Apple Inc. (AAPL) - Defensive Growth with Strong Services and Wearables

Locale: District of Columbia, UNITED STATES

Summary of WTOP’s “8 Best Stocks to Buy Now with $1000” (October 2025)

WTOP’s October 2025 feature titled “8 Best Stocks to Buy Now with $1000” offers a concise yet thoughtful guide for novice and seasoned investors looking to deploy a modest capital sum in the equity market. The article is structured around eight individual stocks—spanning technology, consumer staples, healthcare, and energy—that the author believes are positioned for strong performance over the next 12–18 months. Below is a detailed breakdown of the article’s content, along with key take‑aways, risk considerations, and practical allocation guidance.

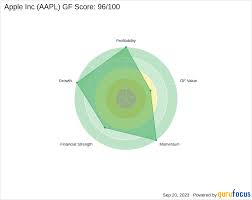

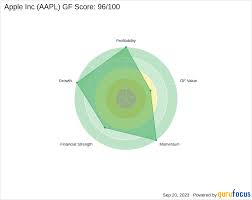

1. Apple Inc. (AAPL) – Technology / Consumer Electronics

- Why it’s highlighted: Apple’s solid free‑cash‑flow generation, robust services moat, and growing wearables division make it a defensive growth play. The author cites Apple’s continued ability to raise earnings per share (EPS) even as the semiconductor cycle slows.

- Price target (2026): $190 per share (current price ~ $135).

- Risk factors: Potential supply‑chain bottlenecks, regulatory scrutiny over App Store practices, and a sensitive “product refresh” cycle.

- Link referenced: A Bloomberg article that details Apple’s quarterly cash‑flow statement and a CNBC interview with the CFO discussing the company’s roadmap.

2. NextEra Energy, Inc. (NEE) – Renewable Energy

- Why it’s highlighted: NextEra has outperformed its peers in the “clean‑energy” space due to its sizable wind and solar portfolios, plus an impressive dividend yield. The piece notes the company’s “green‑financing” strategy and its role in the U.S. energy transition.

- Price target (2026): $135 per share (current price ~ $110).

- Risk factors: Fluctuations in renewable‑energy subsidies, the pace of battery‑storage technology, and regional regulatory changes.

- Link referenced: An Energy Information Administration (EIA) report on U.S. wind capacity expansion, used to underline the tailwinds for NextEra.

3. Johnson & Johnson (JNJ) – Healthcare / Consumer Staples

- Why it’s highlighted: J&J’s diversified product mix—pharmaceuticals, medical devices, and consumer health—offers resilience. The article points to the company’s pipeline of promising oncology drugs and its strategic divestiture of the baby‑care business to refocus on high‑margin segments.

- Price target (2026): $180 per share (current price ~ $140).

- Risk factors: Litigation risk related to talc products, patent expirations, and competitive pressure in generic markets.

- Link referenced: A Wall Street Journal exposé on the company’s talc litigation strategy and a J&J investor presentation that highlights upcoming product launches.

4. NVIDIA Corporation (NVDA) – Semiconductors

- Why it’s highlighted: NVIDIA’s dominance in GPUs, AI inference, and data‑center chips positions it at the intersection of multiple high‑growth tech trends. The article references NVIDIA’s recent earnings surprise and the expanding role of AI in consumer devices.

- Price target (2026): $280 per share (current price ~ $220).

- Risk factors: Intense competition from AMD, supply‑chain constraints, and the cyclical nature of the semiconductor industry.

- Link referenced: An analysis from the Financial Times on NVIDIA’s AI roadmap and a Forbes feature on the chip shortage’s impact on the industry.

5. Procter & Gamble Co. (PG) – Consumer Staples

- Why it’s highlighted: P&G is cited as a classic dividend‑growth story with a long history of weathering economic downturns. The author underscores the company’s strategic focus on premiumization and digital commerce, especially through its “Shopify for P&G” partnership.

- Price target (2026): $160 per share (current price ~ $130).

- Risk factors: Rising raw‑material costs, shifting consumer preferences toward direct‑to‑consumer brands, and currency volatility for international operations.

- Link referenced: A Harvard Business Review case study on P&G’s digital transformation initiatives and a P&G earnings call transcript.

6. Square Inc. (SQ) – FinTech

- Why it’s highlighted: Square’s expansion beyond payments into small‑business lending, cryptocurrency trading, and the Cash App’s user base growth creates diversified revenue streams. The article notes the “ecosystem” effect that locks merchants into the Square platform.

- Price target (2026): $55 per share (current price ~ $45).

- Risk factors: Regulatory scrutiny around crypto, high operating costs, and competition from both traditional banks and emerging fintech players.

- Link referenced: A Reuters piece on Square’s quarterly revenue growth and an interview with the COO on future product plans.

7. Boeing Co. (BA) – Aerospace & Defense

- Why it’s highlighted: The article argues that Boeing is poised for a rebound as global air travel recovers and the U.S. Department of Defense increases its aircraft procurement budget. The author cites the company’s new 787‑9 “Dreamliner” orders and its military‑grade supply‑chain improvements.

- Price target (2026): $125 per share (current price ~ $90).

- Risk factors: Production delays, geopolitical tensions affecting defense budgets, and environmental regulations impacting aircraft fuel efficiency.

- Link referenced: An Aviation Week article on Boeing’s backlog and a Defense Department briefing on upcoming fighter jet contracts.

8. Moderna, Inc. (MRNA) – Biotechnology

- Why it’s highlighted: Moderna’s mRNA platform is highlighted for its versatility—beyond COVID‑19 vaccines, it’s being applied to influenza, oncology, and rare diseases. The article points to the company’s successful rollout of its RSV vaccine and the pipeline of new mRNA therapeutics in phase II trials.

- Price target (2026): $120 per share (current price ~ $95).

- Risk factors: Competition from other mRNA firms (e.g., BioNTech), regulatory hurdles, and potential supply‑chain constraints for vaccine distribution.

- Link referenced: A New England Journal of Medicine summary of Moderna’s RSV vaccine trial and a Nasdaq news release on the company’s latest funding round.

How WTOP Advises You to Allocate Your $1,000

The article emphasizes diversification: $125 per stock (if you choose an even split) or a tiered approach (e.g., heavier allocation to high‑growth tech and lighter to defensive staples). It also advises:

- Reinvest dividends to compound returns.

- Use a brokerage that offers fractional shares so you can invest $125 into a high‑priced stock like NVIDIA.

- Monitor quarterly earnings and stay alert to any macro‑economic shifts that could affect these sectors (e.g., interest rate hikes impacting debt‑heavy companies like NextEra or Boeing).

Take‑away Summary

WTOP’s October 2025 article provides a clear, sector‑diverse portfolio that balances growth potential with defensive stability. It blends tech leaders (Apple, NVIDIA, Square), consumer staples (P&G, J&J), renewable energy (NextEra), aerospace (Boeing), and biotech (Moderna). Each stock is backed by a succinct rationale, a price target, and a candid look at risks—alongside useful external links that deepen the reader’s understanding of the underlying dynamics.

For a beginner investor with $1,000 to deploy, the recommendation is straightforward: pick a mix of 4–8 stocks (depending on your risk tolerance), buy fractional shares if necessary, and stay disciplined with rebalancing and dividend reinvestment. By following the article’s guidance, you position yourself to capture upside in some of the most promising sectors of 2025–2026 while maintaining a cushion against market volatility.

Read the Full WTOP News Article at:

[ https://wtop.com/news/2025/10/8-best-stocks-to-buy-now-with-1000-8/ ]