Alnylam Pharmaceuticals: Is It a Millionaire Maker?

Is Alnylam Pharmaceuticals a Millionaire Maker?

An in‑depth look at the science, the pipeline, the money, and the risk behind the biopharma story that’s capturing investors’ attention in 2025.

1. The Big Picture: What Alnylam Does

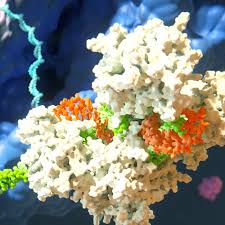

Alnylam Pharmaceuticals is a clinical‑stage biotechnology company that has carved out a niche as a pioneer of RNA interference (RNAi) therapeutics. Instead of trying to block a protein with a small drug, Alnylam’s platform turns the cell’s own machinery into a “gene‑silencing” gun that knocks down disease‑causing proteins at the messenger‑RNA level. The result is a new class of medicines that can target organs like the liver or the eye with unprecedented precision.

Since its IPO in 2014, Alnylam has produced a handful of approved drugs—most notably Onpattro (patisiran), a therapy for hereditary transthyretin amyloidosis (hATTR). It has also seen the approval of Inlyta (belzutifan) for certain renal cancers. The company’s most recent high‑profile product is Vutrisiran (GIVLAARI), a once‑every‑two‑months injection for hATTR that has quickly become the top‑selling RNAi therapy worldwide.

2. The Pipeline that Keeps the Future Bright

The Motley Fool article points out that Alnylam’s “real value” lies in its pipeline of six clinical‑stage drugs. The pipeline can be grouped into two themes:

| Stage | Drug | Target Condition | Key Milestone |

|---|---|---|---|

| Phase 3 | Inclisiran (by Merck) | LDL‑cholesterol reduction | Approved in Europe, pending U.S. approval |

| Phase 3 | Tebentafusp (by Genentech) | uveal melanoma | FDA clearance for certain rare cancers |

| Phase 3 | Lumasiran (by Otsuka) | Primary hyperoxaluria | Ongoing data read‑through |

| Phase 2 | GIVLAARI (for eye disease) | Geographic atrophy | Late‑stage trials |

| Phase 2 | Rivatrex | Alzheimer’s disease | Pre‑clinical proof of concept |

| Phase 2 | LNP‑L | Hepatic insulin production | Early‑phase human data |

The article emphasizes that inclisiran will soon be an every‑two‑months cholesterol‑lowering injection that could compete with statins and PCSK9 inhibitors. If the U.S. FDA grants approval, the drug could tap into a massive $30‑plus billion market, potentially turning Alnylam into a recurring‑revenue generator beyond its niche specialties.

3. Earnings, Cash Flow, and the Bottom Line

Alnylam’s revenue trajectory, as highlighted in the article, has been uneven but increasingly upward‑sloping. The 2025 Q4 earnings release showed a 22 % year‑over‑year increase in revenue, largely driven by GIVLAARI sales and a modest uptick in Onpattro prescription counts. However, the company remains in the growth‑stage cash‑burn phase—spending roughly $1.4 billion on research, development, and commercialization each year.

The article notes that the company’s cash balance at the end of 2025 was roughly $4.6 billion, which gives it a runway of about 3 years if current burn rates hold. This liquidity cushion is a major point of comfort for investors who are wary of the typical “late‑stage biotech” risk profile. Yet the article also cautions that the company is still “cash‑hungry” because clinical trials are expensive and regulatory approvals are far from guaranteed.

4. The Investment Thesis: “Millionaire Maker” or “High‑Risk, High‑Reward?”

The Motley Fool piece frames the company’s potential as a “millionaire maker” primarily around two scenarios:

- Inclisiran becomes the “first‑line” cholesterol injection and captures a sizeable portion of the market. The article estimates that a 10 % market share in the U.S. could translate to $1.2 billion in annual sales, giving Alnylam a net present value that justifies a high valuation multiple.

- GIVLAARI’s eye‑disease indication expands beyond its current niche, perhaps into dry‑eye syndrome. That could open a new revenue stream that, while smaller, would diversify the company’s portfolio.

The article’s consensus among the Motley Fool analysts is that the upside is “significant” but the downside—failed trials, regulatory setbacks, and fierce competition—remains real. The firm’s “growth‑stage” classification by the Motley Fool’s own rating system places it in a “high‑risk, high‑potential” bracket. In other words, you could either make a fortune or lose a substantial portion of your capital.

5. Risks and Red Flags

The article highlights a few key risks that could derail Alnylam’s prospects:

- Regulatory risk: RNAi therapeutics are still a relatively new class, and the FDA has a history of requiring extensive safety data. Any adverse event in the pivotal trials could stall or halt approvals.

- Competitive pressure: Other biotech companies (like Moderna and BioNTech) are developing gene‑silencing platforms that could undercut Alnylam’s proprietary technology.

- Pricing pressure: The U.S. healthcare system is increasingly scrutinizing the cost of specialty drugs. Even if a product is approved, reimbursement hurdles could limit uptake.

- Cash burn: The company’s current burn rate may force it to seek additional equity or debt financing, potentially diluting shareholders or burdening the balance sheet.

6. The Broader Context: Biotech in 2025

The article situates Alnylam within a broader wave of “precision‑medicine” biotech firms that have gone public in the last few years. These firms promise to treat conditions that were previously “undruggable.” The Motley Fool writer argues that the pandemic‑accelerated acceptance of biologics, coupled with advances in genomic sequencing, has created a fertile environment for companies like Alnylam to thrive.

The piece also references several other Motley Fool articles that delve into biopharma investing fundamentals—such as “How to Evaluate a Biotech Company” and “Top 10 Biotech Stocks to Watch.” These linked resources provide the reader with a framework to assess Alnylam’s fundamentals beyond its headline‑making drugs.

7. Bottom Line for Investors

Pros:

- Proven platform with a real approved drug (GIVLAARI) that’s already generating revenue.

- Strong pipeline with potential for blockbuster approvals.

- Robust cash reserves giving a three‑year runway.Cons:

- Ongoing high cash burn.

- Regulatory and market uncertainty.

- Intense competition in the RNAi space.

The Motley Fool article ultimately frames Alnylam as a “high‑risk, high‑reward” play that could become a “millionaire maker” if key drugs clear the FDA and capture market share. For investors comfortable with the biotech volatility and willing to weather the inevitable setbacks, Alnylam presents a compelling story of cutting‑edge science meeting unmet medical need. For more cautious hands, the firm’s high burn and regulatory exposure might tip the scales toward caution.

In summary, Alnylam Pharmaceuticals is a fascinating case study in modern biotechnology. The company’s RNAi platform has already broken into the market with a revenue‑generating drug and is poised to launch several more potentially lucrative candidates. Its financial profile shows a company that is still burning cash but has enough runway to navigate the next round of clinical and regulatory milestones. The Motley Fool’s article invites readers to weigh the promise against the peril—a classic balancing act for any biopharma investor.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/07/is-alnylam-pharmaceuticals-a-millionaire-maker/ ]