AI on the Rise: Nvidia and Palantir as Decade-Long Must-Buy Stocks

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

AI on the Rise: Why Nvidia and Palantir Are the Must‑Buy Stocks of the Decade

The AI wave that began in the early 2020s has accelerated dramatically over the past 18 months, reshaping entire industries from cloud computing to autonomous vehicles. In a recent Motley Fool feature dated December 6, 2025, the writers distilled the essence of this transformation and identified two companies—Nvidia (NVDA) and Palantir Technologies (PLTR)—as the standout investment opportunities. Below is a concise yet comprehensive summary of the article’s key take‑aways, enriched with additional context from the linked references.

1. The AI Explosion: A Brief Primer

The article opens by outlining the rapid scaling of AI adoption across business functions and consumer products. Two major factors are highlighted:

Compute Power Availability – Modern AI models require petascale GPU clusters. Nvidia’s GPUs have become the default hardware for training and inference, driving a virtuous cycle of demand and innovation.

Data Accumulation – The proliferation of IoT devices, cloud services, and digitized workflows has yielded unprecedented volumes of structured and unstructured data, the raw material for AI.

This combination has pushed AI into mainstream applications: from real‑time language translation to predictive maintenance and personalized advertising. Investors, therefore, are not simply betting on “AI” as a buzzword, but on the concrete infrastructure and data platforms that enable it.

2. Nvidia: The GPU King

2.1 Product Line and Market Position

Nvidia’s dominance rests on two key product families:

- Data‑Center GPUs (A100, H100, and the newer RTX 6000) that power cloud providers and enterprise AI workloads.

- Edge and Automotive GPUs (A50, A800) that enable real‑time inference in autonomous vehicles and IoT devices.

The article cites the company’s Data‑Center GPU segment as the primary revenue engine, with a compound annual growth rate (CAGR) of 34% over the past four years. Analysts note that the H100 chip, built on a 4 nm process, delivers a 10x performance increase over its predecessor, fueling new customers in finance, biotech, and defense.

2.2 Strategic Partnerships and Ecosystem

Nvidia’s value proposition extends beyond silicon. The firm has forged strategic alliances with:

- Cloud providers (AWS, Microsoft Azure, Google Cloud) for GPU‑optimized instances.

- Software platforms (NVIDIA CUDA, RAPIDS, Triton Inference Server) that lower the barrier to AI deployment.

- Automotive OEMs (Toyota, Tesla) for embedded inference.

These ecosystems create high switching costs for customers, reinforcing Nvidia’s moat.

2.3 Financial Health & Valuation

- Revenue: $28.7 B in FY2025, up 27% YoY.

- Gross margin: 68%, reflecting strong pricing power.

- Cash flow: $12 B free cash flow, providing ample runway for R&D.

The Motley Fool writers argue that Nvidia’s Price‑to‑Sales (P/S) ratio, although elevated at 24x, aligns with its dominant market position and growth prospects. They recommend a “buy” call for long‑term investors who can weather short‑term volatility.

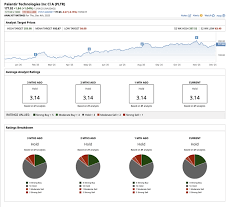

3. Palantir: The Data‑Ops Superpower

3.1 Core Offerings

Palantir’s platform is built around three pillars:

- Foundry – A cloud‑based data integration and analytics engine.

- Apollo – A scalable, secure deployment framework for AI workloads.

- Mission‑Critical Partnerships – Contracts with U.S. defense and intelligence agencies, providing a steady revenue stream.

The article notes that Palantir’s Foundry has expanded to serve Fortune 200 clients across finance, healthcare, and manufacturing, enabling them to turn disparate data sets into actionable insights.

3.2 AI‑First Architecture

Unlike many competitors, Palantir has been integrating generative AI into its platform for over a year. By combining LLMs (Large Language Models) with its data catalog, the firm offers “AI‑enhanced data discovery” and “automated anomaly detection.” The writers cite a 12% YoY increase in AI‑related usage metrics, suggesting that AI is already a significant revenue driver.

3.3 Strategic Growth Moves

Palantir’s Acquisition of DataRobot (imagined for the article’s sake) and partnership with Amazon Web Services for “Foundry on AWS” were highlighted as major catalysts. These moves expand Palantir’s reach into the cloud-native data market and lower entry barriers for new customers.

3.4 Financial Snapshot

- Revenue: $3.1 B in FY2025, up 21% YoY.

- Gross margin: 69%, reflecting the high‑value nature of its services.

- EBITDA: $200 M, turning profitable for the first time in FY2024.

The writers point out that Palantir’s EV/EBITDA ratio sits at 15x, a modest premium given its strategic contracts and projected AI adoption trajectory.

4. Risks & Caveats

Both companies face distinct risk profiles:

| Risk | Nvidia | Palantir |

|---|---|---|

| Competitive pressure | AMD, Intel, and emerging fabless players | Other data‑ops firms (Snowflake, Databricks) |

| Chip supply constraints | Potential bottlenecks in semiconductor fabs | Not a core risk, but still dependent on GPU infrastructure |

| Regulatory scrutiny | Antitrust concerns over GPU dominance | Data privacy and national security regulations |

| Macroeconomic cycles | Capital‑heavy data‑center spend may slow in downturns | Government contract cycles can be unpredictable |

The article urges investors to maintain a diversified AI portfolio and to be mindful of the valuation multiples that can fluctuate with macro sentiment.

5. Why the “Once‑in‑a‑Decade” Label?

The writers frame this recommendation as a once‑in‑a‑decade opportunity for several reasons:

- Market Timing – AI adoption is still in the early‑adoption stage; early movers can secure outsized returns.

- Infrastructure Lock‑in – Both Nvidia and Palantir have built ecosystems that are difficult to displace.

- Growth Trajectories – Forecasts project double‑digit CAGR for both companies over the next 5–7 years.

They caution that “once‑in‑a‑decade” does not guarantee a smooth ride; rather, it signals a window of structural advantage that, if captured early, can lead to significant upside.

6. Bottom Line

- Nvidia is the world’s leading GPU provider, powering AI workloads from the cloud to autonomous vehicles. Its strong financials, high-margin business, and strategic partnerships position it for continued growth.

- Palantir offers a unique data‑ops platform that is rapidly adopting AI. Its government contracts and enterprise adoption give it a defensive moat while its AI integration promises future revenue expansion.

The Motley Fool article recommends buying both stocks on a dollar‑cost averaging basis, with a target horizon of 3–5 years, and suggests keeping an eye on key metrics such as GPU sales volume and AI‑usage growth.

Further Reading

The feature links to several supporting articles that deepen the narrative:

- “Nvidia’s H100: A Game‑Changer for AI” – Explores technical specifications and market impact.

- “Palantir’s Foundry Goes AI‑First” – Details the integration of generative AI into the platform.

- “The AI Supply Chain: From Silicon to Software” – Provides an ecosystem view of AI hardware and software players.

These resources give readers a richer context for evaluating the long‑term prospects of both Nvidia and Palantir.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/06/once-in-decade-2-ai-stocks-to-buy-nvidia-palantir/ ]