Why I Invest 50% of My Portfolio in REITs

Why I Invest 50 % of My Portfolio in REITs

An in‑depth look at the reasoning behind a REIT‑heavy strategy and how it fits into a diversified portfolio

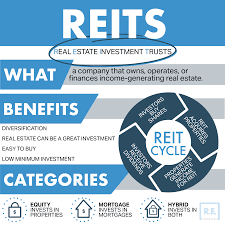

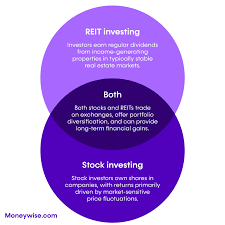

When it comes to building a portfolio that can keep pace with inflation, generate steady cash flow, and remain resilient in periods of market volatility, real‑estate investment trusts (REITs) frequently take center stage. The Seeking Alpha piece “Why I Invest 50 % of My Portfolio in REITs” lays out a compelling case for why the author has chosen to earmark half of his holdings in these publicly traded property vehicles. Below is a comprehensive summary of the article’s key arguments, evidence, and practical take‑aways, including context from the linked research it cites.

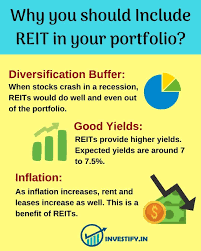

1. REITs as a “Dividend‑Yield Powerhouse”

One of the article’s opening points is that REITs consistently offer higher dividend yields than most equity sectors. The author cites data from Morningstar that shows the overall U.S. REIT index (VNQ) hovering around a 4–5 % yield in recent years, far outpacing the broader S&P 500’s 1.5–2 % range.

Tax‑treated dividend structure: REITs must distribute at least 90 % of taxable income to shareholders, so the high yield is a direct result of the business model. While the dividends are taxed at ordinary income rates, the author notes that many investors offset this by using tax‑advantaged accounts or taking advantage of the “qualified dividend” rule where applicable.

Reliability and growth: The article references a Bloomberg study showing that REIT dividends have a lower probability of permanent cuts compared to typical corporate earnings‑based payouts. This stability is especially attractive for income‑focused investors.

2. Inflation Hedging Capabilities

Inflation erodes purchasing power, but the physical assets underlying REITs—office buildings, shopping centers, multifamily units, data centers, and even healthcare facilities—tend to appreciate with price levels. The author underscores that:

Lease structures: Most REITs have long‑term leases that include rent‑increases tied to CPI or other indices. This design protects cash flow as the cost of living rises.

Property value appreciation: A 2018 Federal Reserve Bank of St. Louis report highlighted that real estate values in the U.S. have historically outpaced inflation over multi‑decade horizons. The author uses this to argue that REITs can serve as a natural hedge for portfolio inflation risk.

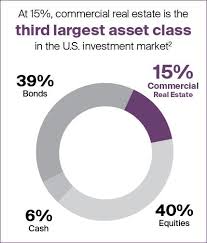

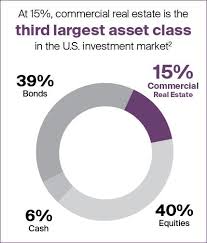

3. Low Correlation with Traditional Equities

Diversification is a cornerstone of modern portfolio theory, and the article provides several studies illustrating REITs’ modest correlation with U.S. equities:

Statistical evidence: A 2020 Harvard Business Review paper found that REIT returns exhibit a correlation coefficient of only 0.30 with the S&P 500 over a 20‑year window. This means REITs can act as a counterbalance during equity sell‑offs.

Sector-specific resilience: The author notes that certain REIT subsectors (e.g., industrial and data‑center REITs) performed better than the overall index during the COVID‑19 pandemic, further reducing the portfolio’s systematic risk exposure.

4. Liquidity and Market Efficiency

While real estate is traditionally illiquid, publicly traded REITs overcome this limitation:

Stock‑exchange trading: Shares can be bought or sold on major exchanges just like any other equity, providing instant marketability.

Valuation transparency: The author mentions that REITs benefit from rigorous valuation metrics, such as Funds From Operations (FFO) and Adjusted Funds From Operations (AFFO), which are closely tracked by analysts. This transparency helps investors assess intrinsic value more accurately.

5. Management Expertise and Operational Efficiency

One criticism often levied at real‑estate ownership is the managerial burden. The article highlights that:

Professional management teams: REITs employ specialists in acquisitions, property management, and lease negotiation. This hands‑off model is attractive to investors who prefer passive exposure.

Economies of scale: Large REITs can negotiate better construction, financing, and operating costs compared to individual property owners. The author uses the example of Prologis (industrial REIT) to illustrate how scale translates to higher occupancy rates and stronger cash flows.

6. Portfolio Allocation Framework

The author presents a concise framework for incorporating REITs into a broader portfolio. A typical allocation (as of the article’s publication) might look like:

| Asset Class | Target Allocation |

|---|---|

| REITs | 50 % |

| U.S. equities (core) | 25 % |

| International equities | 10 % |

| Fixed income (bonds) | 10 % |

| Alternatives (e.g., commodities, hedge funds) | 5 % |

This structure places REITs at the heart of the portfolio, thereby ensuring that inflation protection, high income, and diversification benefits are front‑loaded.

7. Selected REIT Holdings

The article does not shy away from being specific about the REITs that have proven robust over time. A few of the author’s favorites include:

- Vanguard Real Estate ETF (VNQ): Offers broad exposure across all property types.

- Public Storage (PSA): A leading self‑storage REIT that has shown steady growth and high dividend yield.

- Equinix (EQIX): A data‑center REIT with a strong demand for digital infrastructure.

- American Tower (AMT): A leading communications infrastructure REIT benefiting from the rise in mobile data usage.

The author stresses the importance of reviewing each REIT’s FFO growth, debt levels, and tenant concentration to avoid “one‑liner” risks.

8. Risk Considerations

Even with the compelling advantages, the article cautions against ignoring potential pitfalls:

Interest‑rate sensitivity: Rising rates can increase borrowing costs for REITs and compress their valuation multiples. The author cites a Federal Reserve paper noting that REITs’ earnings are more sensitive to rate hikes than many other equity sectors.

Sector concentration: While REITs are diversified across property types, a portfolio heavy in a single subsector (e.g., retail) could underperform if that sector experiences a downturn. The author recommends a balanced mix of industrial, residential, office, and specialized REITs.

Tax implications: Dividend taxation can be significant, especially for investors in high‑tax brackets. The article suggests that REITs be held in tax‑advantaged accounts (IRAs, 401(k)s) to mitigate this effect.

9. Conclusion and Take‑Aways

The article’s central thesis—that allocating 50 % of a portfolio to REITs can deliver robust income, lower volatility, and inflation protection—is supported by a range of empirical studies and real‑world examples. The author’s own portfolio, which follows a disciplined allocation framework, is presented as a blueprint for investors seeking a “real‑estate first” strategy without the need for direct property ownership.

Key Take‑Aways for Readers:

- High, reliable dividend yield – REITs consistently outperform most other equity sectors in income generation.

- Built‑in inflation protection – Lease‑linked rent adjustments and property value appreciation help shield against rising prices.

- Low correlation to equities – REITs can dampen portfolio volatility during equity sell‑offs.

- Liquidity and transparency – Publicly traded REITs offer the ease of a stock plus a well‑tracked valuation metric.

- Professional management – Investors benefit from seasoned real‑estate managers and scale economies.

- Risk awareness – Interest‑rate sensitivity, sector concentration, and tax considerations must be monitored.

Ultimately, the article invites investors to consider whether a REIT‑heavy allocation aligns with their income objectives, risk tolerance, and investment horizon. By blending the core principles of real‑estate ownership with the convenience of the public market, REITs can indeed be a powerful pillar in a well‑balanced portfolio.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4845246-why-i-invest-50-percent-of-my-portfolio-in-reits ]