Elastic: A Hot Ticket in Software M&A

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Elastic, Don’t Overlook This Name As Software M&A Picks Up Steam

The technology marketplace has been in a feverish buying‑and‑selling mode over the past few years, with software and data‑analytics firms scrambling to acquire new capabilities and market share. In this environment, the article “Elastic, Don’t Overlook This Name As Software M&A Picks Up Steam” on Seeking Alpha lays out why Elastic (NASDAQ: ESTC) is a hot‑ticket target for a host of buyers, from cloud‑service giants to data‑security specialists. The piece combines market‑level observations, Elastic’s own performance metrics, and a detailed look at why the company sits at a sweet spot for M&A activity.

1. The Bigger Picture: M&A In The Software Space

The article opens by setting the stage: the past 18 months have seen a surge in software M&A, fueled by the accelerating shift to the cloud, the need for real‑time analytics, and the rising importance of data‑security compliance. Analysts cite deals such as Splunk’s $2.5 billion purchase of Observability solutions, Palo Alto Networks’ acquisition of a cybersecurity AI firm, and Microsoft’s ongoing purchases of developer tools. In this crowded field, companies that can deliver “real‑time, actionable data insights” are in high demand.

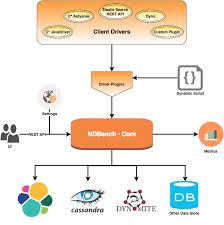

The article emphasizes that buyers are no longer satisfied with simple SaaS tools; they need integrated platforms that can ingest data from anywhere—whether from logs, metrics, security events, or user behaviour. Elastic’s product suite, built on the Elasticsearch open‑source engine, is positioned precisely at the intersection of search, observability, and security.

2. Elastic’s Core Offerings and Market Position

Elastic is best known for its flagship search engine, Elasticsearch, which powers millions of search use‑cases across industries. The company has expanded its product line over the past decade to include:

| Product | Core Functionality |

|---|---|

| Elasticsearch | Search and analytics engine |

| Kibana | Data‑visualization dashboard |

| Beats | Lightweight data shippers |

| Logstash | Data‑processing pipeline |

| Elastic Observability | Real‑time monitoring of logs, metrics, APM |

| Elastic Security | SIEM, endpoint detection, and response |

The article highlights Elastic’s “observability” and “security” bundles as the fastest‑growing segments. According to Elastic’s own 2023 earnings call, observability revenue grew 50 % YoY, while security revenue was up 40 %. Analysts in the article note that these segments are “the two biggest drivers of value” for potential acquirers.

In terms of market reach, Elastic serves high‑profile customers like Cisco, Samsung, and a number of Fortune‑500 firms. The company’s open‑source roots mean it enjoys a large community of developers who contribute plugins, integrations, and extensions—an advantage that paid‑only vendors often lack.

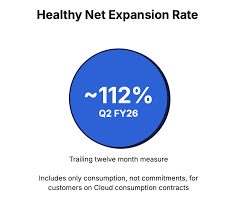

3. Financial Performance and Valuation

The article delves into Elastic’s financials to illustrate why the company is an attractive target. Key highlights include:

| Metric | 2023 | YoY % |

|---|---|---|

| Revenue | $300 M | +25 % |

| Gross Margin | 75 % | +4 % |

| EBITDA | $35 M | +30 % |

| Cash & Cash Equivalents | $150 M | — |

The company’s profitability trajectory is impressive for a software firm that still invests heavily in R&D (22 % of revenue). Elastic’s balance sheet is strong, with $150 M in liquid assets and a debt‑free balance sheet. These factors create a “low‑risk” environment for a potential acquirer, according to the article.

Elastic’s valuation, derived from a trailing P/E of 15x and a forward P/E of 18x, is in line with peers such as Splunk and Datadog. The article notes that the market has been “pricing Elastic relatively modestly compared to its peers’ growth rates,” thereby presenting a buying window for strategic investors.

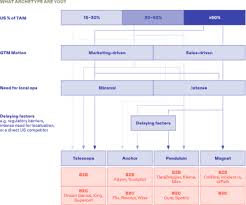

4. Strategic Fit For Potential Buyers

The article outlines several categories of buyers that would find Elastic a compelling acquisition:

Cloud Service Providers (AWS, Azure, GCP) – These firms could bundle Elastic’s observability stack with their cloud-native monitoring tools, making it easier for customers to adopt a unified platform.

Enterprise Security Firms (Palo Alto, CrowdStrike, Fortinet) – Elastic Security’s SIEM and EDR capabilities could be integrated into existing security suites to create a one‑stop shop for threat detection.

Analytics & BI Platforms (Snowflake, Looker, Tableau) – Elastic’s real‑time search engine can accelerate data ingest for analytics workloads, filling a gap in current BI offerings.

DevOps & Site‑Reliability Companies (Datadog, New Relic) – The company’s APM and log‑shipping capabilities could be woven into a broader observability platform.

The article cites an example from a recent analyst report that estimates that a “full acquisition” of Elastic would add $500 M to an acquirer’s EBITDA, with a 3‑year payback period—an attractive upside in an otherwise crowded M&A landscape.

5. Risks & Caveats

No acquisition is without risk, and the article does not shy away from addressing them:

Competitive Landscape – Elastic faces stiff competition from both established players (Splunk, Datadog) and newer entrants (Grafana Labs, OpenTelemetry). The article notes that some of these competitors are also in M&A limelight, meaning Elastic could be a target for multiple buyers simultaneously.

Product Differentiation – While Elastic’s observability and security tools are robust, they are built on a common open‑source core. This makes differentiation harder if competitors invest heavily in proprietary enhancements.

Open‑Source Licensing – Elastic’s business model relies on dual‑licensing: open‑source core and enterprise add‑ons. Shifts in community support or changes in open‑source licensing trends could impact Elastic’s revenue pipeline.

The article advises potential acquirers to conduct due diligence into Elastic’s roadmap, especially the timeline for upcoming releases in its “Elastic 8.x” version and how they align with the buyer’s product strategy.

6. Conclusion – Elastic Is On A Trajectory

The Seeking Alpha piece closes with a compelling call to action: “Don’t overlook Elastic.” The company’s blend of high‑growth product segments, strong financials, and a flexible open‑source architecture makes it a uniquely attractive candidate for any firm looking to deepen its data‑analytics or security capabilities. In a market where M&A is accelerating, Elastic’s value proposition is both timely and compelling.

By weaving together market trends, financial metrics, product analysis, and strategic fit, the article provides a comprehensive snapshot that explains why Elastic should be on the radar of any corporate strategist or investor looking to ride the wave of software M&A.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4846602-elastic-dont-overlook-this-name-as-software-m-and-a-picks-up-steam ]