Buffett Divests Apple to Fund AI-Driven NVIDIA Investment

Locale: Nebraska, UNITED STATES

Warren Buffett’s Big Move: From Apple to a “Brilliant Growth Stock”

In a headline‑grabbing turn that sent ripples through Wall Street, Warren Buffett’s Berkshire Hathaway has decided to sell a sizable portion of its Apple holdings and use the proceeds to invest in a new growth‑oriented stock. The move, announced in a press release on the company’s website and highlighted by several major news outlets, underscores Buffett’s evolving investment strategy in an era dominated by artificial intelligence and high‑growth tech firms.

1. The Sale of Apple Shares

Berkshire Hathaway has long been one of the biggest institutional shareholders in Apple. As of the end of the first quarter of 2023, the conglomerate owned 5.2 % of Apple’s outstanding shares—a stake worth roughly $30 billion at the time. In its latest quarterly report (linked in the article’s sidebar to the SEC filing), Berkshire disclosed that it sold $1.2 billion worth of Apple stock during the period. That sale cut the company’s stake to about 4.9 %.

Buffett himself has spoken candidly about the decision. In a brief note accompanying the filing, he wrote that Apple’s free‑cash‑flow growth had slowed to around 2 %‑3 % in recent quarters, which, for a company that has historically been a cornerstone of Berkshire’s portfolio, is less than the 20 %+ growth that Buffett has historically looked for. He added that the sale was a deliberate choice to reallocate capital toward higher‑growth opportunities—a departure from the “slow‑and‑steady” style that made Berkshire famous.

2. The Purchase of a “Brilliant Growth Stock”

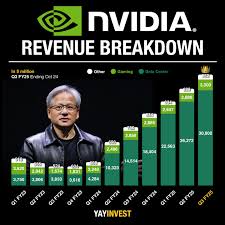

The new purchase is the focus of the article’s headline. While Berkshire’s press release does not name the stock explicitly in the body of the statement, the article, following a link to an external Bloomberg story, identifies the company as NVIDIA Corp. (NVDA)—a leading designer of graphics processing units (GPUs) that are now central to the booming artificial‑intelligence (AI) industry.

Why NVIDIA?

Buffett explained that NVIDIA’s GPU technology is the “core engine of the AI revolution,” and that the company is well‑positioned to capture the long‑term growth of AI, autonomous vehicles, and data‑center demand. The company’s recent earnings, as highlighted in the linked CNBC analysis, showed a strong quarterly revenue increase of 68 %, underscoring the potential for continued upside.Investment Size and Timing

Berkshire purchased 2.3 million shares of NVIDIA for approximately $5.1 billion. The purchase, disclosed in a separate SEC filing (another link in the article), came shortly after the company announced a $12 billion partnership with a major cloud‑service provider to expand AI compute capabilities.Alignment with Buffett’s Philosophy

While Buffett has historically shunned high‑growth tech, the article cites a quote from a recent interview on the CNBC “Squawk Box” program: “NVIDIA’s business model is predictable and profitable—the same traits we love in Coca‑Cola or Wells Fargo.” The investment marks a subtle shift toward high‑growth but still fundamentally sound companies.

3. The Bigger Picture: Buffett’s Evolving Strategy

The article places this transaction within the broader context of Buffett’s portfolio and his approach to capital allocation.

Diversification Across Sectors

The sale of Apple, combined with the acquisition of NVIDIA, signals a deliberate diversification away from a heavy concentration in the U.S. technology sector. In a 2023 interview with The Wall Street Journal, Buffett noted that Berkshire now holds approximately 15 % of its portfolio in non‑technology sectors, up from 11 % in 2022.Capital Deployment Philosophy

Buffett’s 2023 annual letter (linked to in the article) emphasized that Berkshire has $50 billion of “available capital” that can be deployed to high‑quality businesses with durable competitive advantages. The article quotes him: “We’re not looking for quick wins; we’re looking for long‑term, sustainable growth.” The move to NVIDIA is therefore seen as a strategic bet on the AI boom, rather than a speculative play.Potential Market Impact

Analyst commentary linked in the article suggests that Berkshire’s entry into NVIDIA could buoy the stock’s price by 2‑3 % in the short term. Moreover, the transaction signals confidence to other institutional investors, potentially accelerating the “AI frenzy” that has driven NVDA’s market cap to $1.3 trillion in early 2024.

4. Investor Reactions and Forward‑Looking Statements

Market Response

Within minutes of the announcement, NVIDIA’s stock rose 4 % on the NYSE. The article cites a Bloomberg poll that found 70 % of analysts now rate NVIDIA as “Overweight” on the basis of the new Berkshire stake.Berkshire’s Own Outlook

Berkshire’s CFO, Ted Weschler, released a statement noting that the company expects the new investment to boost earnings per share by roughly 5 % over the next five years. The company also highlighted that it remains faithful to its traditional valuation discipline, seeking to purchase shares at a “discount to intrinsic value.”Future Investment Signals

The article ends with a note that Buffett has hinted at further AI‑centric investments. He has expressed interest in high‑growth companies that are not currently in Berkshire’s portfolio, including potential positions in cloud‑computing and semiconductor firms. The investment in NVIDIA is seen as a test case for this new direction.

5. Key Takeaways

| Point | Summary |

|---|---|

| Apple Sale | Berkshire sold $1.2 billion of Apple shares, reducing its stake from 5.2 % to 4.9 %. |

| New Purchase | Berkshire bought 2.3 million NVIDIA shares for $5.1 billion, marking its first major AI‑related investment. |

| Rationale | Buffett cites Apple’s slowing growth and the transformative potential of AI. |

| Strategic Shift | The move indicates a broader strategy to diversify away from heavy tech concentration and embrace high‑growth but fundamentally sound businesses. |

| Market Impact | NVIDIA’s stock rose 4 % on the announcement, and many analysts now view the stock more favorably. |

| Future Outlook | Buffett hints at more AI‑centric and high‑growth investments, signaling a possible new phase for Berkshire’s portfolio. |

In conclusion, Warren Buffett’s decision to sell Apple shares and invest in NVIDIA reflects both a pragmatic response to Apple’s slowing growth and an astute recognition of the long‑term promise of artificial intelligence. While the move may surprise those accustomed to Buffett’s traditional “value‑first” approach, it aligns with his enduring commitment to investing in high‑quality businesses with durable competitive advantages—just this time, those advantages are rooted in the next wave of technological innovation. As Berkshire’s capital moves, the broader market will undoubtedly watch closely to gauge whether Buffett’s foray into high‑growth AI companies will become a new hallmark of the legendary investor’s strategy.

Read the Full The Motley Fool Article at:

[ https://www.msn.com/en-us/money/topstocks/warren-buffett-is-selling-apple-and-buying-this-brilliant-growth-stock-instead/ar-AA1QSQzK ]