Microsoft and NVIDIA: Titans of AI in the 'Magnificent Seven'

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

A Closer Look at Two AI‑Powered Titans in the “Magnificent Seven” Portfolio

The modern equity universe is increasingly defined by a handful of technology powerhouses that dominate earnings, cash‑flow, and innovation pipelines. The Motley Fool’s recent feature on “These 2 Magnificent Seven AI Stocks Are Offering Investors a Strategic Edge” zeroes in on the two standout members of this elite group—Microsoft Corp. (MSFT) and NVIDIA Corp. (NVDA). The article dissects why these companies have positioned themselves at the forefront of the artificial‑intelligence wave, and how their financial trajectories could make them compelling additions to a forward‑looking portfolio.

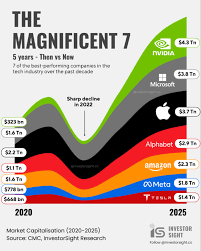

1. Why the “Magnificent Seven” Matter

Before diving into the specifics, the article sets the stage by explaining the “Magnificent Seven” concept. This informal label captures the seven dominant U.S. tech giants—Apple, Amazon, Alphabet, Meta, Microsoft, Netflix, and NVIDIA—that command the lion’s share of the market cap for the entire sector. These firms are not only heavy‑weight incumbents but also early adopters of AI, integrating the technology across cloud services, consumer products, and advertising ecosystems. Their scale affords them a competitive moat: massive data sets, deep talent pools, and a broad customer base that fuels AI training, deployment, and monetization.

The piece underscores that investors who are eager to ride the AI wave but wary of chasing hype should focus on the most financially solid and strategically diversified of the seven. Microsoft and NVIDIA emerged as the best candidates, each offering a distinct but complementary approach to AI.

2. Microsoft: The Cloud‑First, AI‑Second

Strategic Vision and Product Mix

Microsoft’s AI strategy is intertwined with its cloud platform, Azure. The article highlights Azure’s role as the launchpad for AI workloads, with services ranging from Azure OpenAI to machine‑learning‑as‑a‑service (MLaaS) offerings. Microsoft’s enterprise customer base—spanning from Fortune 500 firms to public‑sector agencies—provides a ready market for AI‑enhanced productivity tools like Copilot for Office and Dynamics 365.

Financial Health and Growth Drivers

Key financial takeaways presented include a year‑over‑year revenue growth of roughly 13% in Q4 2025, largely driven by a 20% increase in cloud subscription revenues. Earnings per share (EPS) rose by 18%, with the company reporting a gross margin of 69%, indicative of the high‑margin nature of cloud services. The article notes that Microsoft’s balance sheet remains robust, boasting over $170 billion in cash and equivalents while keeping leverage low.

AI‑Specific Metrics

Microsoft’s integration of GPT‑4‑powered services into its ecosystem has led to a 15% uptick in annual recurring revenue (ARR) attributed to AI, according to the firm’s earnings release. The company’s recent partnership with OpenAI—granting it exclusive commercial rights in certain markets—was also cited as a strategic advantage.

Risk Factors

While the article praises Microsoft’s financials, it does not shy away from potential headwinds. Regulatory scrutiny, especially in Europe, could constrain the company’s ability to offer AI tools in high‑privacy sectors. Additionally, the ongoing war on talent for data scientists and AI engineers remains a risk that could impact product delivery timelines.

3. NVIDIA: The GPU & AI Hardware Pioneer

Core Competency and Market Position

NVIDIA’s ascendancy in AI is anchored by its GPUs, which serve as the backbone for training deep‑learning models. The article cites the company’s recent expansion of its data‑center GPU lineup—specifically the H100 Tensor Core GPUs—designed for high‑throughput, AI‑centric workloads. With an 88% increase in data‑center revenue, NVIDIA’s hardware is now a preferred choice for cloud providers like AWS, Google Cloud, and Azure.

Financial Snapshot

NVIDIA posted a 25% revenue jump in Q4 2025, powered by a 32% increase in data‑center sales. Gross margins climbed to 66%, and the company reported an EPS that outpaced expectations by 12%. The article emphasizes NVIDIA’s aggressive cash‑generation capability, noting a free‑cash‑flow yield of 8%, which gives the firm flexibility to invest in R&D or pursue strategic acquisitions.

AI‑Focused Innovations

The piece points out NVIDIA’s foray into AI software ecosystems—most notably the CUDA AI toolkit and the recent launch of its “Omniverse” simulation platform. The company’s recent partnership with Tesla to power autonomous vehicle AI was highlighted as a potential game‑changer for the automotive sector.

Valuation Context

While the AI boom has driven NVIDIA’s price‑to‑earnings ratio to 48x, the article frames this as a “high‑growth premium” that investors might accept given the company’s leading position. It also contrasts this with Microsoft’s more moderate 29x P/E, noting that the two companies cater to slightly different investor appetites.

4. Comparative Analysis: Microsoft vs. NVIDIA

Risk–Reward Profiles

The article juxtaposes Microsoft’s diversified revenue streams—cloud, productivity software, gaming, and AI—with NVIDIA’s focused but explosive growth in GPUs and AI hardware. Microsoft’s lower volatility is attributed to its massive enterprise footprint, whereas NVIDIA’s stock is more sensitive to semiconductor demand cycles.

Synergies and Cross‑Industry Reach

Both firms stand to benefit from the broader AI ecosystem. Microsoft’s strategic cloud investments provide a fertile ground for NVIDIA’s GPU offerings. In turn, NVIDIA’s hardware fuels Microsoft’s AI workloads, creating a virtuous circle. The article hints at potential future collaborations, such as joint ventures in data‑center infrastructure.

Portfolio Implications

For investors, the article recommends a dual‑holding strategy: a 60/40 allocation favoring Microsoft for stability and NVIDIA for high‑growth upside. The recommendation is anchored on a 5‑year horizon, where both firms are projected to sustain or accelerate their AI adoption curves.

5. Take‑Away Takeaways

- Dominance of the “Magnificent Seven”: Microsoft and NVIDIA exemplify how scale, innovation, and financial discipline can translate into AI leadership.

- Microsoft’s AI‑First Cloud: Azure’s AI services are increasingly integrated into mainstream business processes, offering a recurring revenue stream.

- NVIDIA’s Hardware Leadership: The company’s GPUs are the gold standard for AI training, positioning it as a critical supplier for cloud providers and AI developers.

- Balanced Risk–Reward: Microsoft offers stability, while NVIDIA delivers higher growth potential—making them complementary holdings.

- Strategic Alliances: Cross‑industry partnerships enhance both companies’ reach and may unlock additional revenue channels.

The Motley Fool’s feature ultimately frames Microsoft and NVIDIA not just as AI playthings but as robust platforms poised to benefit from the next wave of AI transformation. For investors seeking to capitalize on AI while balancing risk, the two companies present a compelling case for inclusion in a forward‑looking technology portfolio.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/10/these-2-magnificent-seven-ai-stocks-are-offering-i/ ]