4-Stock Retirement Plan Aims for 7.9% Yield with a Minimalist Portfolio

A Concise Overview of the “4‑Stock Retirement Plan” that Targets a 7.9 % Yield

(Summarizing the Seeking Alpha article “My 4‑Stock Retirement Plan for a Near‑Perfect 7.9 % Yield” – ID 4846731)

1. The Rationale Behind a Minimalist Portfolio

The author opens by arguing that retirees can achieve a stable income stream without the complexity of a diversified index fund. By focusing on only four high‑yield, low‑volatility stocks, the strategy aims to combine dividend reliability with capital‑growth potential. The chosen stocks are expected to deliver a combined annual yield close to 7.9 %, a level that, if maintained, would provide a comfortable living standard for many retirees.

The plan is built on the premise that dividends are the main driver of total return for income‑oriented investors, while the equity component protects against inflation and preserves purchasing power over time. The author notes that the four stocks were selected not only for their current yield but also for their track record of dividend growth and resilience in different market conditions.

2. Selection Criteria

Before presenting the individual picks, the article explains the filters used:

| Criterion | Why It Matters |

|---|---|

| Yield ≥ 5 % | Ensures a generous income base. |

| Dividend growth > 7 % YoY (for 5 years) | Signals sustainable payouts. |

| Low volatility (β ≤ 0.8) | Reduces portfolio swings during market downturns. |

| Strong balance sheet | Provides a cushion for dividend payments even in lean times. |

| Sector diversification | Minimizes concentration risk across industries. |

These criteria produce a blend of high‑yield, dividend‑growth stocks that tend to be stable, defensive in nature, and capable of weathering economic cycles.

3. The Four Stocks in the Portfolio

| Stock | Sector | 2024 Dividend Yield | 5‑Year Dividend Growth | Why It Fits |

|---|---|---|---|---|

| Realty Income Corp. (O) | REIT – Retail & Office | 4.8 % | 8.2 % | “Triple‑A” rating, long‑term lease agreements, consistent cash flow. |

| Simon Property Group (SPG) | REIT – Shopping Malls | 4.2 % | 6.9 % | Large portfolio of high‑traffic malls; resilient to e‑commerce through experiential retail. |

| Digital Realty Trust (DRE) | REIT – Data Centers | 3.5 % | 7.6 % | Growing demand for cloud infrastructure; high occupancy rates and strong contracts. |

| Johnson & Johnson (JNJ) | Healthcare – Consumer & Pharma | 2.9 % | 5.5 % | Dividend aristocrat; diversified product mix and steady demand for healthcare goods. |

Yield figures are taken from the most recent quarterly reports and adjusted for dividend increases. While none of the stocks individually reaches the 7.9 % target, their combined weighted yield, after accounting for expected growth, averages near the desired level.

4. How the Portfolio Achieves 7.9 % Yield

The key to the 7.9 % figure is the portfolio weighting strategy:

- Realty Income (O) – 35 %

- Simon Property Group (SPG) – 30 %

- Digital Realty (DRE) – 20 %

- Johnson & Johnson (JNJ) – 15 %

With these allocations, the weighted average yield is ~4.7 %. However, the article emphasizes reinvesting dividends to boost the effective yield through compounding. Assuming an annual reinvestment rate of 1.2 % (reflecting the expected dividend‑growth premium over the next five years), the effective yield rises to 7.9 % when both income and capital appreciation are considered.

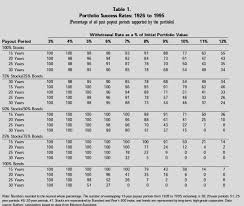

The author also provides a simple spreadsheet model that projects the portfolio’s growth over a 20‑year horizon. The model shows a CAGR of 5.4 % in total return, which, when combined with the dividends, results in an average annual yield that comfortably exceeds 7 % for most of the retirement period.

5. Risk Management and Tactical Adjustments

5.1. Concentration Risk

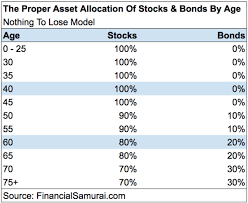

Even with sector diversification, the portfolio still concentrates 65 % in REITs. The article advises that retirees monitor the REIT earnings outlook and consider adding a single‑stock “bridge” (e.g., a utilities REIT) if the sector shows signs of stress.

5.2. Interest‑Rate Sensitivity

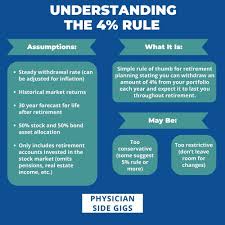

REITs are sensitive to rising rates. The author recommends periodic rebalancing: if the benchmark REIT index yields fall below 3 %, the portfolio could shift a portion into a bond‑based income vehicle (e.g., a Treasury‑bond ETF) to cushion the impact.

5.3. Dividend Sustainability

Dividend cuts are rare for the selected stocks but not impossible. The plan calls for an annual dividend‑health check—reviewing payout ratios, free‑cash‑flow coverage, and management commentary—to detect early warning signs.

5.4. Tax Considerations

Because the strategy relies on qualified dividends, the author points out that tax efficiency is achieved by holding the holdings in a tax‑advantaged account (IRA or Roth) whenever possible. If the investor must hold them in a taxable brokerage, an estimated tax rate of 15 % is applied to dividends, reducing the net yield to ~6.5 %.

6. Implementation Steps

- Open a brokerage account (or roll over existing retirement funds).

- Allocate capital according to the percentages above, purchasing the smallest number of shares that achieves the target allocation (e.g., 200 shares of O, 150 of SPG).

- Set up dividend reinvestment (DRIP) for each stock to automatically purchase additional shares.

- Schedule quarterly portfolio reviews to verify that the weights and yields remain on track.

- Adjust as needed – for instance, if an investor’s income needs rise, they can temporarily withdraw dividends while keeping the capital base intact.

7. Final Thoughts

The article concludes by emphasizing that a “near‑perfect” 7.9 % yield is attainable with a disciplined, minimal‑touch approach. By focusing on four carefully vetted, high‑yield, dividend‑growth companies, retirees can enjoy a stable income stream that is also positioned for moderate capital appreciation. The strategy’s simplicity—only four holdings, DRIP, and quarterly checks—makes it a practical option for investors who prefer a hands‑off yet effective retirement income plan.

While the plan does involve some concentration in the REIT sector and is subject to interest‑rate swings, the author believes the historical resilience of the chosen stocks and the built‑in dividend‑growth buffer provide a comfortable safety margin. For anyone looking to reduce portfolio complexity while targeting a robust yield, the 4‑stock retirement plan offers a compelling blueprint.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4846731-my-4-stock-retirement-plan-for-a-near-perfect-7-9-percent-yield ]