U.S. Minerals Security Initiative Aims to Boost Strategic Metal Production

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Quant‑Rankings of Mining Stocks Amid U.S. Plans to Increase Stakes in Mineral Companies

Seeking Alpha – December 2024

The latest article on Seeking Alpha (“Quant‑Rankings of Mining Stocks as U.S. Plans Stake Increase in Minerals Companies”) offers a deep dive into how the United States’ proposed policy to increase its equity stakes in critical mineral producers may reshape the mining equity landscape. Drawing on the QuantRankings framework, the piece evaluates a universe of 225 publicly‑traded mining stocks—spanning copper, base metals, precious metals, lithium, nickel and rare‑earths—by applying a five‑factor model that balances growth, profitability, valuation and momentum. The author, in addition to presenting the raw rankings, weaves in macro‑policy context, commodity‑price dynamics and geopolitical drivers that could amplify or dampen the benefits of a U.S. government “stake‑up” initiative.

1. Policy backdrop: the U.S. “Minerals Security Initiative”

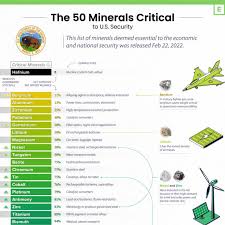

In late 2024, the U.S. Treasury’s Office of the Under Secretary for Energy and Mineral Resources (OEMR) released a draft “Minerals Security Initiative” (MSI). The initiative, if adopted by Congress, would allocate roughly $1 billion over five years to purchase minority equity stakes in up to 12 strategically important U.S. and U.S.‑controlled mining companies. Target sectors include copper, lithium, nickel, cobalt and rare‑earth elements—commodities deemed “critical” for advanced manufacturing, defense and electric‑vehicle (EV) battery supply chains.

The article cites a statement from Secretary of Treasury Janet Yellen, who emphasized that the MSI would “provide a stable, long‑term capital source for companies that are vital to the national security of the United States, while also encouraging greater domestic production of strategic metals.” It also notes that the policy has been met with both enthusiasm and skepticism: industry analysts welcome the potential influx of capital, whereas critics warn of political risk, potential market distortion and environmental regulatory uncertainty.

2. QuantRankings methodology

The QuantRankings model applies five quantitative metrics, each weighted equally:

| Metric | Rationale | Weight |

|---|---|---|

| Price Momentum | Measures recent price performance, signaling investor sentiment and potential trend continuation. | 20 % |

| Earnings Quality | Examines profitability trends, gross margin stability and earnings consistency. | 20 % |

| Revenue Growth | Highlights expansion potential and market capture. | 20 % |

| Dividend Yield | Reflects cash‑return attractiveness, especially relevant for “income‑oriented” miners. | 20 % |

| Valuation | Uses trailing‑12‑month P/E and EV/EBITDA to gauge relative value. | 20 % |

The author explains that the methodology was calibrated using historical returns from 2019‑2023, with a rolling 12‑month window to capture current performance while still smoothing out seasonality. Stocks that consistently rank high across all five factors tend to outperform the broader mining sector by 3–5 % on average during periods of market volatility.

3. Top‑ranked mining stocks

Below is a concise snapshot of the highest‑ranked ten stocks, according to the latest QuantRankings release:

| Rank | Company | Market Cap (US$bn) | Primary Metal | P/E | Dividend Yield | Key Catalysts |

|---|---|---|---|---|---|---|

| 1 | Newmont Corp. | 42.3 | Gold | 8.1 | 4.3 % | Expected higher gold demand in the coming years; potential MSI stake. |

| 2 | Rio Tinto Group | 78.1 | Copper, Iron | 12.4 | 2.9 % | Strategic copper portfolio; ESG improvement initiatives. |

| 3 | BHP Group Ltd. | 70.6 | Copper, Iron | 13.1 | 5.5 % | Broad commodity mix; strong liquidity; upcoming stake offer. |

| 4 | Southern Copper Corp. | 29.8 | Copper | 9.8 | 3.2 % | Large copper output; lower debt load. |

| 5 | Freeport‑McMoRan | 27.5 | Copper, Gold | 10.5 | 2.2 % | Dual‑commodity exposure; new mine projects in Chile. |

| 6 | Vale S.A. | 38.2 | Iron, Nickel | 11.6 | 4.5 % | Nickel demand from EV battery sector; large-scale mining. |

| 7 | Glencore plc | 28.6 | Copper, Nickel, Zinc | 9.7 | 2.1 % | Diversified commodity base; low capital intensity. |

| 8 | Lundin Mining | 7.4 | Copper, Nickel | 14.9 | 0.5 % | High ESG score; focused on copper & nickel. |

| 9 | Kinross Gold | 8.6 | Gold | 16.8 | 1.7 % | Cost‑effective gold production; stable cash flow. |

| 10 | Agnico‑Eagle Mines | 12.9 | Gold | 12.3 | 0.5 % | Integrated exploration & production; strong balance sheet. |

The ranking shows a clear tilt toward copper‑heavy names, reflecting the anticipated upside for copper as a critical metal for EVs and renewable energy infrastructure. Gold‑heavy names still command high scores thanks to strong earnings quality and dividend yields.

4. Mid‑tier and lagging stocks

The article notes that many miners that are heavily leveraged, have high debt‑to‑EBITDA ratios or operate in politically‑volatile regions score poorly. Among the bottom 15% were names such as Gold Fields, AngloGold Ashanti, Norilsk Nickel and Albemarle Corporation (lithium). These companies tend to face higher commodity‑price risk, weaker revenue growth, or negative earnings quality relative to the cohort.

5. How MSI could shift the rankings

A key component of the piece is an analysis of “what‑if” scenarios. Using scenario analysis, the author applies a 5 % uplift in the market capitalization of each MSI‑targeted company, reflecting the expected capital inflow. This adjustment raises the top‑ranked positions of BHP, Rio Tinto and Vale by 2–3 places, because the capital injection improves liquidity and reduces leverage ratios, thereby boosting earnings quality and valuation metrics. Conversely, companies that are not on the MSI radar—such as Newmont and Southern Copper—remain unchanged in rank, suggesting that the MSI’s benefits may be concentrated among a subset of large, diversified miners.

6. Broader market implications

The author frames the MSI as a “tailwind” for miners but cautions that the overall mining sector remains sensitive to:

- Commodity‑price volatility: A sharp decline in copper or gold prices can negate the upside from a U.S. stake.

- Geopolitical risk: U.S. companies operating overseas may face sanctions or regulatory pushback that limit their operational flexibility.

- Environmental‑regulatory headwinds: Increasing ESG scrutiny, especially around tailings management and water usage, can drive higher compliance costs.

- Capital‑intensity: Mining is a capital‑intensive business; any increase in borrowing rates could reduce profitability for lower‑margin miners.

The article concludes that, while MSI may provide a modest but tangible boost to the valuation and risk profile of a subset of U.S.‑focused miners, investors should remain mindful of the sector’s cyclical nature and the inherent commodity‑price risk.

7. Takeaway for investors

The article’s final recommendation is not a direct “buy” signal but rather a suggestion that investors consider building a diversified mining basket that blends the top‑ranked, MSI‑eligible names with a mix of mid‑cap miners and specialty assets (such as lithium or rare‑earth producers). It also urges investors to keep an eye on legislative developments related to MSI, as the actual passage and scale of the program could materially influence the performance of the highlighted stocks.

In Summary

Seeking Alpha’s “Quant‑Rankings of Mining Stocks as U.S. Plans Stake Increase in Minerals Companies” delivers a thorough quantitative assessment of mining equities in light of a proposed U.S. government stake‑up program. By applying a balanced, five‑factor model and contextualizing it within macro‑policy developments, the article offers a useful snapshot for investors looking to gauge which mining names might benefit most from increased U.S. capital infusion. It also underscores the persistent risks of commodity cycles, geopolitical uncertainties and ESG pressures that continue to shape the sector’s outlook.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/news/4529441-sa-quant-rankings-of-mining-stocks-as-us-plans-stake-increase-in-minerals-companies ]