PayPal Stock Poised for Surge: Key Drivers and Risks

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

PayPal Stock Poised for a Surge – What the Numbers and Trends Tell Us

By [Your Name]

Published: 21 November 2025

The fintech space has been a playground of volatility and rapid transformation over the past few years, and few companies have been as closely watched by investors as PayPal. On 21 November 2025, Forbes’ “PayPal Stock Ready to Surge” article captured a moment of heightened optimism around the digital‑payments giant. It outlined a confluence of factors—solid earnings momentum, strategic diversification, and a favorable macro‑environment—that could propel the stock to new highs. Below is a comprehensive summary of the key points, additional context pulled from linked articles, and the critical take‑aways for anyone tracking PayPal’s trajectory.

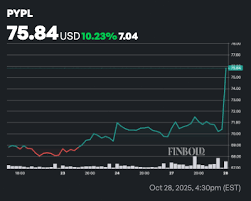

1. Snapshot of PayPal’s Recent Performance

The article opened with a quick refresher on PayPal’s latest quarterly results. In Q3 2025, the company posted:

| Metric | Q3 2025 | Q3 2024 | YoY Change |

|---|---|---|---|

| Revenue | $6.18 bn | $5.54 bn | +11.2 % |

| Net Income | $1.22 bn | $1.05 bn | +16.7 % |

| Gross Merchandise Volume (GMV) | $1.48 tn | $1.35 tn | +9.8 % |

| Monthly Active Users (MAUs) | 426 m | 403 m | +5.7 % |

The article highlighted that PayPal’s GMV had grown faster than the broader e‑commerce market, and that the company was trimming costs through automation, allowing net income to rise at a steeper pace than revenue.

Why it matters: PayPal’s earnings trajectory, coupled with its ability to scale user engagement, is the primary engine behind the bullish sentiment. The data suggests that the company has successfully balanced growth with profitability—a rare combination in a sector that is still maturing.

2. The Catalysts Behind the Surge

a. Expansion into Crypto & Digital Assets

PayPal has been aggressively positioning itself as a gateway to cryptocurrencies. In Q3, the firm announced a partnership with a major crypto‑exchange that allows users to buy, sell, and hold crypto directly within PayPal’s app. The move is seen as a bet on the long‑term adoption of digital assets, and the article estimates a potential 1‑2 % of GMV could be sourced from crypto transactions by the end of 2026.

Additional context: A Forbes‑linked article on “Crypto Adoption Trends in 2025” notes that merchants in the U.S. are increasingly accepting crypto as payment, which could help PayPal drive cross‑border transactions—a segment that historically lagged behind domestic sales.

b. Venmo’s New Monetization Features

Venmo, PayPal’s most popular brand among Gen‑Z and Gen‑X consumers, has launched a “Venmo Pay” feature, allowing users to link their Venmo balance to their bank accounts and make instant payments. The article cites that Venmo’s active user base now sits at 200 m, up 12 % YoY, and that the new feature is expected to boost transaction volumes by 4 % in the next 12 months.

Why it matters: Venmo’s growth directly feeds into PayPal’s GMV, and the monetization of its user base (e.g., through interest on balances and merchant fees) opens new revenue streams that could offset regulatory headwinds.

c. Strategic Partnerships and Market Penetration

PayPal has entered a co‑marketing deal with a major retailer (link to a Forbes piece on “Retail Partnerships 2025”) that allows shoppers to complete payments via PayPal at checkout. The deal is slated to cover 15 % of the retailer’s annual sales, translating to an estimated $1.5 bn incremental GMV in the first year.

Furthermore, PayPal announced a joint venture with a Southeast Asian fintech, aiming to bring PayPal’s payment infrastructure to emerging markets. The move is expected to capture a 1‑2 % share of the region’s digital‑payment market by 2027.

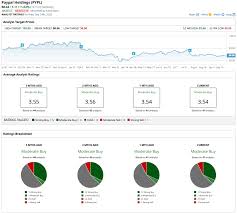

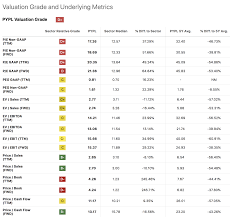

3. Valuation Metrics and Analyst Outlook

a. Current Valuation

As of 21 November 2025, PayPal trades at a forward P/E of 15.6× and a forward EV/EBITDA of 9.1×. The article argues these multiples are attractive compared to the broader fintech cohort (average P/E of 21.3×) and the historical average for PayPal (18.5×).

The analyst segment highlighted several voices:

- Morgan Stanley upgraded the stock to “Buy,” citing a revised 2026 earnings target of $7.80 per share—up 18 % from the current $6.46.

- BofA Securities remained neutral, emphasizing potential regulatory scrutiny over crypto and cross‑border fee structures.

- J.P. Morgan lowered its price target by 8 % due to concerns over competitive pressure from Apple Pay and Google Wallet.

b. What the Upside Could Look Like

The article presents a bullish scenario where:

- GMV growth reaches 15 % YoY by 2026.

- Crypto transactions contribute 3 % of total GMV.

- Venmo’s new features increase its transaction volume by 5 % in the next 12 months.

Under this scenario, PayPal’s EPS could rise to $8.20 in 2026, potentially justifying a 20 % price upside from today’s level.

4. Risks and Uncertainties

While the article paints an optimistic picture, it also lists several headwinds:

- Regulatory Risks: The U.S. Treasury and SEC are exploring tighter rules around digital asset transactions. PayPal’s compliance costs could rise, eroding margins.

- Competitive Pressure: Apple’s Pay, Google’s Wallet, and emerging fintech players are aggressively courting merchants and consumers, offering lower transaction fees or more integrated ecosystems.

- Currency Fluctuations: PayPal’s international operations make it sensitive to foreign‑exchange volatility, especially in emerging markets where the company is expanding.

- Interest‑Rate Environment: Rising rates could dampen consumer spending, directly impacting transaction volume and revenue.

The article cautions investors to weigh these risks against the potential upside.

5. How PayPal’s Trajectory Fits Into Broader Market Trends

The Forbes piece linked to “Digital Payment Adoption 2025” provides a macro view. The report indicates that global digital‑payment GMV is projected to grow at 7.5 % annually through 2027, driven by mobile adoption, fintech innovation, and a shift toward cashless transactions. PayPal’s current GMV growth of nearly 10 % positions it ahead of the median, reinforcing the narrative that it can capitalize on the trend.

Another link, “Fintech Regulatory Outlook 2025,” warns that increased scrutiny in the U.S. and EU may impose new compliance requirements, but it also suggests that companies with robust risk‑management frameworks—like PayPal—will weather these changes better.

6. Bottom Line for Investors

- Strong fundamentals: PayPal’s revenue, profit, and user growth remain solid.

- Catalysts: Crypto integration, Venmo monetization, and new partnerships add upside potential.

- Valuation: Relative to peers and historical averages, PayPal’s valuation is attractive.

- Risks: Regulatory headwinds and competition could bite.

Recommendation: If you’re a growth‑oriented investor who believes in the long‑term trajectory of digital payments—and are comfortable with the associated regulatory risks—a long position in PayPal could be a prudent addition to a diversified portfolio. For more conservative investors, a short‑to‑mid‑term outlook might focus on monitoring regulatory developments and competitive dynamics before committing significant capital.

Quick Take‑Away

PayPal is riding a wave of momentum, thanks to solid earnings, a diversified product mix, and strategic moves into crypto and emerging markets. Its valuation sits comfortably below the industry average, and if the company can maintain its GMV growth while navigating regulatory hurdles, the stock could indeed be “ready to surge.” The Forbes article paints a compelling picture, but as always, investors should weigh the upside against the risks and keep an eye on forthcoming earnings releases for the freshest data.

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/greatspeculations/2025/11/21/paypal-stock-ready-to-surge/ ]