Hidden Pitfalls of Dividend-Focused Investing for Retirees

Kiplinger

KiplingerLocale: Massachusetts, UNITED STATES

The Hidden Pitfalls of Dividend‑Focused Investing for Retirees

When retirees first learn about the appeal of dividend investing—steady income, the promise of “passive” cash flow, and the allure of a “tax‑efficient” return—it’s easy to fall in love with the idea. Yet, a recent Kiplinger article, “Downsides of Dividend Investing for Retirees,” cautions that the bright side of dividends often comes with a host of risks that can erode the very income streams retirees rely on. Drawing on research, tax‑policy nuances, and real‑world case studies, the article dissects why dividend investing is not a silver‑bullet strategy and offers a more balanced approach to income planning.

1. Tax Treatment Isn’t All That Simple

A common selling point for dividend investing is the favorable tax treatment of “qualified” dividends, which are taxed at a maximum rate of 15% (or 20% for high‑income earners) rather than ordinary income rates. However, the Kiplinger piece highlights that many dividends—especially from foreign stocks, REITs, and certain municipal securities—are non‑qualified and thus taxed at ordinary rates. For retirees already living in the 25–37% brackets, this can quickly erode the net yield.

The article also links to a deeper exploration of the qualified dividend rules in the IRS Tax Code, noting that a dividend’s status depends on factors such as the holding period, the issuer’s domicile, and the type of security. Even a seemingly innocuous investment in a “dividend‑aristocrat” can deliver ordinary‑income taxes if the investor doesn’t keep the shares in a qualified account.

2. Concentration and Lack of Diversification

Many dividend portfolios become a single‑ticket strategy, concentrating a large portion of assets in a handful of high‑yield companies or sectors such as utilities, telecom, or real‑estate investment trusts (REITs). The Kiplinger article cites a 2023 study by Morningstar that found dividend‑heavy portfolios had a 17% higher volatility than broad market indices during periods of rising interest rates.

The article links to a companion piece on sector concentration risk, which warns that when a retiree’s income is tied to a small group of companies, a single corporate scandal, regulatory change, or interest‑rate shock can send the entire portfolio tumbling. In contrast, a diversified mix of bonds, growth stocks, and alternative assets typically offers a smoother income path.

3. Dividend Sustainability—Payout Ratios and Earnings Volatility

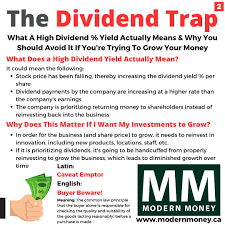

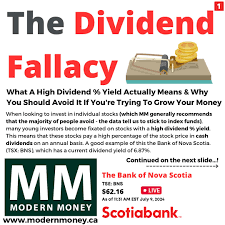

A headline dividend yield can be misleading if it is not backed by sustainable earnings. The Kiplinger article explains that many high‑yield stocks are paying out more than 70–80% of their earnings—a payout ratio that suggests little room for dividend cuts when earnings falter. It cites the dividend sustainability framework developed by analysts at the CFA Institute, which examines a company’s free‑cash‑flow coverage ratio and long‑term earnings growth.

The article also links to a deeper dive into payout ratio analysis, providing a step‑by‑step method for evaluating whether a company’s dividend is likely to survive an earnings shock. In short, retirees should avoid “dividend traps” where a high yield is actually a red flag.

4. The Rising Rate Puzzle

Dividends have historically been viewed as a hedge against inflation and a source of fixed income in a low‑rate environment. However, the Kiplinger article points out that as the Federal Reserve raises rates, dividend yields tend to decline. This is because higher rates boost bond yields, making bonds more attractive relative to dividend‑paying stocks, and because companies may cut dividends to preserve capital.

An embedded link to a recent Federal Reserve commentary on rising rates explains that when short‑term rates climb, high‑yield stocks can experience a “yield compression” effect. Retirees who rely on a dividend ladder may see their portfolio’s effective yield slip beneath the level needed to cover living expenses.

5. Inflation‑Protection Shortcomings

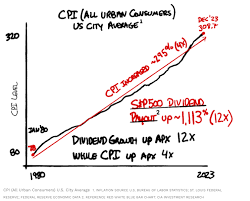

Even when a portfolio’s gross yield is healthy, the real return can be eroded by inflation. The Kiplinger article references a 2021 Wall Street Journal feature that found dividend growth rates have been sluggish for the past decade. For retirees, this means that a 4% nominal yield may provide only 1–2% real purchasing power when inflation averages 2–3% per year.

The article links to a real‑return calculator that illustrates how a modest 3% inflation rate can shrink the real yield of a 4% dividend portfolio by nearly one third over a decade. It underscores that relying on dividends alone for income may leave retirees exposed to the eroding force of rising prices.

6. Practical Alternatives and Mitigation Strategies

While the article paints a sobering picture, it does not advocate abandoning dividends altogether. Instead, it proposes a more nuanced, risk‑aware approach:

Blend Dividend and Bond Income – A 60/40 mix of dividend‑paying equities and high‑quality bonds can provide steady cash flow while offering the downside protection of fixed‑income instruments. The Kiplinger article links to a portfolio‑allocation guide that shows how this blend buffers against interest‑rate swings.

Focus on Dividend Growth, Not Yield – Companies that have a history of steadily increasing dividends (often the “dividend aristocrats”) tend to exhibit lower volatility and more sustainable payouts. The article links to a list of dividend‑growth stocks that have averaged 8% annual growth over the past 20 years.

Utilize Tax‑Advantaged Accounts – Retirees can shelter dividend income from taxes by holding dividend‑heavy holdings in IRAs or Roth accounts. The article refers to a Kiplinger white paper that discusses optimal account placement for dividend investors.

Monitor Payout Ratios and Earnings Quality – Regularly reviewing a company’s free‑cash‑flow coverage ratio and dividend history helps flag early signs of potential cuts. The article links to a free‑cash‑flow screener that allows investors to track these metrics in real time.

Incorporate Alternative Income Streams – Annuities, short‑term bond ladders, and even small‑cap growth funds can provide additional sources of income without overreliance on dividends. The article cites a retirement‑income diversification study that shows the benefits of a multi‑asset approach.

Conclusion

Dividend investing offers an appealing promise of predictable cash flow and potential tax advantages, but the Kiplinger article demonstrates that these benefits come with significant caveats. Rising rates, concentrated sector exposure, unsustainable payout ratios, and inflation erosion can all erode the real income that retirees expect from their dividend portfolio. By understanding the tax nuances, avoiding dividend traps, maintaining diversification, and blending dividends with other income sources, retirees can craft a more resilient strategy that balances the allure of dividend income with the realities of a volatile market.

In essence, dividends should be treated as one piece of the retirement income puzzle—valuable, but not the centerpiece. The Kiplinger article invites investors to look beyond the headline yield and to build a balanced, tax‑efficient, and inflation‑protected portfolio that will keep retirees well‑supplied long after the next rate hike.

Read the Full Kiplinger Article at:

[ https://www.kiplinger.com/retirement/retirement-planning/downsides-of-dividend-investing-for-retirees ]