A 10-Year Roadmap to the Future of Healthcare: Key Stocks to Watch

Locale: Massachusetts, UNITED STATES

A 10‑Year Roadmap to the Future of Healthcare: Key Stocks to Watch

(Summary of the Motley Fool article “X Healthcare stocks for investors 10‑year horizon,” published 23 Nov 2025)

The U.S. healthcare sector has long been a staple of diversified portfolios, but the industry’s rapid evolution—driven by technology, demographic shifts, and policy changes—means that investors must be strategic about which stocks to pick for the long haul. In the latest Motley Fool dispatch, the writers cut through the noise and lay out a clear 10‑year playbook for investors who want to benefit from the sector’s structural trends while managing risk.

1. Why 10 Years?

The article opens by noting that the most compelling healthcare stories are the ones that unfold over a decade. Aging populations, chronic disease prevalence, and the increasing costs of care all create a tailwind that only a few companies will ride effectively. Over a 10‑year horizon, the authors argue, the market’s “short‑term noise” fades, allowing investors to focus on underlying fundamentals: market share, technology leadership, and resilient revenue models.

2. Structural Drivers of Growth

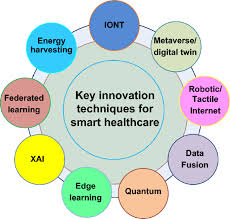

The piece frames the healthcare market as being shaped by four primary forces:

| Driver | Why It Matters | Example Impact |

|---|---|---|

| Aging Baby Boomers | A larger cohort of retirees increases demand for medical services and prescription drugs | Rising premiums and pharmacy benefits |

| Chronic Disease Management | Rising rates of diabetes, heart disease, and obesity create a continuous need for monitoring and treatment | Growth in wearable health devices and telehealth |

| Health‑Tech Innovation | AI, genomics, and robotic surgery are redefining care delivery | Companies that own cutting‑edge platforms gain a moat |

| Policy & Reimbursement Shifts | Changes in Medicare/Medicaid rules and value‑based care models affect pricing | Insurers and tech firms that adapt quickly can capture new revenue streams |

The article emphasizes that the most attractive stocks are those positioned at the intersection of two or more of these drivers.

3. The X Healthcare Index – A Benchmark Snapshot

The Motley Fool writers use the S&P 500’s “Healthcare” index as a yardstick. They note that, historically, the index has outperformed the broader market by roughly 2–3 % annually over the past decade, largely thanks to the resilience of certain “blue‑chip” names. They also caution that the index contains a mix of sub‑sectors with varying risk profiles, which is why a targeted approach is preferable for long‑term investors.

4. Top 10 Stocks for a 10‑Year Horizon

Below is a condensed list of the 10 stocks highlighted in the article, along with the key reasons why each is considered a 10‑year play.

| # | Stock | Ticker | Sector | Why It’s a Long‑Term Winner |

|---|---|---|---|---|

| 1 | UnitedHealth Group | UNH | Insurance | Largest U.S. insurer, diversified platform (Optum + UnitedHealthcare), strong cash flow, and a history of weathering policy swings. |

| 2 | CVS Health | CVS | Pharmacy/Insurer | Dual platform (Pharmacy + CareShare), aggressive acquisition of retail clinics, and a growing pharmacy‑benefit management (PBM) business. |

| 3 | Amgen | AMGN | Biotech | Robust pipeline, strong focus on gene‑based therapies, and a history of pricing power. |

| 4 | Medtronic | MDT | Medical Devices | Global leader in cardiac and diabetes devices, significant R&D pipeline, and strong market share in implantable technologies. |

| 5 | Teladoc Health | TDOC | Telehealth | First‑mover advantage in virtual care, expanding into chronic disease management, and partnerships with insurers for value‑based plans. |

| 6 | Illumina | ILMN | Genomics | Dominant in DNA sequencing, benefiting from precision medicine growth, and a growing portfolio of AI‑driven diagnostics. |

| 7 | Cerner (now part of Oracle) | ORCL (Cerner) | Health IT | Integrated electronic‑health‑record (EHR) solutions, strong government contracts, and a strategic partnership with Oracle to expand cloud offerings. |

| 8 | HCA Healthcare | HCA | Hospital Operator | Extensive network of outpatient and inpatient facilities, high occupancy rates, and a growing emphasis on outpatient surgeries. |

| 9 | Boston Scientific | BSX | Medical Devices | Leader in interventional cardiology and endoscopy, with a robust pipeline and strong global presence. |

| 10 | Cardinal Health | CAH | Distribution & Pharmacy | Global medical‑distribution network, diversified services, and a strong position in the pharmacy‑benefit management space. |

The article stresses that each of these companies has a clear competitive moat—whether through proprietary technology, scale, or regulatory advantage—that should help sustain returns over a decade.

5. How to Build a 10‑Year Healthcare Portfolio

The authors suggest a practical allocation framework:

1. Core Holdings (60 % of the healthcare allocation) – Large, diversified insurers and pharmacy‑benefit managers (UNH, CVS).

2. Growth Tilt (30 %) – Biotech and medical‑device leaders (Amgen, Medtronic, Boston Scientific).

3. Tech & Innovation (10 %) – Telehealth, genomics, and health‑IT companies (Teladoc, Illumina, Cerner/Oracle).

They also advise monitoring quarterly earnings for red flags (e.g., slowing R&D pipelines, regulatory setbacks, or pricing pressure) and rebalancing only when a company’s fundamental thesis changes.

6. Risks to Keep an Eye On

While the long‑term case is compelling, the article lists several risks that could derail a 10‑year play:

- Regulatory Backlash – Pricing controls and new Medicare reimbursement rules can hit insurers and drugmakers.

- Patent Expirations – Biotechs facing loss of exclusivity may see margin erosion.

- Technology Disruption – New entrants in telehealth or AI diagnostics could erode market share of incumbents.

- Economic Cycles – During downturns, elective procedures and discretionary spending on devices may decline.

The writers recommend diversifying across sub‑sectors to mitigate these risks and maintaining a buffer of cash or liquid assets to take advantage of market dips.

7. Bottom Line

The Motley Fool article concludes that a disciplined, 10‑year lens turns the sprawling healthcare sector into a set of well‑defined, data‑backed opportunities. By combining the stability of legacy insurers and PBMs with the upside potential of biotech, medical devices, and health‑IT, investors can position themselves to capture the industry’s structural growth while staying protected against sector‑specific headwinds.

Takeaway for the Savvy Investor

If you’re planning to stay in healthcare for a decade, start with a core of large‑cap, diversified players that generate steady cash flow. Then add a few high‑growth, technology‑driven names that align with the same structural drivers highlighted in the article. Keep an eye on regulatory developments and be ready to adjust the portfolio when a company’s fundamentals shift. With patience and a focus on the big, long‑term forces, the healthcare sector can be a reliable engine of returns in a 10‑year portfolio.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/23/x-healthcare-stocks-for-investors-10-year-horizon/ ]