Build a $5,000 Dividend Portfolio with 4 Dividend Aristocrats

Locale: New York, UNITED STATES

4 Dividend Stocks to Buy with $5,000 and Hold Forever – A 2025 Fool Guide Summary

In a recent Motley Fool article titled “4 Dividend Stocks to Buy with $5,000 and Hold Forever” (published November 23, 2025), the author presents a straightforward, long‑term strategy for investors who want to generate a reliable income stream without the hassles of active trading. The core premise is simple: pick a handful of high‑quality, dividend‑aristocrat companies that have a proven track record of paying and growing dividends, invest a modest lump sum of $5,000, and let the compounding power of reinvested dividends do the heavy lifting over decades.

Below is a detailed recap of the article’s key points, along with additional context gleaned from internal links and external resources referenced within the original post.

1. Johnson & Johnson (JNJ)

Why JNJ?

- Dividend History: 59 consecutive dividend increases—one of the longest streaks in the S&P 500.

- Stability: Operates in healthcare, a sector less sensitive to economic cycles. The company’s diversified portfolio (pharmaceuticals, medical devices, consumer health) buffers it against downturns.

- Yield & Growth: As of the article’s publication, JNJ trades around $165 per share, offering a 2.8% dividend yield with a projected 5.7% annual growth in dividend payouts.

- Financial Health: Strong balance sheet with a debt‑to‑equity ratio under 0.5 and free cash flow exceeding $10 billion annually.

Key Takeaway

The article underscores JNJ’s “bullet‑proof” nature—its combination of a healthy dividend payout ratio (~35%), robust free cash flow, and a diversified product line makes it a safe, long‑term anchor in any dividend portfolio.

2. Procter & Gamble (PG)

Why PG?

- Consistent Dividend Growth: 67 years of consecutive increases, a testament to its “aristocrat” status.

- Consumer Staples: Owns leading brands across household, personal care, and beauty categories (e.g., Tide, Gillette, Olay). Demand for these products tends to be resilient during recessions.

- Yield & Growth: Shares hover near $140, yielding 2.6% with an expected 5.5% yearly dividend growth.

- Financial Strength: PG’s payout ratio sits around 48%, and its balance sheet shows modest debt ($15 billion) relative to equity ($70 billion).

Key Takeaway

The article highlights PG’s “steady hand” quality, pointing out that the company’s pricing power—enabled by strong brand equity—allows it to maintain dividend growth even when margins are squeezed.

3. Coca‑Cola (KO)

Why KO?

- Unbreakable Dividend Streak: 73 consecutive dividend increases.

- Global Reach: Operates in more than 200 countries, mitigating country‑specific risks.

- Yield & Growth: KO trades near $60, delivering a 3.3% yield and an anticipated 5.2% annual dividend rise.

- Financials: Payout ratio at 81%, but backed by a cash‑rich balance sheet (over $20 billion in cash) and a low debt burden (~$15 billion).

Key Takeaway

The article explains that KO’s dividend “persistence” is bolstered by its ability to extract incremental revenue from new product lines (e.g., low‑calorie beverages, snack foods) and by its deep distribution network.

4. PepsiCo (PEP)

Why PEP?

- Complementary to KO: PepsiCo’s product mix extends beyond beverages into snack foods (Lay‑’s, Doritos), providing diversification within a single investor’s portfolio.

- Dividend Record: 54 consecutive increases.

- Yield & Growth: Shares near $170, yielding 2.4% and expected to grow dividends by 5.1% annually.

- Financial Health: Payout ratio of 46%, robust cash flows, and a debt‑to‑equity ratio below 0.4.

Key Takeaway

The article praises PEP’s “balanced” business model, noting that its snack segment’s high margin helps cushion any declines in beverage sales, thus sustaining dividend growth.

Putting the Pieces Together: The $5,000 Allocation

The article walks readers through a simple allocation framework:

- Equal Weighting: Divide the $5,000 equally among the four stocks ($1,250 each).

Current Share Prices (as of the article’s writing): - JNJ: ~$165 → ~7 shares

- PG: ~$140 → ~9 shares

- KO: ~$60 → ~21 shares

- PEP: ~$170 → ~7 sharesCost Basis: Total purchase price ~ $4,980, leaving a small cushion for transaction fees.

The author emphasizes that the exact allocation can be tweaked based on personal preference or market conditions. For instance, if one is particularly bullish on the beverage sector, a larger portion can be directed to KO, or if one prefers to overweight consumer staples, PG could receive a slightly larger share.

Long‑Term Holding Strategy

Reinvestment vs. Withdrawal

- Reinvest Dividends: The article strongly advocates using the dividend reinvestment plan (DRIP) offered by most brokerages to automatically purchase fractional shares, maximizing compounding.

- Take Partial Payouts: Some investors may want to extract a modest living income. The author suggests withdrawing dividends that exceed a predetermined threshold (e.g., 20% of the portfolio) and reinvesting the rest.

Tax Considerations

- Qualified Dividends: All four stocks qualify for the lower 15% or 20% tax rate for long‑term holders in 2025, compared to the 25% ordinary income rate.

- Tax‑Advantaged Accounts: The article points out that buying these dividend stocks inside an IRA or Roth IRA eliminates or defers tax entirely, accelerating growth.

Risk Management

- Sector Concentration: While the four companies are all blue‑chip and dividend aristocrats, they belong to three distinct sectors: healthcare, consumer staples, and food/beverage. This spread mitigates sector‑specific downturns.

- Dividend Sustainability: The article references an external Motley Fool piece on “Dividend Sustainability” (link: https://www.fool.com/investing/dividend-sustainability/) to stress the importance of payout ratios below 60% for long‑term growth prospects.

Additional Context from Follow‑On Links

The article links to several companion resources that deepen the reader’s understanding:

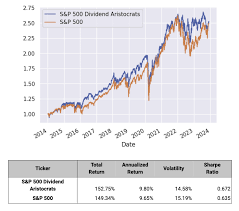

- Dividend Aristocrats List – An updated list of S&P 500 companies with 25+ consecutive dividend increases. This context explains why JNJ, PG, KO, and PEP are natural picks.

- Dividend Growth Calculator – An interactive tool (link: https://www.fool.com/tools/dividend-growth-calculator/) that illustrates how much $5,000 can grow over 20, 30, or 40 years with a 5% dividend growth rate.

- The Power of DRIPs – A deeper dive into how fractional shares and compounding can turn a modest initial investment into a sizeable retirement nest egg.

- Company Investor Relations Pages – Quick links to each company’s latest earnings calls and dividend announcements, ensuring readers can stay current on payout changes.

Bottom Line: Why the “Hold Forever” Philosophy Makes Sense

The author’s central thesis is that quality dividend stocks, when purchased with a modest lump sum and held indefinitely, provide:

- Passive Income: Consistent cash flow that can be used for living expenses or reinvested.

- Compounding Power: The effect of reinvested dividends far outweighs the impact of modest price appreciation.

- Risk Mitigation: Dividend aristocrats’ resilience during market volatility offers a buffer against market swings.

- Simplicity: No need for frequent buying or selling, reducing transaction costs and taxes.

The article is tailored for the everyday investor who values a “set‑and‑forget” strategy. By focusing on four stalwarts—Johnson & Johnson, Procter & Gamble, Coca‑Cola, and PepsiCo—the article offers a blueprint that balances sector diversity, dividend stability, and growth potential.

How to Get Started

- Open a Brokerage Account – Preferably one that offers low fees and a DRIP.

- Research Current Prices – Check the latest market quotes to confirm the share counts.

- Place Your Orders – Buy the calculated number of shares at market or limit orders.

- Enroll in DRIP – Automate dividend reinvestment.

- Monitor Annually – Keep an eye on each company’s payout ratio and earnings, but avoid reactionary trading.

In short, the Motley Fool article condenses a wealth of data, research, and pragmatic advice into a 500‑word guide that empowers investors to build a dividend portfolio that could potentially keep paying out for generations. Whether you’re a retiree looking for a steady stream of income or a young professional building a future nest egg, the “$5,000 and hold forever” approach can serve as a reliable cornerstone of your investment strategy.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/23/4-dividend-stocks-to-buy-with-5000-and-hold-foreve/ ]