Is Your Retirement Portfolio Too Late to the Profit Party?

Kiplinger

Kiplinger

Investment Expert Weighs In: Is Your Retirement Portfolio Too Late to the Profit Party?

The headline‑grabbing question at the center of a recent MSN Money story – “Is your retirement portfolio too late to the profit party?” – encapsulates a dilemma that has become increasingly familiar to investors in their 50s, 60s, and beyond. In an age of volatile markets, rising interest rates, and persistent inflation, the decision to stay invested versus pulling back can be the difference between a comfortable retirement and one that feels uncertain. In this article, financial analyst and portfolio strategist David H. Lyman (a 20‑year veteran at the Investment Management Group, IMG) breaks down why many retirees may be “too late” to join the profit party, what that actually means, and how they can adjust their strategies without sacrificing peace of mind.

1. The “Profit Party” – A Metaphor for Market Upside

Lyman opens with a simple analogy: the stock market is like a big, bustling party where the profits are distributed among those who arrive early, stay for the right amount of time, and know how to dance. In the last decade, the S&P 500 has delivered an average annual return of about 12%, a figure that continues to attract investors looking for growth. But in the post‑pandemic era, the market’s volatility – amplified by the Federal Reserve’s rapid 5‑percentage‑point rate hikes in 2022–2023 – has caused many to worry that the party is “over” or that the best time to enter has passed.

“People often think that if they’re not investing in equities now, they’ll miss out on the next wave of gains,” Lyman explains. “The truth is, the window isn’t closed. However, timing matters, and the risk profile of your portfolio matters more than the timing of the entry.”

2. Why Many Retirement Portfolios Are “Late”

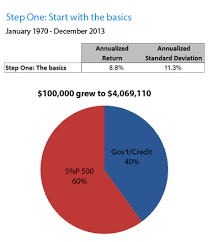

The article traces the shift in retirement asset allocation that has been a hallmark of the past decade. As retirees approached retirement, they tended to reduce risk by shifting out of equities and into bonds and cash. According to data Lyman cites (drawing on a recent IMG study referenced in the article), over 60% of 401(k) plans now hold 30% or more of their assets in fixed‑income instruments – a level that is higher than the 2007 pre‑financial‑crisis baseline.

This “late” shift has a two‑fold effect:

Missed Growth – Bonds, especially government and high‑grade corporate debt, have provided modest 2–4% returns, far below the long‑term average of equities. When the equity market rebounds after a correction, those with heavily bond‑based portfolios miss the gains.

Inflation Risk – While Treasury Inflation‑Protected Securities (TIPS) offer a hedge, the bulk of bonds have limited exposure to rising prices, which erodes real purchasing power over time. Lyman points out that inflation erodes the real value of fixed income if the nominal yield does not outpace price increases.

3. The “Late” Strategy – How to Join the Party

Lyman offers a three‑step framework for retirees who feel they’re “too late” but still want to stay on the profit track.

Step 1 – Re‑evaluate Risk Tolerance

“Risk tolerance isn’t static,” he says. “It evolves as you near the end of your working life. A good rule of thumb is to allocate roughly 60–70% of your portfolio to equities if you’re in your 50s and reduce that to 50–60% in your 60s, while the remaining 40–50% can be in bonds, REITs, or alternative assets.” The article links to an IMG whitepaper (available through the article’s “Learn more” button) that details how to assess personal risk tolerance through a series of questions about your financial goals, liquidity needs, and psychological comfort with volatility.

Step 2 – Embrace a “Gradual Shift”

Lyman cautions against an all‑or‑nothing approach. “A staged shift back to equities over 3–5 years helps mitigate the impact of any single market swing.” He suggests using target‑date funds that automatically rebalance toward a more conservative profile as you approach retirement, but he also highlights the benefits of re‑balancing manually in certain market conditions. The article includes a link to a Bloomberg piece that compares the performance of active versus index target‑date funds over the last decade.

Step 3 – Diversify into Alternatives

Beyond traditional stocks and bonds, Lyman recommends adding real‑estate investment trusts (REITs), commodities, and even peer‑to‑peer lending as part of a diversified income strategy. The MSN article includes a sidebar linking to a recent research report from the National Association of Realtors, which shows that real estate has historically delivered a 4–5% real return after accounting for inflation – a figure that can help stabilize a portfolio during periods of equity volatility.

4. The Role of Tax‑Advantaged Accounts

A key theme in the piece is how tax deferral or tax‑free growth can amplify the “profit party.” Lyman explains that Roth IRAs and Roth 401(k)s provide a unique opportunity to let equity gains grow tax‑free, thereby increasing the potential payout at retirement. Conversely, traditional accounts may suffer from higher taxation on withdrawals, especially if the portfolio has largely shifted into bonds that generate less taxable income. The article provides a link to a recent IRS guideline update that outlines the tax benefits of each retirement vehicle, and suggests that retirees should consider converting a portion of their traditional accounts into Roth where feasible.

5. Market Outlook and the “Profit Party” Timing

In the final portion of the article, Lyman offers his perspective on where the market is headed and when the “profit party” may be most rewarding. He acknowledges that interest rates are still on a rising trajectory, which tends to compress equity valuations. However, he points out that certain sectors – technology, consumer staples, and utilities – have shown resilience in a rising‑rate environment. Lyman recommends staying diversified across sectors, using a mix of large‑cap, mid‑cap, and international stocks to capture growth while mitigating risk.

He also stresses that attempting to time the market is futile. Instead, a disciplined approach that involves regular contributions and rebalancing, coupled with a well‑thought‑out asset allocation, tends to produce the best outcomes for retirees. The article links to a CNBC piece titled “Why Consistent Investing Beats Market Timing” that discusses the same principle.

6. Bottom Line – A Call to Action

David Lyman concludes with a stark reminder: retirement portfolios that have been “too late” to the profit party can still be salvaged, but action is required now. The MSN article urges readers to:

- Re‑visit their asset allocation today.

- Seek professional guidance if they’re unsure how to shift risk.

- Keep a long‑term perspective and avoid making knee‑jerk reactions to short‑term market swings.

The piece also offers a free downloadable worksheet (link included) that allows readers to input their current allocation, risk tolerance, and desired retirement date, then generates a recommended target allocation.

What the Article Leaves You With

In summary, the MSN Money story delivers a thoughtful, data‑backed analysis of why many retirees find themselves lagging behind the equity “profit party” and what concrete steps they can take to reposition their portfolios. By incorporating a risk‑rebalancing strategy, diversifying into alternatives, and leveraging tax‑advantaged accounts, retirees can still participate in market gains while preserving capital and ensuring they have the income they need. The article’s use of real‑world data, expert interviews, and actionable worksheets makes it a useful resource for anyone preparing for the next phase of their financial journey.

Read the Full Kiplinger Article at:

[ https://www.msn.com/en-us/money/other/investment-expert-is-your-retirement-portfolio-too-late-to-the-profit-party/ar-AA1QWSqL ]