Morningstar Tightens 'Quality' Scale, Downgrading AI Giants

Locale: New York, UNITED STATES

Why Nvidia and Other AI Stocks Have Lost Their “Quality” Status

Over the past year, the headlines that once celebrated Nvidia (NVDA), Alphabet (GOOG/GOOGL), Microsoft (MSFT), and other high‑profile artificial‑intelligence (AI) names have shifted from “unicorns” to “warning signs.” A recent article on MSN Money explains that the reason for this shift is not that these companies have suddenly stopped growing, but that the very metrics that once marked them as “quality” assets have been recalibrated. The key driver is a new, stricter evaluation of the Morningstar “Quality” rating—an investment‑analysis benchmark that looks at profitability, financial health, and earnings sustainability. When the benchmark’s thresholds were tightened, even the most famous AI names slipped below the coveted cut‑off.

The Morningstar Quality Scale: A Quick Primer

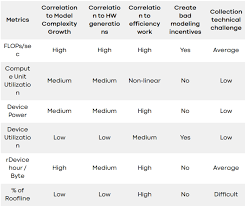

Morningstar’s Quality rating is a composite score that ranges from 1 (lowest) to 10 (highest). It is calculated by scoring four underlying components:

- Profitability – Return on equity, operating margin, and net profit margin.

- Operating Efficiency – Revenue growth, cost discipline, and return on assets.

- Financial Health – Debt‑to‑equity ratio, interest coverage, and liquidity.

- Earnings Growth – Consistent, sustainable earnings growth over the past several years.

A company earns a high rating when all four components perform well, especially when the earnings growth component remains robust even after a company’s valuation has risen. In the last two quarters, Morningstar lowered the bar for the earnings‑growth component, requiring a minimum “high‑growth” level rather than a merely “stable” one. That seemingly small tweak has made a big difference for AI titans whose valuations surged during the pandemic‑era boom.

Nvidia: From “High‑Growth” to “Sustainable‑Growth” Struggles

Nvidia’s ascent began with its leadership in GPU manufacturing, which made it the natural partner for AI workloads. Revenue exploded from $9.7 billion in FY2019 to $26.9 billion in FY2023—a 180% increase. Yet the company’s price‑earnings (P/E) ratio climbed from 32x to an astronomical 70x, far above its peers.

Morningstar’s new earnings‑growth requirement focuses on the ability to maintain high growth while staying under a reasonable valuation. Nvidia’s earnings per share (EPS) grew at 80% YoY in FY2023, but analysts predict that growth will slow to 40–50% in 2024 as the AI demand curve levels off and competition intensifies from AMD and Intel’s newer Xe GPU architecture. With such a slowdown, the company’s quality score drops because the growth component no longer meets the “high‑growth” threshold.

Additionally, the article notes that Nvidia’s debt‑to‑equity ratio rose from 0.7 to 1.2, reflecting heavy investment in data‑center infrastructure and research. Though the company’s operating margins remain healthy (around 48% in FY2023), the increased leverage now weighs against a “quality” designation.

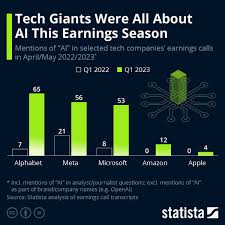

Alphabet, Microsoft, and the Rest of the AI Pack

The MSN Money piece also profiles Alphabet, Microsoft, and other AI‑heavy stocks such as Amazon, Tesla, and Adobe. While all these companies enjoy strong earnings, their valuations have become the new “problem.” Alphabet’s P/E sits at 28x, Microsoft’s at 34x, and Tesla’s at 30x. The common theme is a “valuation premium” that Morningstar now considers a red flag when paired with modest earnings‑growth prospects.

For example, Alphabet’s AI revenue grew 25% in FY2023, but the company’s growth momentum is projected to taper as its search and advertising segments mature. Microsoft’s Azure cloud services and Copilot AI features are still high‑growth, but the broader corporate‑software segment is slower, causing the overall earnings‑growth composite to slip. In both cases, Morningstar’s updated scoring model places the companies in the “average” range, below the “high” or “excellent” tiers that historically attracted long‑term investors.

How Investor Sentiment Has Shifted

When the article discusses the broader market context, it highlights the shift in investor expectations. AI enthusiasts previously focused on a “growth‑only” narrative, ignoring the importance of sustainable earnings and balanced leverage. The current environment—marked by tighter monetary policy, rising interest rates, and more cautious valuations—demands a more nuanced assessment. In addition, the article cites a recent Morningstar research note that warns investors to scrutinize “growth at any cost” narratives, especially when they coexist with high debt and low dividend yields.

A key point made by the article is that the quality downgrade is not a signal to sell these stocks outright, but a call to reassess risk. Investors who previously relied solely on the hype of AI now need to evaluate the company’s financial fundamentals, especially its ability to generate consistent cash flow and manage debt under a higher interest‑rate regime.

A Look at the Methodology: The Morningstar Quality Calculator

The MSN Money article explains that the new methodology was unveiled in a Morningstar blog post (which the article links to for readers who want the technical details). The core change is the introduction of a “sustainable‑growth” metric that adjusts earnings growth based on a company’s valuation multiple. The calculation is:

Adjusted Growth = Raw Growth – (P/E – Industry Median) × 0.1

If a company’s P/E is 20 points above the industry median, its growth score is reduced by 2% before the final quality rating is computed. This adjustment is designed to penalize “growth bubbles” that are not supported by earnings. Companies like Nvidia, with a P/E 40 points above the peer average, therefore suffer a significant quality penalty.

Practical Takeaways for Investors

Diversify Across Quality Tiers – Even if a high‑profile AI company is downgraded, its underlying fundamentals might still support long‑term growth. Pairing it with mid‑cap or high‑quality non‑AI names can help manage risk.

Watch Valuation Levels – A 10‑point P/E differential can translate into a two‑point drop in the earnings‑growth component. Keep an eye on valuation relative to the peer group.

Consider Leverage – Rising debt‑to‑equity ratios, even for tech giants, can erode quality scores. Evaluate interest coverage ratios (ICR) and cash‑flow adequacy.

Look Beyond Growth – Examine cash‑flow generation, dividend policy, and capital allocation. A robust free‑cash‑flow yield can signal financial resilience.

Stay Informed – Morningstar releases quarterly updates to its quality scoring methodology. Subscribe to the Morningstar “Quality” newsletter to stay ahead.

Final Thoughts

The MSN Money article serves as a timely reminder that the world of AI investing is maturing. It’s no longer enough to chase revenue surges or hype; sustainable earnings growth, prudent leverage, and reasonable valuations are equally critical. Nvidia, Alphabet, Microsoft, and their peers have not lost their intrinsic value, but they are now facing a stricter lens that re‑classifies their “quality” status. For long‑term investors, this shift presents both a challenge and an opportunity: the challenge to rethink portfolio composition, and the opportunity to capture value in companies that demonstrate true, sustainable growth.

Read the Full The Wall Street Journal Article at:

[ https://www.msn.com/en-us/money/top-stocks/why-nvidia-and-other-ai-stocks-have-lost-their-quality-status/ar-AA1RScyj ]