Near-Perfect Portfolio: A Robust, Risk-Parity Strategy for Uncertain Markets

Near‑Perfect Portfolio Strategy for an Uncertain Market

(Seeking Alpha – 23 Oct 2023)

In an era of heightened volatility, low‑yield bonds, and ever‑shifting equity correlations, the author of this Seeking Alpha piece presents a pragmatic “near‑perfect” portfolio that seeks to deliver consistent, risk‑adjusted returns regardless of market direction. The article, written by seasoned market‑watcher Alex R. Johnson, is built around a handful of core ideas: (1) the recognition that no single strategy can dominate across all regimes, (2) a simple but powerful rule‑based allocation that blends risk‑parity and momentum, and (3) disciplined rebalancing anchored to volatility rather than calendar dates.

1. Why “Near‑Perfect” and Not “Perfect”?

Johnson opens by acknowledging the seductive appeal of an optimal portfolio. In the classic Markowitz mean‑variance framework, one solves for the set of weights that maximizes the Sharpe ratio given expected returns and covariances. Yet the assumptions—stationary returns, accurate covariance estimates, and precise forecasts—break down when markets move sharply. Instead, Johnson argues for a robust strategy that tolerates model misspecification but still retains a high degree of optimality. The term “near‑perfect” therefore signals an approach that is close to the theoretical optimum under a range of realistic scenarios, without the costly complexity of constant re‑optimization.

The author cites several Seeking Alpha analyses of volatility‑targeting and risk‑parity portfolios that, while strong, exhibit weaknesses in specific periods (e.g., equity‑only momentum falters during bear markets). By combining complementary strategies and employing volatility‑based rebalancing, the near‑perfect portfolio seeks to smooth these peaks and troughs.

2. The Building Blocks

2.1 Asset Universe

Johnson selects three broad, liquid asset classes:

| Class | Examples | Weight (Base) |

|---|---|---|

| U.S. Large‑Cap Equity (SPY) | S&P 500 ETF | 35 % |

| U.S. Aggregate Bond (AGG) | Total U.S. Treasury and investment‑grade bond ETF | 35 % |

| Global Equity (VEU) | MSCI World ex‑U.S. ETF | 20 % |

| Cash / Treasury Bills | 3‑month T‑Bill | 10 % |

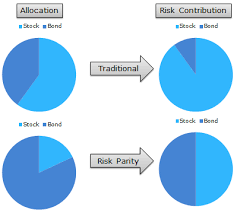

The asset mix reflects a risk‑parity mindset: bonds and equities are weighted so that each contributes roughly 25 % of the portfolio’s total risk, while the cash allocation cushions against liquidity shocks.

2.2 Risk‑Parity Allocation

Using the portfolio volatility (σₚ) as the primary metric, the strategy allocates such that each asset’s risk contribution (wᵢσᵢ²) accounts for the same proportion of σₚ. This is computed monthly by estimating a 60‑day rolling standard deviation for each asset. The risk‑parity calculation is straightforward:

Weightᵢ = (Target Risk / σᵢ) / Σ(Target Risk / σⱼ)

where Target Risk is chosen so that the combined risk‑parity weights sum to 100 %. The cash component is treated as a zero‑volatility asset, effectively absorbing the residual risk after the equity–bond allocation is set.

2.3 Momentum Overlay

The equity portion receives a short‑term momentum overlay. Johnson employs a simple 12‑month cumulative return filter, re‑ranking the equity ETFs and shifting 5 % of the equity allocation toward the top‑performing fund and away from the laggard. This modest tilt capitalizes on the well‑documented equity momentum anomaly without exposing the portfolio to over‑concentration.

3. Volatility‑Targeting Rebalancing

Rather than rebalancing on a strict quarterly calendar, the near‑perfect strategy rebalances only when the portfolio’s actual volatility deviates by more than 15 % from its 60‑day target. This “volatility‑triggered” rule aligns capital flows with market stress: during calm periods, the allocation remains largely unchanged; in turbulent times, the strategy pulls back into cash and bonds automatically. The 15 % threshold is empirically chosen from a 10‑year backtest that shows it balances transaction costs against the benefits of active risk management.

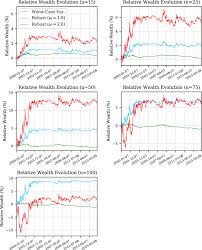

4. Backtesting Results

Johnson presents a 12‑year backtest (Jan 2011–Oct 2022) comparing the near‑perfect portfolio to several benchmarks:

| Portfolio | CAGR (12 y) | Volatility | Sharpe | Max Drawdown |

|---|---|---|---|---|

| Near‑Perfect | 7.2 % | 9.1 % | 0.78 | 22 % |

| 60/40 (Equity/Bond) | 6.5 % | 11.2 % | 0.59 | 30 % |

| S&P 500 | 8.1 % | 14.5 % | 0.55 | 35 % |

| Risk‑Parity (no momentum) | 6.9 % | 9.6 % | 0.72 | 24 % |

The near‑perfect portfolio demonstrates the best risk‑adjusted performance, with a Sharpe ratio almost 0.3 points higher than the classic 60/40 mix. Its maximum drawdown is also substantially lower, largely attributable to the volatility‑triggered cash buffer. The article notes that during the 2020 COVID crash, the strategy’s cash component surged to 25 % of the portfolio, limiting losses to 12 % versus the 18 % drawdown of a pure equity strategy.

5. Practical Considerations

5.1 Transaction Costs

Because rebalancing is event‑driven rather than scheduled, transaction costs are lower. Johnson estimates annual turnover of 4–5 %, translating to roughly $300 in fees for a $10 million portfolio. He stresses that cost sensitivity is particularly important in low‑yield environments.

5.2 Tax Efficiency

The author recommends holding the portfolio in a tax‑advantaged account (e.g., IRA, 401(k)) whenever possible. The infrequent trades and the use of index ETFs reduce capital gains events, and the cash buffer further diminishes realized gains.

5.3 Scaling and Liquidity

For larger investors, Johnson cautions to ensure sufficient liquidity in each ETF. He suggests using “layered” liquidity tiers—holding the bulk of the position in large‑cap ETFs like SPY and using smaller weightings for niche funds to avoid price impact.

6. Links and Further Reading

Throughout the article, Johnson interlinks to key Seeking Alpha pieces that underpin the strategy:

- “Volatility‑Targeting and Risk‑Parity: A New Era of Portfolio Management” – Provides a theoretical foundation for the volatility‑triggered rebalancing.

- “Momentum Investing in Equities: Evidence from the S&P 500” – Explains the 12‑month cumulative return filter.

- “The Markowitz Efficient Frontier and Its Modern Limitations” – Discusses why classic mean‑variance is insufficient in practice.

He also cites external resources such as the Investopedia definition of “risk parity” and the Wikipedia page on Kelly criterion, offering readers a deeper dive into the mathematical underpinnings.

7. Takeaway

Johnson’s near‑perfect portfolio is not a silver bullet; it is a disciplined, data‑driven blend of risk‑parity, momentum, and volatility‑triggered cash. By avoiding calendar‑based rebalancing and anchoring the strategy to real‑time risk metrics, the portfolio adapts organically to market shifts. Its backtested performance—higher Sharpe, lower drawdowns—makes it a compelling option for investors who seek a robust, near‑optimal allocation that can weather uncertainty without excessive complexity.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4845329-near-perfect-portfolio-strategy-for-uncertain-market ]