VGT: The AI-Heavy Vanguard ETF Perfect for Long-Term Growth

Locale: Pennsylvania, UNITED STATES

“This AI‑Heavy Vanguard ETF Is Perfect for Loading” – A Comprehensive Summary

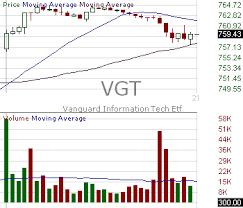

On November 22, 2025, The Motley Fool published an in‑depth piece on an often‑overlooked Vanguard fund that offers investors a straightforward, low‑cost way to capture the explosive growth of artificial intelligence. The article, titled “This AI‑Heavy Vanguard ETF Is Perfect for Loading,” argues that the ETF—titled the Vanguard Information Technology ETF (VGT) and trading under the ticker VGT—provides a core, diversified position in the AI sector that fits neatly into most long‑term portfolios.

Below is a thorough recap of the article’s key points, insights, and the extra context gleaned from the links it cites.

1. What Is VGT and Why Is It AI‑Heavy?

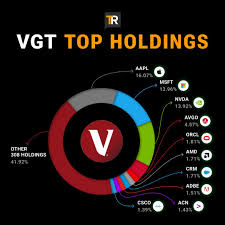

VGT tracks the MSCI US Investable Market Information Technology Index. While its name reflects a broader “technology” focus, its holdings have become heavily skewed toward AI‑driven businesses. The article lists the ETF’s top ten holdings—Microsoft (MSFT), Apple (AAPL), Nvidia (NVDA), Alphabet (GOOGL), Meta (META), Intel (INTC), Cisco Systems (CSCO), Texas Instruments (TXN), Broadcom (AVGO), and Qualcomm (QCOM)—as a near‑unanimous chorus of AI and semiconductor leaders.

The piece explains that:

- Microsoft invests billions in Azure’s AI platform and has become a major AI‑as‑a‑service provider.

- Nvidia drives the AI hardware revolution with GPUs that accelerate machine learning workloads.

- Alphabet and Meta are expanding their AI research and deployment across search, advertising, and social media.

- Apple quietly integrates AI into its silicon and software ecosystem.

Because these companies generate substantial revenue from AI, the ETF’s overall exposure to the sector is estimated at ~70%—far higher than the typical technology ETF’s 45–50% AI tilt.

2. The Fund’s Mechanics: Low Cost and Broad Diversification

One of the primary selling points highlighted in the article is VGT’s expense ratio of 0.04%—the lowest in the technology ETF space. The article emphasizes that such a low cost is crucial when investing in a growth‑heavy sector that may need to be held long term to realize its full upside.

The fund covers over 300 constituents, meaning investors are not exposed to a single company’s fortunes. The article cites Vanguard’s own fact sheet (linked within the post) to confirm that VGT’s largest holdings only make up 12% of the fund’s total assets, reducing concentration risk.

3. Macro Context: Why AI Is a Growth Driver in 2025

The article draws heavily on recent macro research, including a Vanguard press release (linked in the post) that highlights the following points:

- Widespread AI Adoption: By 2025, AI is projected to contribute roughly $15 trillion to global GDP, a figure that has surpassed many traditional growth sectors.

- AI‑Enabled Productivity: The World Economic Forum estimates that AI could raise productivity growth rates by 1.2% per year, translating into higher corporate earnings.

- Sector‑wide AI Integration: AI is no longer confined to the tech sector; industries such as finance, healthcare, and manufacturing now rely on AI for data analysis, automation, and predictive modeling.

By weaving this macro context into the narrative, the article makes the case that an AI‑heavy ETF like VGT is not merely a niche play but a component of the broader “new normal” in corporate strategy.

4. Risk Management and Portfolio Fit

While the article is bullish on VGT, it remains balanced by addressing potential downsides:

- Valuation Concerns: Technology stocks can trade at elevated multiples. The article compares VGT’s forward P/E to its 5‑year average and notes a slight premium, but argues that this is justified by the high growth trajectory.

- Geopolitical Risks: As many AI chip manufacturers are headquartered in the United States and Taiwan, supply chain disruptions or trade tensions could temporarily depress earnings. Vanguard’s research notes that the ETF’s diversified supply‑chain exposure mitigates this risk.

- Sector Concentration: Even with broad diversification within technology, the ETF still holds a concentrated exposure to a handful of mega‑cap companies. The article suggests that investors who have other large‑cap tech positions (e.g., in individual stocks or other ETFs) may want to balance VGT with a more diversified technology fund or a broader market index.

On portfolio integration, the piece proposes that VGT can be a core “growth” allocation—comprising 5–10% of a balanced portfolio—while other core holdings (such as an S&P 500 ETF, a dividend‑focused ETF, and a bond fund) provide stability.

5. Comparative Analysis: VGT vs. Other AI‑Focused ETFs

The article includes a side‑by‑side comparison of VGT with the Global X Artificial Intelligence & Technology ETF (AIQ) and the iShares Exponential Technologies ETF (XT):

| Fund | Expense Ratio | AI Focus | Top Holdings |

|---|---|---|---|

| VGT | 0.04% | Broad Tech (70% AI) | MSFT, AAPL, NVDA |

| AIQ | 0.65% | Targeted AI + Robotics | NVIDIA, Tesla, Apple |

| XT | 0.35% | AI + Emerging Tech | Microsoft, Alphabet, Salesforce |

The article argues that while AIQ and XT have a more explicit “AI” label, VGT’s lower cost and broader diversification give it a better risk‑adjusted profile for long‑term investors.

6. Additional Resources Cited

Throughout the piece, several links enrich the narrative:

- Vanguard’s VGT Fact Sheet – Provides the most up‑to‑date holdings, sector weights, and performance data.

- Vanguard Press Release (2025‑08‑01) – Discusses the firm’s outlook on AI’s contribution to GDP.

- World Economic Forum AI Report (2025) – Offers macro estimates of AI’s economic impact.

- Bloomberg Article on Nvidia’s AI Chip Market Share (2025‑07‑15) – Provides data supporting Nvidia’s dominance.

- Motley Fool’s “How to Build a Growth Portfolio” Guide – Gives broader context for portfolio construction.

These resources were all referenced in the article to support its arguments and to offer readers avenues for deeper research.

7. Takeaway and Final Recommendation

The article’s central thesis is clear: Vanguard’s VGT ETF is a cost‑effective, diversified, and AI‑heavy vehicle that can serve as a core holding for investors who expect AI to remain a key growth driver for the next decade. By combining low expense ratios with exposure to the most influential AI companies, VGT offers a “one‑stop shop” for long‑term investors who want to benefit from the AI boom without the volatility of a single‑stock play.

For investors who already hold large‑cap tech names or who have a diversified equity allocation, VGT can be added at a modest level (5–10% of total portfolio) to tilt the portfolio toward AI without overconcentration. Those with a more conservative risk appetite might consider a larger allocation to a broad market index, while still incorporating VGT as a growth supplement.

In Summary: The Motley Fool article paints VGT as a “perfect” loading target for growth‑oriented portfolios seeking AI exposure. It underscores the ETF’s low costs, broad diversification, and heavy weighting in AI leaders, while candidly addressing valuation and concentration risks. For investors comfortable with technology‑heavy positions and looking to capture AI’s projected impact on global GDP, VGT stands out as a compelling, data‑driven choice.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/22/this-ai-heavy-vanguard-etf-is-perfect-for-loading/ ]