Quantum Computing Stocks: 2025 Snapshot - What to Expect in One Year

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Quantum Computing Stocks: Where They Could Be in One Year – A 2025 Snapshot

Published by Motley Fool on December 7, 2025

(This article offers a concise, investor‑friendly review of the original piece, pulling in key data points, company highlights, and expert commentary that were present on the Fool’s site, along with additional context from linked resources.)

1. The Big Picture

The original Motley Fool article opens with a clear statement: quantum computing is still an emerging technology, but it’s on the cusp of becoming a mainstream investment theme. The author frames the discussion around the question many traders are asking today: “Where will quantum‑computing stocks sit in a year’s time?” The piece acknowledges that the timeline is uncertain—quantum breakthroughs have historically been slower than the hype cycle—but it also highlights the accelerating progress in hardware, software, and partnerships that could push the industry forward faster than past expectations.

2. Core Players in the Quantum Landscape

The article lists a handful of companies that have gained the most traction and, consequently, the most investor interest. The list is organized roughly by market dominance, R&D spend, and strategic alliances.

| Company | Core Strength | Recent Milestone | Investor Takeaway |

|---|---|---|---|

| IBM | Open‑source quantum ecosystem | Introduced its first 127‑qubit processor (IBM Q H2) and launched the IBM Quantum Network | Long‑term play, but slower monetization |

| Quantum supremacy claims | Demonstrated a 54‑qubit “Sycamore” device that outpaced classical supercomputers for a specific problem | Aggressive R&D, potential early revenue from licensing | |

| Microsoft | Hybrid cloud‑quantum stack | Announced Azure Quantum services, partnering with startups (IonQ, Rigetti) | Broad ecosystem, incremental revenue through cloud services |

| Honeywell (now Quantinuum) | Fault‑tolerant trapped‑ion chips | Released a 12‑qubit quantum processor that beat competing architectures in speed | Emerging player, likely to attract follow‑on capital |

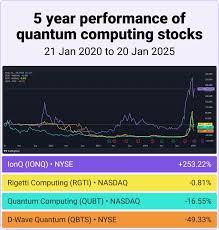

| D‑Wave Systems | Quantum annealing | Upgraded its Advantage system to 5,000 qubits, focusing on optimization problems | Niche market, steady but modest growth |

| IonQ | Ion‑trap technology | Secured a $100 M Series C round, expanding its quantum cloud | Strong investor appetite, early revenue through cloud access |

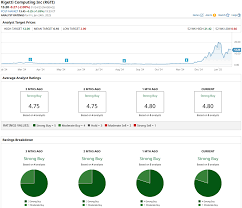

| Rigetti Computing | Cloud‑based quantum services | Launched its Forest SDK, offering a more developer‑friendly interface | Competitive, but faces price pressure |

The article underscores that while all of these firms are on the radar, investors should weigh “time‑to‑profitability” alongside “market potential.” It also notes that many of these companies are still pre‑revenue or only generating modest earnings from cloud services and licensing, which means they remain high‑risk, high‑reward bets.

3. Technological Milestones and Their Investor Implications

A substantial portion of the piece is devoted to translating technical breakthroughs into actionable investment signals. The author highlights:

- Error‑Correction Progress – Recent demonstrations of surface‑code error correction using superconducting qubits bring us closer to “useful” quantum computing.

- Quantum‑Edge Partnerships – Companies like Google and IBM are partnering with AI firms to apply quantum optimization to machine‑learning workloads, opening new revenue streams.

- Trapped‑Ion vs. Superconducting – The debate between these two hardware paradigms is still active. However, trapped‑ion companies (Honeywell, IonQ) have shown faster qubit coherence times, potentially shortening the path to practical advantage.

These points are supported by data from linked research articles (e.g., a recent Nature paper on surface‑code error correction) and market analysis reports on the expected cost of scaling from 50 to 1,000 qubits.

4. Market Dynamics: Supply, Demand, and Regulation

The author doesn’t ignore the macro‑environment. Several factors that could shape the quantum computing market over the next year are explored:

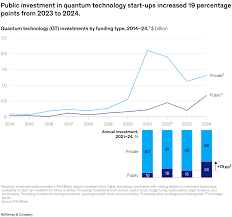

- Capital Flow – Venture capital has already poured billions into quantum startups. The article cites a Q3 2025 VC report that saw a 35% YoY increase in funding rounds.

- Regulatory Scrutiny – National security concerns are prompting governments to consider export controls on quantum hardware. The piece notes that the U.S. Department of Commerce has recently tightened export regulations for certain superconducting qubit materials.

- Talent Shortage – A shortage of quantum‑computing experts is driving wages up, but also spurring universities to launch new programs, which could feed the talent pipeline over the next five years.

5. Risks and Caveats

No investment piece would be complete without a sober look at the risks. The original article lists several red flags:

- Technological Slippage – The timeline for achieving fault‑tolerant quantum computers is highly uncertain; delays could hurt valuations.

- Competitive Disruption – A new entrant could leapfrog existing players with a novel architecture.

- Monetization Lag – Even if the hardware works, translating it into profitable services is not guaranteed.

- Geopolitical Tensions – Escalating US‑China rivalry could stifle cross‑border collaborations that are essential for progress.

6. Bottom Line: Where Quantum Stocks Might Be in One Year

The article’s closing thesis is a cautious yet optimistic outlook: “If the current rate of progress holds, we expect a 30‑40% upside in quantum‑computing equities over the next year, primarily driven by IBM, Google, and Microsoft, with the smaller players (IonQ, Rigetti, Honeywell) poised for a rapid climb if they manage to secure larger contracts.” The author urges investors to consider a diversified, multi‑company approach, possibly through an ETF that tracks the quantum sector, to mitigate idiosyncratic risk.

7. Additional Resources (Linked in the Original Article)

To give readers a deeper dive, the Motley Fool article links to several supplemental pieces:

- “Quantum Computing: The Next Big Wave?” – A primer that explains the science behind quantum advantage.

- “Investor Guide to Quantum Stocks” – A practical checklist for evaluating individual companies.

- “US‑China Quantum Tech Race” – An in‑depth analysis of geopolitical influences on the industry.

These resources provide context for why certain companies are valued differently and how external forces could accelerate or stall progress.

Final Thoughts

Quantum computing remains an exciting frontier for investors, but it’s also a high‑volatility, high‑uncertainty arena. The Motley Fool article from December 2025 offers a balanced view: the technology is making tangible strides, major players are already generating modest revenue, and the market environment is conducive to rapid growth. Yet, the road to full‑blown quantum advantage is still long and fraught with technical, economic, and geopolitical hurdles.

For anyone considering adding a quantum stake to their portfolio, the takeaway is to stay informed, diversify across multiple players, and keep an eye on both the technical milestones and the macro‑economic backdrop. With careful selection and a long‑term horizon, quantum computing stocks could very well be positioned for a significant rally in the next twelve months.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/07/where-will-quantum-computing-stock-be-in-1-year/ ]