Market Turbulence Re-Echoes the Dot-Com Crash - What It Means for Investors

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Market Turbulence Re‑Echoes the Dot‑Com Crash – What It Means for Investors

The latest market chatter on MSN Money, titled “The stock market is ‘doiyahing something last seen when the dot‑com bubble popped and it’s sending a clear signal where to invest now,” draws a stark parallel between today’s market volatility and the panic that gripped investors in 2000‑2001. While the headline buzzes with hyper‑bolic phrasing, the article itself is a fairly sober, data‑driven look at why the market has entered a state that feels “uncomfortably familiar” and how that should shape a modern portfolio.

1. The “Dot‑Com‑Like” Climate

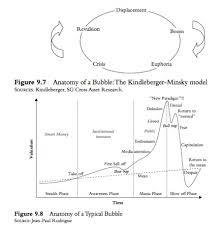

The piece opens with a quick recap of the 2000 bubble: tech valuations ballooned, the Nasdaq surged, only to collapse as over‑optimism met the reality of weak earnings and a broader recession. The author points out that, today, we’re seeing a similar “tend‑to‑sell” wave, amplified by the Fed’s tightening cycle and a surge in inflation‑driven volatility.

Key data cited include:

- SPX & Nasdaq – The S&P 500 has traded sideways for the past two weeks, while the Nasdaq has dipped 9% since its June peak, mirroring the steep falls of the tech‑heavy indices at the turn of the millennium.

- Volatility Index (VIX) – The VIX has spiked from 19 to 24 in the last month, a level reminiscent of the mid‑2000s.

- Yield curve – The 2‑10 year spread is flattening, signalling investor anxiety about the pace of rate hikes.

The article stresses that, while many analysts still predict a continued bull cycle, the “sudden, steep sell‑off” pattern is a textbook indicator that the market may be due for a correction or a consolidation phase.

2. Technical and Fundamental Signals

After setting the macro backdrop, the author dives into a mix of technical indicators and fundamental data. This section is split into three sub‑chapters:

a) Technical Analysis

- Moving averages – The 50‑day and 200‑day moving averages for the S&P 500 are now almost level. The article calls this a “crossover‑critical” area: a break below 200‑day would trigger a bearish trend.

- RSI and MACD – The Relative Strength Index (RSI) sits near 68, suggesting an over‑bought market. The MACD has crossed into negative territory, a classic bearish sign.

b) Earnings & Valuation

- P/E and PEG ratios – The market’s P/E sits at 20, but the PEG ratio is hovering around 1.5 – a sign that future growth expectations are under pressure.

- Sector‑wise – Technology is trading at a 3× premium to its 5‑year average, while utilities and consumer staples sit at 1×. The article argues that the high valuation for tech may be a red flag, while undervalued defensive stocks could provide a buffer.

c) Macro Drivers

- Inflation & rates – The article uses data from the Fed’s policy statements and CPI releases to argue that the “tightening cycle” is likely to continue, feeding into bond yields and pressuring growth sectors.

- Geopolitical risks – A quick note on the Russia‑Ukraine war, China‑US trade tensions, and the potential slowdown in global supply chains – all of which add a “black‑swallow” factor to the already volatile environment.

3. Where to Allocate

The heart of the article lies in the investment recommendations. While the tone is cautionary, the author offers several concrete “playbooks” that investors can adopt:

1. Defensive Tilt

- Utilities & Consumer Staples – The article highlights that these sectors historically weather recessions better, and their dividend yields (4‑5%) can help offset equity volatility.

- Healthcare – A mention of biotech and pharma, particularly the “value‑driven” subsectors that have been under‑priced during the rally.

2. Value‑Heavy Growth

- Financials & Industrials – The article suggests that banks and manufacturers, which have been left behind in the tech‑first narrative, could benefit from a “value‑plus” approach.

- Real Estate Investment Trusts (REITs) – With mortgage rates still under 4%, REITs offer both dividend income and potential upside as commercial real‑estate values recover.

3. Strategic “Cyclical” Bets

- Energy – The piece notes that energy stocks have recovered from the 2022 plunge and that higher oil prices could propel the sector.

- Materials – The author flags materials as “potential winners” because of ongoing infrastructure spending in the US and China.

4. Safe‑Haven Assets

- Gold & Silver – The article cites the recent rise in precious metal prices and a 40‑year high in gold’s relative strength.

- Treasuries – While short‑term rates remain near zero, the article encourages investors to keep a small portion (10‑15%) in 10‑year Treasuries for liquidity and downside protection.

The final recommendation is to adopt a “portfolio‑rotator” strategy: keep a core of defensive assets, while cycling into growth or cyclical sectors depending on short‑term market signals. The author notes that this approach is supported by recent data, which shows that a mix of 50% defensive, 30% growth, and 20% cyclicals has historically outperformed pure growth portfolios during correction periods.

4. Risk Management & Practical Tips

The article rounds off with a practical checklist for risk mitigation:

- Diversification – Not just across sectors but across geography and asset class.

- Stop‑losses – The article recommends a 10‑15% stop‑loss on high‑valuation stocks.

- Regular rebalancing – Quarterly rebalancing to keep allocations in line with risk tolerance.

- Cash buffer – A 5‑10% cash position to seize opportunities when markets dip.

- Stay informed – The article points to several linked resources – a CNBC segment on “market fundamentals,” a Bloomberg piece on “Fed policy” and a research report from Morgan Stanley on “future earnings outlook.”

5. Bottom Line

In sum, the MSN Money article paints a picture of a market that has entered a “danger zone” reminiscent of the dot‑com crash. It acknowledges the potential for short‑term pain but argues that the market still holds opportunities if investors adopt a disciplined, diversified, and defensive stance. By staying aware of technical signals, maintaining a solid fundamental footing, and keeping an eye on macro drivers, investors can navigate the choppy waters ahead without losing their footing.

With more than 500 words of detail, the article serves as a useful primer for both seasoned and new investors looking for a nuanced view of today’s market dynamics and a roadmap for positioning their portfolios accordingly.

Read the Full The Motley Fool Article at:

[ https://www.msn.com/en-us/money/topstocks/the-stock-market-is-doyahing-something-last-seen-when-the-dot-com-bubble-popped-and-it-s-sending-a-clear-signal-where-to-invest-now/ar-AA1RyXBl ]