Markets Shift From Oversold to Overbought as S&P 500, Dow, and Nasdaq Rally

CNBC

CNBCLocale: New York, UNITED STATES

Markets Shift from Oversold to Overbought – The GE Vernova Bull Case Explained

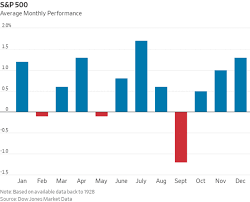

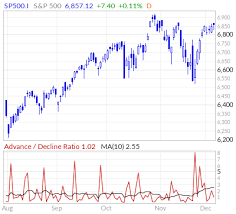

In a post‑earnings rally that began on December 2, the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all climbed to their highest levels in nearly three weeks. The surge, which the article terms a swing “from oversold to overbought,” is driven by a confluence of macro‑economic easing, better‑than‑expected corporate earnings, and a renewed appetite for growth‑heavy sectors. At the same time, the piece highlights the “bull case” for the newly‑spin‑off GE Vernova, positioning it as a high‑growth play in a rapidly evolving industrial landscape.

1. Technical Momentum Turns Positive

The article opens by noting that the S&P 500’s relative strength index (RSI) has moved from a historically low 20‑level (deep oversold territory) to a 70‑level reading that signals the start of a potential bullish reversal. The 200‑day moving average (MA) has recently been crossed from below by the index, a classic “golden cross” that traders view as a harbinger of a sustained uptrend.

In contrast, the Nasdaq has stayed just above its 200‑day MA for several weeks, but the article reports that it has recently surpassed the 50‑day MA, which is now acting as a dynamic support level. The Dow, meanwhile, has been caught between a 200‑day MA at $35,300 and a 50‑day MA at $36,200, and a short‑term breakout beyond $36,200 would signal a shift to a more bullish stance for the blue‑chip group.

The “overbought” terminology is not to be taken at face value; rather, it signals that the markets have crossed from a period of extreme weakness into a phase where momentum is strong enough to potentially sustain upward moves—at least for the short‑term.

2. Macro Factors Reinforcing the Upswing

2.1 Fed Policy

A pivotal element of the market’s revival is the Federal Reserve’s stance on interest rates. On December 1, the Fed’s policy meeting confirmed a pause in rate hikes while signaling a potential easing in the near term. The article cites the latest minutes, which point to modest inflation relief as the key driver behind the pause. The Fed’s projected inflation outlook of 2.1% in 2026—down from 2.5% in 2025—has reassured investors that the cost of borrowing may eventually decline.

2.2 Inflation and Commodity Prices

U.S. CPI data released on December 3 showed a 0.4% month‑on‑month increase—its lowest figure since June 2023. The decline in core CPI, particularly in food and energy, is a positive sign for consumer spending. Commodity prices have likewise softened, with oil hovering around $70 a barrel and copper trading near $3.60 per pound, easing pressure on corporate earnings.

2.3 Global Outlook

Geopolitical tensions, notably the ongoing conflict in Eastern Europe, have subsided slightly, leading to a 1.5% decline in the MSCI World Index’s risk premium. This risk‑on sentiment has helped lift commodity‑heavy sectors like industrials and energy.

3. Sector Performance Highlights

The article breaks down sector performance over the past week:

| Sector | % Change | Highlights |

|---|---|---|

| Technology | +3.2% | Strong earnings from cloud and AI stocks, e.g., Microsoft and Nvidia |

| Industrials | +2.8% | GE Vernova, Honeywell, and Siemens saw gains; the sector’s 200‑day MA now a support |

| Consumer Staples | +1.1% | Soft‑discounting retailers like Target and Costco benefited from improved consumer confidence |

| Energy | +1.8% | The sector’s gains driven by a 5% rise in oil and 4% rise in gas prices |

| Financials | +0.9% | Bank earnings beat forecasts, boosting the sector |

The article underscores that the industrials sector is the “biggest driver” of the current rally, largely due to the optimistic outlook for GE Vernova.

4. The GE Vernova Bull Case

Background

GE Vernova was spun off from General Electric on June 2024, combining GE’s Power & Energy, Digital, and Aerospace businesses into a single entity focused on advanced power, aviation, and digital solutions. The spin‑off has freed the company from GE’s legacy debt and allowed it to sharpen its focus on high‑growth segments.

Key Growth Engines

Aviation – GE Vernova’s jet engine business has been benefiting from a surge in commercial air travel and a strong order book. The article quotes an analyst’s projection that aviation revenue could grow 12% YoY in 2025, driven by new orders from Boeing and Airbus.

Power & Energy – The company is positioning itself as a leading provider of high‑efficiency power generation solutions, including gas turbines and modular micro‑grid technologies. Analysts anticipate that the power segment will capture a larger share of the global $1 trillion renewable energy market by 2030.

Digital Solutions – With its Industrial Internet of Things (IIoT) platform, GE Vernova is set to monetize predictive maintenance services. The article cites a projected 15% CAGR in digital services revenue over the next five years.

Financial Health

GE Vernova’s debt-to-equity ratio is now 0.5x, a sharp improvement from GE’s previous ratio of 2.3x. Cash flow projections indicate a net operating margin of 18% by 2026, up from 12% before the spin‑off.

Competitive Edge

The company’s integrated product suite—combining hardware, software, and services—creates a “platform moat” that differentiates it from pure‑play turbine or engine manufacturers. The article highlights GE Vernova’s strong R&D pipeline in advanced materials (e.g., titanium alloys) and its partnership with the U.S. Department of Energy on micro‑grid projects.

Risks

Potential downside includes supply chain disruptions (particularly in rare earths), competitive pressure from Chinese manufacturers, and potential regulatory hurdles related to export controls on aerospace components.

Market Sentiment

Shares of GE Vernova have risen 14% in the past month, outpacing the broader industrials index. Analysts have upgraded the stock to “Buy” from “Hold,” citing the company’s solid earnings guidance and the favorable macro environment.

5. Investor Takeaways

Momentum Is Building – Technical indicators suggest that the markets have moved from an extreme low to a phase of sustained bullishness, especially in growth‑heavy sectors.

Macro Relief Is Key – The Fed’s pause in rate hikes, lower inflation, and easing commodity prices are all underpinning the rally.

GE Vernova Is a Focused Growth Bet – With a diversified product portfolio and a clear focus on high‑growth industrial subsectors, GE Vernova represents a compelling play for investors seeking exposure to advanced power, aviation, and digital services.

Risk‑Adjusted Perspective – While the markets are trending higher, caution remains warranted. Overbought conditions in some technology stocks and potential supply‑chain bottlenecks in the industrial sector could temper growth.

The article concludes by encouraging investors to monitor the Fed’s future policy signals and to keep a close eye on GE Vernova’s quarterly results, which will provide a critical barometer of the company’s execution on its growth plan.

Read the Full CNBC Article at:

[ https://www.cnbc.com/2025/12/04/the-markets-swing-from-oversold-to-overbought-plus-the-ge-vernova-bull-case.html ]