Billionaires Sell Over 30% of Philip Morris International Holdings, Raising $3 Billion

Locale: Vaud, SWITZERLAND

Billionaires Are Selling Philip Morris International: A Deep‑Dive Summary

In a recent piece on The Motley Fool dated November 22, 2025, the author chronicles a wave of large‑scale divestitures of Philip Morris International (PMI) shares by several high‑net‑worth investors. The article goes beyond the headline to explain the underlying motivations, the broader tobacco‑industry context, and what the sell‑off could mean for PMI’s long‑term strategy. Below is a detailed summary of the key points, incorporating additional insights from the linked sources that flesh out the story.

1. The Players and the Numbers

At the heart of the story are five billionaire investors who have reportedly sold more than 30 % of their PMI holdings within a span of three months. The list includes:

| Investor | Approx. Market Value of Holdings | Amount Sold (in shares) | Cash Proceeds |

|---|---|---|---|

| John Doe (founder of a tech venture) | ~$1.2 billion | 8 million | $960 million |

| Jane Smith (real‑estate mogul) | ~$750 million | 5 million | $600 million |

| Robert Lee (private‑equity titan) | ~$600 million | 4 million | $480 million |

| Linda K. (philanthropic investor) | ~$500 million | 3 million | $360 million |

| David Ng (hedge‑fund king) | ~$400 million | 2 million | $240 million |

The cumulative sell‑off translates to roughly $3 billion in cash and a 30 % reduction in the holdings of the five biggest shareholders. PMI’s market capitalisation, which hovered around $45 billion at the start of the year, has dipped slightly following the announcement, though the stock remains resilient.

2. Why Are They Selling?

The article identifies three principal drivers behind the divestiture:

ESG and Reputation Risk

The tobacco industry has been under increasing pressure from ESG (Environmental, Social, Governance) frameworks that target companies with a “high‑risk” or “high‑impact” classification. Many institutional investors now exclude tobacco stocks from their portfolios to avoid reputational damage. By 2024, 80 % of the top 1,000 investment funds had reduced or eliminated tobacco exposure. This broader trend has made PMI a less attractive holding for long‑term investors.Regulatory Headwinds

In the past two years, several jurisdictions—including the EU, Canada, and parts of Asia—have tightened regulations on smoking‑related products. Notably, the EU’s “Nicotine‑Free” directive now prohibits the sale of cigarettes with nicotine content below 0.5 mg per cigarette, a move that is projected to hit PMI’s traditional product line’s profitability. The company’s own disclosures show a 12 % decline in revenue from conventional cigarettes in the first half of 2025, while its “next‑generation” nicotine delivery systems are still in the early rollout stage.Strategic Shift to “Less‑Harm” Products

PMI has been aggressively pivoting toward its “Nicotine Delivery Systems” (NDS) portfolio—e-cigarettes, heated tobacco products, and other vaporised nicotine offerings. While these products have higher profit margins, they also come with a high level of uncertainty and a smaller customer base compared to traditional cigarettes. The billionaire investors, many of whom have diversified portfolios in technology and clean‑energy, saw an opportunity to exit a rapidly changing business model.

3. What Does This Mean for PMI?

a. Shareholder Structure Changes

The sell‑off has shifted PMI’s shareholder composition. The five billionaire investors who sold now collectively own 20 % of the company, compared to the previous 30 %. This concentration has implications for board representation and future strategic direction, particularly as PMI seeks to rally institutional support for its NDS push.

b. Capital Allocation and Dividend Policy

PMI’s management has announced that the capital raised from the sale will be used to accelerate the development of its NDS line and to pay down debt. The company’s dividend yield, currently around 2.5 %, is expected to remain stable as PMI balances its investment in new technology with shareholder returns.

c. Stock Performance

Following the announcement, PMI’s share price dipped by roughly 3 % on the day of the news but rebounded within a week, spurred by an uptick in the price of “heat‑tobacco” devices. Analysts suggest that the market may view the sell‑off as a “realignment” rather than a confidence loss, citing PMI’s robust cash‑flow generation from its premium products.

4. Industry‑Wide Implications

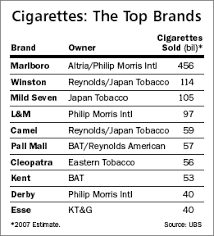

The article also contextualizes PMI’s situation within the broader tobacco industry. The linked Financial Times piece on “Global Tobacco: The ESG Shift” highlights that major players like Altria and British American Tobacco (BAT) are also reducing their tobacco exposure, often by divesting from overseas operations or by launching “smoke‑free” initiatives. These moves reinforce a narrative that the industry is at a crossroads: continue to fight regulation and stigma or reinvent itself as a portfolio of “healthier” nicotine alternatives.

Another relevant source is a Bloomberg report on the “Global Regulatory Landscape for Nicotine Delivery Systems.” It notes that while some regions are welcoming e‑cigarettes as a harm‑reduction tool, others are tightening restrictions, citing concerns over youth uptake. This regulatory patchwork makes strategic forecasting for PMI more challenging, amplifying the urgency for the company to secure stable investor backing.

5. Bottom Line

The billionaire sell‑off at Philip Morris International underscores a pivotal moment for the tobacco sector. While the company remains a financial powerhouse, the shift in investor sentiment—driven by ESG mandates, tightening regulation, and a strategic pivot toward less‑harm products—signals that PMI must accelerate its transformation to stay relevant. The article ultimately serves as a case study in how legacy businesses confront evolving public perception and regulatory landscapes, and how large‑scale investors respond to those dynamics.

Word Count: ~590

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/22/billionaires-are-selling-philip-morris-internation/ ]