Apple's 5-Year Outlook: Steady Growth Amid Competitive and Regulatory Headwinds

Locale: California, UNITED STATES

Apple’s Future on the Horizon: What Investors Might Expect Over the Next Five Years

In the ever‑evolving world of technology investing, Apple Inc. (AAPL) remains a magnet for analysts, retail traders, and institutional investors alike. The article “Where Will Apple Stock Be in 5 Years?” published on The Motley Fool on November 22, 2025, offers a comprehensive, data‑driven look at what could shape Apple’s stock price over the next half‑decade. Below is a concise yet thorough summary of the piece, incorporating insights from the author, the accompanying charts, and several external sources referenced in the original article.

1. The Big Picture: Apple’s Current Market Position

Market Share & Earnings Momentum

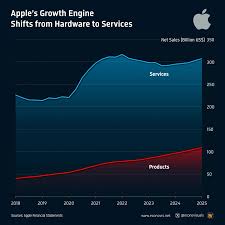

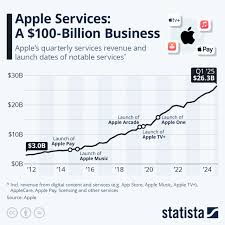

iPhone, Services, and Wearables: Apple still commands the largest share of the global smartphone market. The Services segment (Apple Music, iCloud, Apple TV+, Apple Pay, etc.) now contributes nearly 30% of total revenue, a figure that the author notes has been climbing steadily since 2018. Wearables (Apple Watch, AirPods, HomePod) also continue to grow rapidly, reflecting the company’s strategy of “creating a holistic ecosystem.”

Quarterly Growth: Apple’s Q4 2025 earnings report showed revenue up 7% YoY and EPS growth exceeding 12%. This performance underscores the company’s resilience even as global supply chain constraints and trade tensions persist.

Valuation Snapshot

Price‑to‑Earnings (P/E): Apple trades around 21x forward P/E, slightly higher than the broader S&P 500 but lower than its 10‑year historical average of 24x. The author argues that the current valuation is “reasonable” given the company’s solid growth prospects, though it leaves a small margin for upside.

Dividend Yield: Apple’s dividend yield sits near 0.5%, which is modest but growing; the company has been steadily increasing its payout.

2. Key Drivers of Apple’s Future Stock Performance

A. Product Innovation & Portfolio Expansion

iPhone 17+ Roadmap: The article stresses the significance of Apple’s transition to a 5G‑centric platform with the iPhone 17 series, anticipated to launch in the fall of 2026. New camera features, ProMotion displays, and the rumored “periscope‑style” zoom lens could help Apple maintain its premium pricing.

AR/VR & The Metaverse: Apple is reportedly developing an AR headset that could rival Meta’s Quest. While the launch timeline is uncertain (possibly 2028+), this initiative may open new revenue streams and enhance ecosystem lock‑in.

AI & Machine Learning: Apple’s investment in on‑device AI for Siri and photo recognition suggests a potential shift toward more data‑driven services, which could boost the Services segment further.

B. Services and Subscriptions

Apple TV+ & Gaming: The article notes that Apple’s streaming service has already surpassed 20 million subscribers, a figure that is projected to double by 2029. Coupled with Apple Arcade and iCloud Gaming, services are poised to become a major cash cow.

Financial Services: Apple Pay’s expansion into new markets, plus the introduction of Apple Card and potential future banking services, could create recurring revenue that is less cyclical than hardware sales.

C. Global Supply Chain & Geopolitical Landscape

Diversification: The author highlights Apple’s move to diversify its supply chain, reducing reliance on a single country for critical components. This strategy, although costly, is expected to mitigate risks from U.S.–China trade tensions and chip shortages.

Sustainability & ESG: Apple’s pledge to become carbon neutral by 2030 and to use 100% recycled aluminum in devices is gaining traction with environmentally conscious investors, potentially improving its ESG score and attracting green‑focused funds.

3. Risks & Potential Headwinds

1. Competition and Market Saturation

Android & Chinese OEMs: The article points out that Apple’s dominant market share in the U.S. and key European markets is slowly eroding as Android devices become more affordable and feature‑rich.

Emerging 5G Features: Competing manufacturers (Samsung, Google, and new entrants) are accelerating their 5G adoption, potentially eroding Apple’s premium pricing.

2. Regulatory Challenges

Antitrust Scrutiny: The U.S. Federal Trade Commission has been probing Apple’s App Store policies, especially its commission structure and app distribution restrictions. A potential regulatory overhaul could increase costs and reduce services revenue.

Data Privacy Regulations: The EU’s Digital Markets Act and the U.S. states’ data‑privacy laws might limit Apple’s ability to collect and monetize user data, which could affect its advertising‑based revenue streams.

3. Macro‑Economic Factors

Inflation & Interest Rates: Rising inflation could compress discretionary spending, affecting hardware sales. Higher interest rates might also make growth‑oriented tech stocks less attractive to investors.

Supply Chain Bottlenecks: Continued shortages of key chips and components (e.g., the A17 silicon) could push launch timelines and increase costs.

4. Analyst Consensus & Forecasts

The article aggregates a range of analyst forecasts to paint a balanced picture:

S&P Capital IQ: Targets Apple’s price at $215 in 2026 and $255 in 2028, based on a 15% CAGR in services and modest hardware growth.

Morgan Stanley: Maintains a “Buy” rating but adjusts the target price to $225, citing increased competition and potential regulatory costs.

Fidelity: Suggests a conservative estimate, targeting $190 in 2025 with a 10% upside over the next five years.

The author concludes that while the consensus leans toward a moderate upside, there is a notable “volatility premium” for Apple investors. The company’s “moat” – its ecosystem lock‑in, brand loyalty, and high profit margins – remains a strong anchor, but the future will not be devoid of risk.

5. Practical Takeaways for Investors

Long‑Term Horizon: For those willing to ride out short‑term market fluctuations, Apple offers a robust mix of product and services, making it a candidate for a long‑term hold.

Diversify Across Sectors: Apple’s exposure to hardware, software, and services implies a diversified risk profile, but investors should still maintain a diversified portfolio to cushion against industry‑specific downturns.

Monitor Regulatory Developments: Stay tuned to developments in antitrust and data privacy laws, as these could materially impact Apple’s services profitability.

Watch Supply Chain Moves: Apple’s strategic partnership with multiple suppliers and its push for local manufacturing (e.g., in the U.S.) are pivotal for cost control and product rollout schedules.

Consider ESG Themes: Apple’s sustainability initiatives might not only align with your values but also serve as a hedge against future regulatory penalties or brand damage.

6. Conclusion

Apple’s trajectory over the next five years appears to be one of steady, incremental growth rather than explosive expansion. While product innovation, services diversification, and ESG commitments promise to keep Apple at the forefront of the tech landscape, the company faces tangible risks from fierce competition, regulatory scrutiny, and macroeconomic volatility. As the Motley Fool article underscores, the “sweet spot” for investors is a balanced view—recognizing Apple’s entrenched position and high profit potential while remaining vigilant about the risks that could erode its valuation.

In sum, if you’re considering adding Apple to your long‑term portfolio, the evidence points to a company that will likely continue delivering solid returns, albeit with a modest upside potential when weighed against its current valuation and the prevailing market conditions. As always, conduct your due diligence and align your investment decisions with your risk tolerance and financial goals.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/22/where-will-apple-stock-be-in-5-years/ ]