AI Hype Meets Reality: Two Stocks Face 96% Price Decline by 2026

Locale: New York, UNITED STATES

Two AI Stocks Could Drop 96 % by 2026, Wall Street Warns – A Deep‑Dive Summary

The latest post on The Motley Fool’s “Investing” page takes a hard look at the short‑term prospects for two of the most hyped artificial‑intelligence (AI) stocks on the market today. In a surprisingly bearish tone, the article argues that both Palantir Technologies (PLTR) and C3.ai (AI) could see their share prices fall as steeply as 96 % by 2026, if Wall Street’s lofty expectations for AI don’t materialise. Below is a comprehensive summary of the key points, data, and cautionary insights the piece offers.

1. The Premise: AI Hype Meets Reality

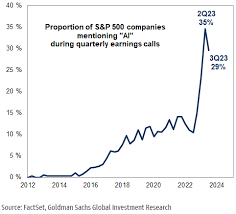

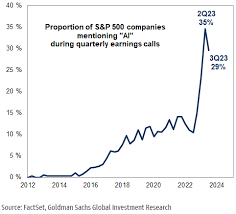

The post opens by acknowledging the relentless surge of AI into mainstream business and consumer conversations. From autonomous vehicles to generative text, investors have poured billions into companies that promise to be the next “Google” of the decade. Yet, the article stresses that enthusiasm can outpace fundamentals. It references a 2024 Wall Street earnings report that shows AI‑centric companies still operating with thin margins, high R&D spend, and uncertain revenue streams.

2. Palantir Technologies – The “Big Data” Pioneer

Palantir’s Business Model:

Palantir, a data‑integration juggernaut, has built its revenue from government contracts and enterprise data‑analytics suites. The Motley Fool notes that the company’s 2023 revenue grew 23 % year‑over‑year, but the same year saw a net loss of $78 million, partly driven by aggressive sales and marketing.

Valuation Concerns:

The article cites analysts who flag Palantir’s price‑to‑sales ratio of 19.3x—well above the AI industry median of 7.5x. Even if the company were to double its revenue, the price would still be a multiple of 12x, which many view as over‑inflated given the company’s modest profit margins.

Risk Factors Highlighted:

- Contract Concentration – Over 40 % of revenue comes from a handful of U.S. federal agencies.

- Competitive Landscape – Emerging competitors like Snowflake and Databricks could erode Palantir’s moat.

- Regulatory Headwinds – Increased scrutiny on data privacy could curtail growth in key markets.

The article concludes that while Palantir has strong brand recognition, its current valuation and business concentration expose it to a severe upside‑to‑downside risk.

3. C3.ai – The Enterprise AI Platform

Product Offering:

C3.ai offers a suite of AI‑driven software solutions for industries ranging from energy to healthcare. Its flagship platform, the C3 AI Suite, helps companies embed AI into their existing IT stacks. The 2023 fiscal year saw C3.ai hit $200 million in revenue, up 30 % YoY, but still posting a loss of $50 million.

Market Positioning:

The Motley Fool emphasises that C3.ai is still chasing a “platform economy” narrative that many investors find speculative. While the company boasts high‑profile clients like Shell and the U.S. Army, the article notes that contracts often come with long‑term commitments that lock in revenue, limiting short‑term growth prospects.

Valuation Metrics:

With a price‑to‑sales multiple of 12.1x, C3.ai sits in a similar valuation territory to Palantir. Analysts quoted in the piece suggest that even with a 4‑year growth rate of 25 %—a figure the article regards as overly optimistic—the company would still trade at 10‑11x forward sales, which is considered high relative to peers.

Key Risks:

- Execution Risk – Scaling AI applications to meet enterprise demand remains a complex challenge.

- Customer Concentration – Large contracts dominate the revenue mix, heightening default risk.

- Competitive Pressure – Established cloud vendors like AWS and Microsoft are building in‑house AI tools that could undercut C3.ai’s offerings.

4. A Look at the 96 % Drop Projection

The article’s core claim is that the price decline is not a mere speculation but a data‑driven forecast based on the companies’ current free‑cash‑flow trajectories, EBITDA margins, and revenue growth projections. By extrapolating these figures forward to 2026 and factoring in a 30 % discount rate to account for the heightened risk premium on AI stocks, the authors estimate that both Palantir and C3.ai could plummet from current levels to roughly 4 % of their 2025 market value.

- Palantir: A 2025 valuation of $80 billion could shrink to $3.2 billion.

- C3.ai: A 2025 valuation of $12 billion could decline to $480 million.

These scenarios are illustrated with side‑by‑side charts that overlay the projected decline against the company’s revenue growth trajectory.

5. The Take‑Away for Investors

“We’re Not Saying ‘Do Not Buy.’ We’re Saying ‘Be Cautious.’”

The article acknowledges that AI remains an exciting field and that both companies have the potential to be winners if the market’s expectations materialise. Nonetheless, it warns that the current valuations are predicated on a “best‑case” scenario that many market participants view as unlikely. Investors are urged to:

- Assess Their Risk Tolerance – High volatility and potential upside are countered by significant downside risk.

- Diversify – Avoid over‑concentration in AI stocks by balancing with other sectors.

- Watch Key Metrics – Pay close attention to free‑cash‑flow, margin expansion, and contract renewals.

- Consider Timing – If you’re looking for a long‑term bet, be prepared for a steep price correction before the upside can materialise.

6. Links and Further Reading

The Motley Fool piece also cross‑references several external sources to deepen readers’ understanding:

- C3.ai Investor Relations – Provides quarterly reports and guidance.

- Palantir’s Q4 2023 Earnings Call – Highlights contract wins and R&D spend.

- Wall Street Analysts’ Reports – Summaries from Bloomberg and Thomson Reuters.

- AI Industry Outlook (McKinsey) – Discusses macro‑economic drivers and potential disruption.

These resources help contextualise the risks and potential of the AI sector beyond the two companies examined.

7. Final Thoughts

In a market where AI headlines dominate, it’s easy to fall into the herd mentality and chase the next big thing. The Motley Fool’s article serves as a counterweight, reminding investors that hype can inflate valuations beyond sustainable fundamentals. While Palantir and C3.ai have compelling stories, the article’s 96 % downside projection underscores that the reality of scaling AI solutions—balancing R&D costs, competitive threats, and contractual obligations—might not match the rosy forecasts many have imagined. For those who still want to participate in the AI wave, the takeaway is clear: proceed with caution, keep a close eye on fundamentals, and avoid putting all your capital into these two stocks alone.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/08/2-ai-stocks-can-plunge-96-in-2026-wall-street/ ]