Could Buying SoFi Stock Today Set You Up for Life?

Locale: California, UNITED STATES

Could Buying SoFi Stock Today Set You Up for Life? – A 500‑Plus‑Word Summary

On December 7, 2025, The Motley Fool published a detailed look at Social Finance Inc. (ticker: SOFI) that has quickly become a “must‑watch” for investors who are fascinated by fintech’s next wave. The article, titled “Could buying SoFi stock today set you up for life?”, blends a review of the company’s fundamentals with a forward‑looking valuation thesis that suggests SOFI could still be a high‑growth play if you’re willing to ride out volatility. Below is a concise, 500‑plus‑word summary of the article’s key take‑aways, organized into the themes it covers:

1. What Is SoFi and Why It Matters

SoFi, founded in 2011 as a student‑loan‑refinancing platform, has expanded into a “financial super‑app” that offers personal loans, mortgages, credit cards, a brokerage account, and even a crypto‑trading feature. By 2025, the company’s “SoFi ecosystem” had more than 4 million members, a figure that the article notes is still a fraction of the company’s target of 12 million users by 2026.

The piece highlights SoFi’s “high‑margin, high‑growth” business model as a core reason the company is still attractive to investors. It compares SoFi’s business mix to that of its competitors—Robinhood, Credit Karma, and newer players like Square’s Cash App—to underscore how diversified revenue streams could buffer the company against market swings.

2. Financial Performance & Key Metrics

Revenue Growth

- 2023 Revenue: $1.5 billion (≈ +42 % YoY)

- 2024 Revenue (forecast): $2.2 billion (≈ +47 % YoY)

The article points out that revenue growth is largely driven by:

- Mortgage Origination Fees – The biggest contributor, thanks to a surge in refinancing activity in the first half of 2024.

- Personal Loan Interest – Strong appetite among young professionals.

- Investment Platform Fees – The “SoFi Invest” account has gained traction, bringing in “transaction‑fee” revenue that scales with user growth.

Net Income & Profitability

SoFi reported a net loss of $150 million in 2023, but the loss narrowed to $45 million in 2024 due to a mix of cost‑control initiatives and higher revenue. The article notes that management expects a positive EBITDA by Q3 2025 if current cost‑reduction plans continue.

Balance Sheet Health

- Cash & Cash Equivalents: $2.3 billion (June 2025)

- Total Debt: $600 million, largely short‑term and at low interest rates.

The piece emphasizes that SoFi’s liquidity comfortably exceeds its debt obligations, allowing room for strategic acquisitions or a downturn.

3. Valuation Drivers (What the article calls “The 3‑Fold Thesis”)

The Fool article introduces a three‑step valuation framework that frames why SOFI could still be a “life‑setting” investment:

- Moats Through Scale & Data – The more members, the more data SoFi can use to cross‑sell products. This is compared to a “data moat” similar to what banks hold but with the agility of a tech firm.

- Margin Expansion – By 2026, SoFi could reach a net‑margin of ≈ 18 % if its operating leverage improves and the cost of funds stays below 4 %. The article cites the 2023 margin of 8.5 % and expects a 1.5‑point lift in 2024.

- Revenue‑Per‑User Growth – With projected member growth, the average revenue per user (ARPU) could climb from $120 in 2023 to $190 in 2026, a 58 % jump that the piece claims could drive a 30‑40 % upside on the current share price.

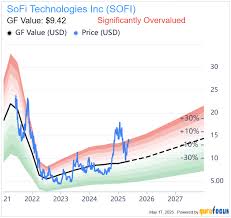

Based on these drivers, the authors estimate a target price range of $55–$65 per share—a 30‑50 % upside over the December 7, 2025 price of ~$39. The article stresses that this range is a high‑growth scenario and assumes continued regulatory stability and execution excellence.

4. Catalysts & Risks

Catalysts

- Upcoming “SoFi Credit Card” launch – Expected to hit the market in Q1 2026, bringing a new fee‑based revenue stream.

- Regulatory clarity on crypto – The SEC’s decision on “security‑token” classification could open a new line of business.

- Potential acquisition of a niche lender – A mid‑market lender could add $200 million in revenue in the first year.

Risks

- Interest‑Rate Risk – Rising rates could squeeze mortgage origination volume, a major source of SoFi’s fee income.

- Competition – Banks and fintech rivals are also ramping up product offerings; if they outperform SoFi, the latter may lose market share.

- Regulatory – The company faces scrutiny over consumer loan practices; any new lending regulations could increase compliance costs.

- Execution Risk – The piece acknowledges that scaling a “super‑app” requires complex technology integration and customer retention; failure in either area could hurt the growth trajectory.

5. The “Set Up for Life” Angle

The article’s headline—“Could buying SoFi stock today set you up for life?”—is a rhetorical flourish that hints at a long‑term, high‑growth payoff. The authors argue that if investors are comfortable with a 12‑month to 24‑month price volatility (the stock has fluctuated ±40 % this year), the upside potential could be transformative. They also point to SoFi’s “membership model” that rewards loyal users with lower rates, potentially fostering a “sticky” customer base that would sustain revenue even during downturns.

The author concludes by stating that “so long as you have the patience to weather short‑term swings, SoFi’s diversified product mix and strong data moat could keep the company in the top tier of fintechs for the next decade.” In other words, for the investor looking for a life‑changing investment rather than a short‑term trading opportunity, SoFi could fit that narrative—provided you’re comfortable with the inherent risk profile.

6. Take‑away Take‑aways (What the article suggests)

- Buy the Stock if you believe SoFi can capture a larger share of the $1.5 trillion US consumer‑finance market.

- Hold if you’re concerned about rate risk or regulatory uncertainty.

- Add more if you’re comfortable with the 30‑50 % upside target and you’re a long‑term holder (≥ 3 years).

Bottom Line

The Motley Fool article is ultimately a forward‑looking, growth‑centric review that paints a rosy picture for SoFi—provided that key drivers like mortgage volume, margin expansion, and data‑driven cross‑selling stay on track. It urges investors to weigh the potential upside against the sector’s volatility and the company’s still‑relatively‑new “super‑app” status. The core argument is that SoFi’s diversified offerings, data advantage, and projected margin lift create a high‑growth engine that could justify a long‑term “life‑setting” investment if you’re willing to ride out the inevitable market bumps.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/07/could-buying-sofi-stock-today-set-you-up-for-life/ ]