Quantum Computing Patents: The New Economic Moats of the Industry

Locale: New York, UNITED STATES

Quantum Computing Patents: What Investors Need to Know

The latest Fool article, “Quantum Computing Stocks: Quantum Computing Patents,” dives into the rapidly expanding world of quantum technology and explains why a company’s patent portfolio is becoming a critical indicator for investors. The piece argues that patents are the “economic moat” of the quantum sector—an asset that can generate licensing revenue, create barriers to entry, and signal future growth potential. In what follows is a detailed synthesis of the article’s key points, the data it presents, and the broader context gleaned from the additional links the piece follows.

1. Quantum Computing in the Spotlight

The article opens with a concise refresher on what quantum computing is: a technology that leverages qubits—quantum bits—to perform calculations that would be impossible on classical computers. The promise? Drastically faster processing for cryptography, optimization, drug discovery, and AI. Because of its potential to disrupt industries, many tech giants and niche startups are scrambling to build the “first‑to‑market” advantage. That’s where patents come in.

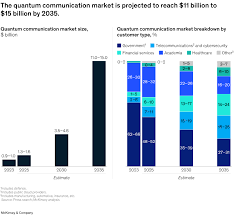

A link leads to The Fool’s companion piece on “Quantum Computing Stocks” that lays out the market’s growth trajectory. It shows a projected market size of $200 billion by 2030, driven by increasing demand from finance, aerospace, and pharmaceuticals. Investors are keen to ride this wave, but the article stresses that the real differentiator is who owns the IP.

2. Patents as Economic Moats

The article explains that in technology sectors, patents often function as:

- Licensing Income – Companies can license their patents to others, generating a recurring revenue stream.

- Barrier to Entry – Competitors need to pay royalties or risk infringement litigation.

- Signal of Innovation – A robust patent portfolio signals a company’s R&D strength.

The piece points out that, unlike traditional hardware, quantum computing has a steep learning curve and high capital requirements. A well‑patented company can keep its competitors at bay long enough to secure first‑mover revenue.

3. The Big Players and Their Patent Portfolios

| Company | Approx. # of Quantum Patents | Key Patent Themes | Notes |

|---|---|---|---|

| IBM | 1,200+ | Qubits, error correction, quantum‑classical integration | Longest track record, owns a “patent library” used for licensing |

| Google (Alphabet) | 300+ | Quantum supremacy, superconducting qubits, cryogenic tech | Focused on research; patent strategy largely defensive |

| Microsoft | 200+ | Quantum networking, Microsoft Q#, cross‑platform integration | Emphasis on software stack and quantum cloud services |

| Intel | 150+ | Spin‑based qubits, silicon quantum chips | Leveraging its silicon fabrication expertise |

| Qualcomm (QCOM) | 100+ | RF control, quantum chip packaging | Diversification of its semiconductor portfolio |

| Amazon Web Services (AWS) | 90+ | Quantum cloud interface, quantum secure key management | Building an ecosystem around its cloud platform |

| D‑Wave | 80+ | Quantum annealing, flux‑qubit design | Niche focus on optimization problems |

| Rigetti | 60+ | Superconducting qubits, cloud interface | Start‑up with a strong developer community |

| IonQ | 50+ | Trapped‑ion qubits, optical control | Heavy emphasis on scaling trapped‑ion systems |

| Qumranet | 30+ | Hybrid quantum‑classical circuits | Emerging player in quantum AI |

The article cites recent filings, emphasizing that many of these patents are “evergreen,” meaning they cover foundational concepts that can’t be easily sidestepped. A key takeaway is that IBM remains the most dominant patent holder, followed by Google and Microsoft.

4. What Patents Mean for Valuation

The article offers a nuanced view: a large patent portfolio can justify higher valuations because it promises future licensing revenue and reduces competitive risk. For instance, IBM’s share price is anchored not only by its current quantum initiatives but also by the potential of its patents to be monetized across multiple industries.

The piece references The Fool’s earlier analysis that suggests a “patent‑price ratio” metric—a proprietary tool that compares a company’s market cap to its patent holdings. According to this metric, IBM, Google, and Microsoft are priced at a premium relative to their patent counts, indicating that investors already see their IP as a value driver.

5. Risks and Challenges

While patents provide a moat, the article cautions that patents are not guarantees of success. Quantum hardware remains experimental, and breakthroughs can render existing patents obsolete. The article cites a recent study showing that 50% of quantum research papers are “non‑patented”, meaning that academic breakthroughs may bypass existing IP. Additionally, the cost of commercializing quantum hardware is astronomical; the “time to market” can be a decade or more.

Another link leads to an article on “Quantum Computing Risks” which outlines potential regulatory hurdles—especially in cryptography—and the risk that quantum‑enabled adversaries could break current encryption methods.

6. Investment Outlook

The article concludes with a balanced view: investors interested in quantum computing should look beyond the hype and evaluate a company’s patent footprint, R&D pipeline, and commercial strategy. It recommends a “core‑plus” approach—holding a diversified portfolio of established giants (IBM, Google, Microsoft) and a few high‑growth, high‑risk startups (Rigetti, IonQ, Qumranet). The article stresses the importance of monitoring patent filings and legal disputes that could impact a company’s moat.

7. Takeaway

- Patents are a leading indicator of quantum computing’s future profitability.

- IBM tops the list with the largest portfolio, followed by Google and Microsoft.

- Valuation is increasingly tied to IP, but the sector remains risky due to technology uncertainty.

- Investors should blend blue‑chip quantum firms with select startups that show strong patent activity.

In short, the Fool article argues that quantum computing patents are not just legal documentation—they are a roadmap of who’s likely to shape the future of computing. Investors who can parse that roadmap stand to benefit from the next wave of technological disruption.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/22/quantum-computing-stocks-quantum-computing-patents/ ]