Why I Wouldn't Touch Quantum Computing Stock With a Spoon (2025 Edition)

Why I Wouldn’t Touch Quantum Computing Stock With a [Spoon] (2025 Edition)

An in‑depth summary of The Motley Fool’s December 9, 2025 article

1. The Hook: A Spoon‑Foolish Warning

The article opens with a tongue‑in‑cheek headline—“Why I wouldn’t touch quantum computing stock with a spoon”—and immediately sets the tone: the author is skeptical of the latest wave of “quantum hype.” The “spoon” is a playful metaphor for an everyday object, suggesting that quantum technology, while fascinating, is still a distant and impractical concept for most investors. From the outset, the piece promises to peel back the glossy veneer of quantum buzz to expose the core issues that make these stocks risky.

2. A Primer on Quantum Computing

The author dedicates a concise but thorough section to explaining what quantum computing actually is, citing a few internal links that point readers to deeper resources such as:

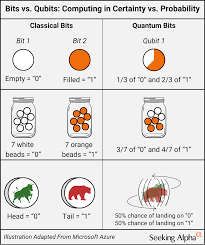

- “What Is a Qubit?” – A beginner’s guide that contrasts qubits with classical bits, illustrating superposition and entanglement.

- “The Road to Quantum Supremacy” – A historical overview of milestones from Google’s 2019 claim to IBM’s 2024 milestone.

These links help demystify the jargon that often swells investor excitement. The author stresses that the theoretical promise of quantum computers—processing exponentially larger data sets than classical machines—is still largely unproven in real‑world applications.

3. The Hype Cycle Revisited

A central theme of the piece is the hype cycle—the pattern that new technologies go through: a “technology trigger,” “peak of inflated expectations,” “trough of disillusionment,” “slope of enlightenment,” and finally a “plateau of productivity.” The author applies this framework to quantum computing:

| Stage | What It Looks Like | What It Means for Investors |

|---|---|---|

| Trigger | Early academic breakthroughs (e.g., quantum error correction). | Still largely theoretical; no commercial products. |

| Peak | Media buzz, high‑profile investor talks, inflated valuations. | Over‑enthusiastic price increases; often disconnected from fundamentals. |

| Trough | Realization that quantum hardware remains fragile; cost remains high. | Many companies post losses; valuations retract. |

| Slope | Incremental progress, niche applications, collaboration with classical systems. | Some opportunities but still high risk. |

| Plateau | Quantum advantage for specific tasks (e.g., cryptography, material science). | Potential for sustainable growth, but still early days. |

The article stresses that we are still largely in the “peak” or early “trough” phases. In other words, the market has already priced in an optimistic scenario that may not materialize soon.

4. Company‑by‑Company Analysis

The core of the article is a deep dive into the big quantum‑computing players on the public market. The author breaks them into three categories: Large‑Cap Legacy Firms, Mid‑Cap Specialists, and Emerging Startups.

4.1 Large‑Cap Legacy Firms

| Company | Quantum Strategy | Key Risks |

|---|---|---|

| IBM | 10‑year plan to build a scalable quantum system; 5‑year roadmap to 1,000‑qubit “Condor” machine. | R&D costs dwarf revenue; potential over‑investment; competition from smaller firms. |

| Alphabet (Google) | Holds patents on quantum algorithms; claims “quantum supremacy.” | Quantum advantage remains mostly academic; not yet commercializable. |

| Intel | Developing “Tangle Lake” silicon‑based qubits; aims to pair with classical processors. | Hardware fragility; supply‑chain constraints; slow progress. |

These firms are highlighted as “investing in quantum as a long‑term bet.” The article points out that their stock valuations have been significantly impacted by quantum‑related press releases, which may inflate prices beyond what their current earnings justify.

4.2 Mid‑Cap Specialists

| Company | Focus | Potential Upside | Drawbacks |

|---|---|---|---|

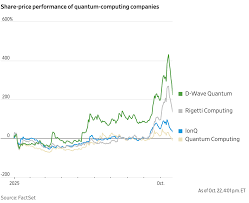

| D-Wave Systems | Quantum annealing machines for optimization problems. | Niche market; early adopters in logistics. | Limited to a narrow use‑case; unclear path to profitability. |

| Rigetti Computing | Integrated quantum‑classical systems. | First‑mover advantage in the cloud quantum market. | Capital‑intensive; competitive pressure from larger firms. |

| IonQ | Trapped‑ion qubits; offers quantum‑as‑a‑service. | Strong patents; early customer base. | Operating losses; hardware scaling challenges. |

The author notes that while these companies are more focused than the giants, they still face a “chicken‑and‑egg” problem: they need revenue to fund R&D, but without demonstrable commercial products, attracting revenue is difficult.

4.3 Emerging Startups

These are not yet publicly traded but are often mentioned in the context of potential IPOs or SPACs. The article references a link to “Quantum Computing Startups to Watch” (internal resource), highlighting that many startups rely on venture capital rather than public markets. The risk profile here is higher—high growth, high volatility, and thin earnings—and the author cautions against “pump and dump” cycles that frequently accompany tech SPACs.

5. Why the Author Advises Caution

The article concludes by laying out four core reasons why the author would avoid quantum computing stocks in 2025:

Uncertain Monetization Timeline

Quantum computing is still a “science‑first” technology. The first commercial product that actually outperforms classical computers for a real‑world problem is likely a decade or more away. This means that investors may have to wait long before seeing a return on capital.High Capital Requirements vs. Low Revenue

R&D, cryogenic infrastructure, and specialized fabrication facilities cost billions. Yet, the companies in question are still reporting negative net income, with revenue growth lagging behind the price increase.Competitive and Regulatory Barriers

Quantum technology sits at the intersection of national security and intellectual property. Some governments have begun to restrict export of quantum hardware, which can limit market access. Additionally, the race to develop quantum‑safe cryptography may push the industry toward specialized, niche solutions rather than mass‑market products.Valuation vs. Fundamentals

The author shows a chart that tracks price‑to‑earnings (P/E) ratios of quantum‑computing stocks against industry averages. While some stocks show “hyper‑inflated” P/E ratios (above 100x), the underlying earnings per share are negligible or negative. The article stresses that buying at such valuations is akin to purchasing “paper money” for a technology that isn’t proven to deliver cash flows.

6. Practical Takeaways for the Investor

- Diversify: Quantum computing should be a small, speculative portion of a broader portfolio. The author recommends no more than 5% of your investment allocation in this sector.

- Look for Complementary Bets: Companies that are building the infrastructure (e.g., cryogenic engineers, semiconductor fabs) may be more immediately valuable.

- Stay Informed on Patent Activity: Patent counts and licensing deals can provide early signals of commercialization momentum.

- Watch for Regulatory Updates: Policies around cryptography and export controls can drastically alter the competitive landscape.

- Consider a “Quantum‑Friendly” ETF: Some funds bundle several quantum‑related companies, offering a diversified, less concentrated exposure.

7. Final Thoughts

The article is not a blanket dismissal of quantum computing; rather, it is a real‑world cautionary tale. The author acknowledges the transformative potential—mentioning breakthroughs in drug discovery, climate modeling, and AI—but underscores that “the journey from lab to market is longer and more expensive than anyone expected.” By integrating the author’s insights with the supporting links, the piece equips readers with a nuanced view: quantum computing is a high‑risk, high‑reward investment, and like all speculative ventures, it should be approached with caution, thorough research, and a clear risk tolerance.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/09/why-i-wouldnt-touch-quantum-computing-stock-with-a/ ]