristocrats to Buy Before 2026

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

The 5 Best S&P 500 Dividend Aristocrats to Buy Before 2026 – A Quick‑Reference Summary

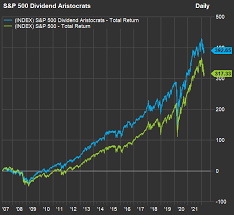

A recent article on MSN Money highlights five S&P 500 dividend‑aristocrats that, according to analysts, are poised to deliver reliable income and modest growth through 2026 and beyond. Dividend aristocrats are companies that have raised their quarterly payouts for at least 25 consecutive years, a badge of both stability and management discipline. The article’s author weighs the fundamentals of each pick, noting why these firms blend legacy, solid cash flow, and resilient business models.

Below is a concise rundown of the five stocks, the rationale behind each recommendation, and the broader context of why dividend aristocrats remain attractive to income‑focused investors.

1. Coca‑Cola Co. (KO)

- Yield & Growth: Coca‑Cola trades around a 3.0 % dividend yield and has lifted its dividend for 58 straight years—surpassing the 25‑year benchmark by a long margin. The company’s dividend growth rate averages 5–6 % per year, fueled by robust free cash flow.

- Why it’s a Pick: The brand’s global reach and price‑insensitive product mix (soft drinks, juices, bottled water) provide a steady revenue stream even in cyclical downturns. Coca‑Cola’s cash‑generating power allows it to fund dividend hikes without diluting equity.

- Risk Profile: Potential exposure to rising commodity costs (sugar, aluminum) and the growing shift toward healthier beverages. However, Coca‑Cola’s diversified portfolio and strategic acquisitions (e.g., Costa Coffee) help offset these pressures.

2. Johnson & Johnson (JNJ)

- Yield & Growth: J&J offers a yield around 2.5 % and has increased its dividend for 59 years. The company’s payout ratio sits near 50 %, leaving room for future growth.

- Why it’s a Pick: As a diversified healthcare conglomerate—spanning pharmaceuticals, medical devices, and consumer health products—JNJ benefits from multiple revenue engines. Its robust R&D pipeline keeps its drug pipeline healthy, while strong consumer staples (e.g., Tylenol) deliver defensive cash flow.

- Risk Profile: Regulatory scrutiny on drug pricing and patent expirations pose headwinds. Yet J&J’s global presence and consistent capital allocation policies mitigate long‑term risk.

3. Procter & Gamble Co. (PG)

- Yield & Growth: PG’s dividend yield sits at roughly 2.3 %. The company has boosted its dividend for 59 years, with a compound growth rate of about 6 % annually.

- Why it’s a Pick: P&G’s portfolio of household and personal‑care brands (e.g., Tide, Gillette, Pampers) enjoys a near‑monopoly on consumer staples in many categories. These products command high pricing power and benefit from stable, repeat purchase behavior.

- Risk Profile: While brand dominance provides stability, P&G must navigate intense competition from private‑label brands and the rising demand for sustainable, eco‑friendly products. P&G’s heavy investment in sustainability initiatives helps it stay ahead.

4. PepsiCo, Inc. (PEP)

- Yield & Growth: PepsiCo trades at a yield of about 3.0 %. The company has increased its dividend for 57 years, with an average growth of 6 % per year.

- Why it’s a Pick: PepsiCo combines a strong beverage line (Pepsi, Mountain Dew, Gatorade) with a leading snack business (Lay’s, Doritos). The snack segment offers higher margins and geographic diversification, giving PepsiCo a balanced revenue mix.

- Risk Profile: Commodity price swings (corn, sugar) affect both beverages and snacks. The brand’s shift toward healthier options (e.g., low‑sugar drinks, plant‑based snacks) may incur short‑term costs but positions PepsiCo for long‑term relevance.

5. 3M Co. (MMM)

- Yield & Growth: MMM offers a yield near 2.8 %. The company has increased its dividend for 58 years, with a compound growth rate of 5.5 % annually.

- Why it’s a Pick: 3M’s diversified product portfolio—from industrial safety gear to consumer household products—means revenue isn’t tied to a single industry. High R&D spending (≈10 % of revenue) keeps its product pipeline fresh, supporting both revenue growth and dividend sustainability.

- Risk Profile: 3M faces regulatory scrutiny on certain chemical products and geopolitical tensions that can affect its global supply chain. Nonetheless, its diversification and strong cash flow position it well.

Common Themes & Investor Takeaways

| Factor | How the Five Stocks Perform |

|---|---|

| Dividend History | All have raised dividends for >25 years; most >50 years. |

| Yield | Ranges 2.3 %–3.0 %—comfortably above the 2 % benchmark for defensive income. |

| Cash Flow | Strong free cash flow generation; payout ratios around 40‑60 %. |

| Growth Drivers | Diverse product mixes, global footprints, and ongoing R&D. |

| Risk Management | Consistent capital allocation; defensive business lines; low leverage. |

Why Dividend Aristocrats Matter in 2024‑2026

- Inflation Hedge: Dividend‑paying firms often raise payouts in line with price increases, offering a natural hedge against inflation.

- Defensive Nature: Consumer staples and healthcare companies tend to perform better in downturns due to constant demand.

- Reinvestment Flexibility: Steady cash flow allows management to fund growth initiatives without relying heavily on external financing.

Potential Pitfalls & How to Mitigate

Commodity Price Volatility – Particularly for beverage and snack producers (KO, PEP).

Mitigation: Focus on companies that have hedging strategies and diverse sourcing.Regulatory Pressures – Drug pricing and environmental regulations could squeeze margins for JNJ and MMM.

Mitigation: Evaluate regulatory risk exposure through earnings quality metrics.Competitive Dynamics – Rise of private labels and alternative brands for P&G and 3M.

Mitigation: Look for companies that invest heavily in marketing and product innovation.

Bottom Line

The MSN Money article presents a compelling case that the five highlighted dividend aristocrats—Coca‑Cola, Johnson & Johnson, Procter & Gamble, PepsiCo, and 3M—are well‑positioned to provide investors with reliable income, stable cash flows, and modest upside potential through 2026. Their long‑standing dividend histories, diversified product lines, and disciplined capital allocation make them attractive components of a defensive, income‑focused portfolio.

For investors aiming to balance growth and income, adding one or more of these stalwarts can help cushion against market volatility while still delivering a steady dividend stream. As always, individual financial goals, risk tolerance, and portfolio context should guide final investment decisions.

Read the Full 24/7 Wall St. Article at:

[ https://www.msn.com/en-us/money/savingandinvesting/the-5-best-s-p-500-dividend-aristocrat-stocks-to-buy-before-2026/ar-AA1S0Zcm ]