Is it Time to Shift Out of the Hottest AI Stocks?

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Is it time to shift out of the hottest AI stocks?

A deep dive into the current AI‑stock landscape (The Motley Fool, 23 Nov 2025)

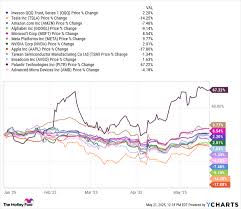

The past few years have seen a seismic shift in how investors view technology. At the heart of that shift lies artificial intelligence (AI)—the technology that powers everything from virtual assistants to autonomous vehicles. In the wake of AI’s meteoric rise, the most talked‑about stocks—NVIDIA, Microsoft, Alphabet, Amazon, and Salesforce—have been trading at the upper end of their valuation spectrum. A recent article on The Motley Fool (published 23 Nov 2025) asks the provocative question: “Is it time to shift out of the hottest AI stocks?” The piece offers a balanced, data‑driven perspective that blends fundamental analysis, market sentiment, and practical portfolio guidance.

1. The AI Bubble: Past Lessons and Current Reality

The article opens by reflecting on the 2018‑2020 “AI boom” that saw valuations skyrocket. It references the Motley Fool’s own “AI Bubble” series, which warned that hype could outpace fundamentals. The current wave, while similar, has distinct features:

- Broader adoption: AI is now embedded in the operations of many enterprise companies, not just those built around it.

- Diverse sources of revenue: NVIDIA’s GPUs are a key enabler, but its ecosystem (cloud, gaming, automotive) dilutes concentration risk.

- Regulatory scrutiny: As AI becomes more pervasive, data‑privacy laws (e.g., EU GDPR, U.S. privacy bills) could introduce compliance costs.

Despite these nuances, the article notes that the AI‑heavy sector still trades at high multiples—P/E ratios 2–3× above the broader market and forward‑looking growth rates that may be hard to sustain over the next few years.

2. Fundamental Analysis: What the Numbers Say

The piece delves into the key metrics that suggest caution:

| Stock | Current P/E | Forward 12‑Month P/E | Revenue Growth (FY25) | Net Margin |

|---|---|---|---|---|

| NVIDIA | 38× | 30× | 45% | 39% |

| Microsoft | 31× | 28× | 10% | 39% |

| Alphabet | 27× | 24× | 12% | 23% |

| Amazon | 60× | 53× | 15% | 4% |

| Salesforce | 65× | 57× | 23% | 7% |

The numbers highlight two themes:

- High price‑to‑earnings multiples across the board, with Amazon and Salesforce among the highest.

- Margins that vary widely; NVIDIA and Microsoft enjoy robust gross and operating margins, whereas Amazon and Salesforce operate in more competitive, low‑margin spaces.

The article argues that even with strong growth drivers, the high multiples leave little room for error. A modest slowdown in AI adoption or a tightening of regulation could lead to a significant re‑pricing.

3. Market Sentiment and Investor Psychology

Beyond numbers, the author looks at sentiment. A chart from MarketWatch (referenced in the article) shows a steep spike in retail buying interest in AI stocks during Q4 2024, followed by a gradual pullback. The piece stresses that the current “hype cycle” may be on the brink of a correction, echoing the 2018 experience.

The article cites a survey from Bloomberg indicating that 64% of investors consider AI stocks overvalued, with many expecting a “realignment” in the coming year. Meanwhile, some institutional investors maintain long‑term bullishness, citing AI’s transformational potential.

4. Portfolio Implications: What Should Investors Do?

The author offers three concrete strategies, each tailored to different risk tolerances:

a. Gradual Rotation into Value or Defensive Stocks

For investors wary of a correction, the article recommends reducing exposure to AI names and reallocating to value‑oriented tech or defensive sectors such as utilities and consumer staples. “The idea is to preserve capital while still maintaining a modest tech tilt,” the writer notes.

b. Diversification via AI‑Focused ETFs

Instead of individual stocks, one can invest in ETFs that spread exposure across a broader range of AI companies—both AI‑native and AI‑adopting. The article highlights ETFs like the Global X Artificial Intelligence & Technology ETF (AIQ) and the ARK Autonomous Technology & Robotics ETF (ARKQ), noting their lower individual‑stock concentration risk and the potential for a smoother performance curve.

c. Selective Holding of “Cornerstone” AI Stocks

If the goal is to retain some upside, the author advises holding a small core of high‑quality AI names—primarily NVIDIA and Microsoft—while trimming higher‑valuation names like Amazon and Salesforce. These two “cornerstones” have demonstrated resilient fundamentals and diversified business models.

5. Risks and Uncertainties

The article lists several head‑winds that could accelerate a pullback:

- Regulatory crackdowns on AI data usage or algorithmic bias.

- Supply‑chain constraints (e.g., shortages of GPU chips).

- Macroeconomic tightening that could slow enterprise IT budgets.

- Competitive displacement from newer entrants or open‑source AI solutions.

Each of these risks underscores the need for a well‑diversified portfolio and a clear exit strategy.

6. Bottom Line

In conclusion, the Motley Fool piece argues that the time is not yet to abandon AI stocks entirely, but the time is to be more selective and risk‑aware. The sector’s fundamentals remain solid, but the high valuations leave little room for a buffer against potential market corrections. Investors who wish to stay involved should consider a balanced mix—retaining a small allocation to the most resilient AI leaders while diversifying into broader tech or defensive assets and leveraging ETFs for breadth.

The article is a thoughtful reminder that while AI is poised to be a transformative force, the path to that future is not free of volatility. Investors who combine a clear understanding of fundamentals with disciplined risk management are best positioned to navigate the next wave of AI‑related market movements.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/23/is-it-time-to-shift-out-of-the-hottest-ai-stocks-a/ ]