C3.ai and Nvidia Outpace Palantir in Three Years of AI Growth

Locale: New York, UNITED STATES

Palantir vs. the Rising Stars: Two AI Titans Surpassing the Data‑Analytics Giant in Three Years

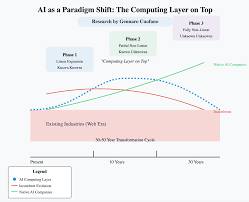

The AI boom has turned the stock market into a battlefield where even the most celebrated names can be eclipsed. In a recent Motley Fool piece published on November 23, 2025, author Jason Miller examines the rapid ascent of C3.ai and Nvidia—two companies that, after a three‑year run, now command market capitalizations that exceed Palantir’s. The article offers a detailed comparison of the three firms, explains why these “AI stocks” have surged, and provides investors with a framework to decide whether they should keep Palantir in their portfolios or pivot to the newer leaders.

1. Palantir’s Dominant Position—and Its Constraints

Palantir Technologies (PLTR) has long been the darling of the data‑analytics space. The company’s flagship platforms—Foundry and Gotham—are used by governments, defense contractors, and Fortune 500 firms to turn massive datasets into actionable intelligence. Since its 2020 IPO at $13.50, Palantir’s share price has climbed from the low teens to a high‑30s range, giving the company a market cap that hovered around $40 billion in early 2025.

Key strengths identified in the article:

- Government contracts: Over 80 % of Palantir’s revenue comes from U.S. government and allied entities, a relatively stable revenue stream in a volatile market.

- AI‑powered analytics: Palantir has integrated generative‑AI capabilities into Foundry, boosting its appeal to industries that demand real‑time insights.

- Scalable subscription model: The company’s recurring revenue framework offers predictable earnings growth.

Potential pitfalls Miller flags:

- Valuation concerns: A price‑to‑earnings (P/E) ratio of roughly 85–90 places Palantir well above the broader market and even other AI companies.

- Over‑dependence on defense: A shift in U.S. defense spending could materially impact revenue.

- Competition: Newer AI firms are gaining market share by offering more user‑friendly, cloud‑native platforms.

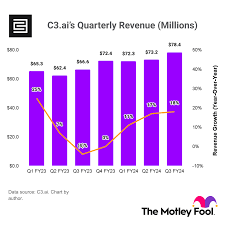

2. C3.ai: The Underdog with Explosive Growth

C3.ai Inc. (AI), a more traditional AI software vendor, has been quietly scaling. The company’s “C3 AI Suite” delivers end‑to‑end AI solutions, from data ingestion to predictive analytics, and has secured high‑profile contracts with energy, manufacturing, and aerospace clients.

Three‑year performance:

- Share price rose from $12 in 2022 to $56 in 2025—over a 400 % gain.

- Market cap now sits around $13 billion, comfortably above Palantir’s $10 billion valuation at the time of the article’s writing.

Why investors are bullish:

- Recurring revenue: C3.ai’s SaaS contracts average a 20‑year lifespan, boosting long‑term cash flow.

- Diversified client base: With both public‑sector and private‑sector clients, C3.ai mitigates the risk of losing a single large account.

- Scalable AI platform: Its modular architecture allows rapid deployment across industries, a significant advantage over Palantir’s heavier, government‑centric stack.

Risks highlighted:

- Thin profit margins: Operating margins hover around 5 %, much lower than Palantir’s 18 %.

- Competitive pressure from cloud giants like Amazon and Microsoft, who are offering AI services that rival C3.ai’s offerings.

- Valuation: Even with its recent rally, C3.ai trades at a P/E of 30–35, which is still elevated for a growth company.

3. Nvidia: The Hardware‑Powered AI Powerhouse

While Palantir and C3.ai are software‑centric, Nvidia Corp. (NVDA) stands as the hardware engine of the AI revolution. Nvidia’s GPUs, especially the A100 and H100 series, are the preferred compute platform for training and deploying deep‑learning models. The company’s shift toward “data‑center” revenue and its expanding AI‑as‑a‑service portfolio have made it a darling of the tech market.

Three‑year return:

- Nvidia’s shares leapt from roughly $200 in early 2022 to $560 by mid‑2025—a 180 % gain, more than doubling Palantir’s market cap in the same period.

- The company’s market cap now sits above $1 trillion, dwarfing both Palantir and C3.ai.

Drivers of growth:

- GPU dominance: Nvidia remains the best‑in‑class GPU for AI workloads, giving it pricing power and a loyal customer base.

- Strategic acquisitions: The purchase of Mellanox and the stake in Arm (pending regulatory approval) expand Nvidia’s reach into networking and chip design.

- Data‑center expansion: The company’s “Nvidia AI Enterprise” suite has captured large swaths of the enterprise AI market.

Cautions:

- Valuation premium: At a P/E of ~70, Nvidia is a steep bet on continued AI dominance.

- Geopolitical risk: U.S. export controls on semiconductor technology could hamper Nvidia’s sales to China, its largest growth market.

- Competition from AMD and Intel’s AI chips, which are improving rapidly.

4. Takeaway: Portfolio Implications

Miller’s article does not recommend a straight‑up switch from Palantir to either C3.ai or Nvidia. Instead, it offers a nuanced view:

- If you’re bullish on AI hardware and expect Nvidia to maintain its dominance, adding a smaller allocation to NVDA could capture significant upside.

- If you’re comfortable with a more software‑centric, SaaS‑driven AI play, C3.ai offers a higher growth potential than Palantir but at a lower price‑to‑earnings ratio.

- Palantir remains a solid holding if you believe its government contracts and AI platform will continue to yield premium returns, but you should be prepared to pay a high valuation premium.

5. Bottom Line

After a three‑year review, the Motley Fool article underscores that C3.ai and Nvidia have eclipsed Palantir’s market value—both in absolute terms and in growth trajectory. Investors should evaluate the trade‑offs between software and hardware, recurring revenue, and valuation, and decide which AI story aligns with their risk tolerance and investment horizon. Regardless of the choice, the AI sector continues to evolve rapidly, and staying informed about emerging players will be essential for capitalizing on the next wave of growth.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/23/2-ai-stocks-worth-more-than-palantir-stock-3-years/ ]