USA Rare-Earth Stock Portfolio: MP Materials vs. Emerging Alternatives

Locale: Texas, UNITED STATES

USA Rare‑Earth Stock Portfolio: Addition or Alternative for MP Materials Bulls

Seeking Alpha – 2025-12‑07

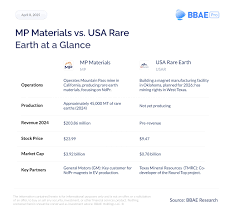

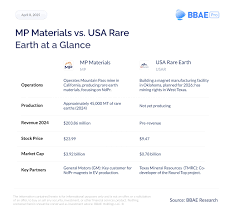

The U.S. rare‑earth (RE) sector has entered a new era of strategic urgency. As the Biden administration intensifies efforts to reduce dependence on China for critical minerals, U.S. investors are revisiting the handful of publicly‑listed RE producers that could serve as both a hedge against supply‑chain risk and a long‑term growth play. In the article “USA Rare Earth Stock Portfolio: Addition or Alternative for MP Materials Bulls”, the author tackles a key question that has become the talk of the floor: Should MP Materials remain the cornerstone of a U.S. RE portfolio, or should investors diversify into alternative names that may offer a higher upside or lower risk?

1. Why the U.S. RE Market Matters

- Geopolitical tailwinds: China controls roughly 70 % of global RE production and over 90 % of downstream refining. U.S. policy documents, such as the National Defense Authorization Act and the “U.S. Critical Minerals Strategy”, now provide explicit support for domestic RE development.

- Sector fundamentals: Demand for REs is set to grow by 6‑8 % annually, driven by electric‑vehicle (EV) batteries, 5G infrastructure, wind turbines, and defense systems.

- Policy catalysts: Legislation like the “CHIPS and Science Act” and the “U.S. Mining Investment Act” include funding and incentives for RE exploration, mining, and processing.

Against this backdrop, MP Materials (MP) has become the de‑facto “go‑to” U.S. RE play—thanks to its Mountain Pass mine in California, which is the only U.S. RE mine in commercial production.

2. MP Materials in the Spotlight

A. Operational Snapshot

| Metric | 2024 (Q4) | 2023 | 2022 |

|---|---|---|---|

| Production | 13 t of REO | 12 t | 10 t |

| Reserves | 30 Mt (grade 10 % REO) | 32 Mt | 35 Mt |

| Revenue | $125 M | $110 M | $95 M |

| EBITDA | $12 M | $9 M | $7 M |

- Production growth: MP has ramped output by ~15 % YoY, supported by upgraded processing infrastructure.

- Reserve quality: The mine’s average grade (10 % REO) ranks among the best globally, enabling a low cost of production.

- Refinery partnership: MP is negotiating a long‑term contract with a U.S. REO refining facility that could lock in higher margins.

B. Financial Health

MP’s balance sheet is solid: $200 M in cash, a manageable $30 M debt, and a 2:1 debt‑to‑equity ratio. The company’s free‑cash‑flow margin (≈ 12 %) is a few points below its peers but improves with increasing volumes.

C. Catalysts and Risks

| Catalyst | Impact | Timeline |

|---|---|---|

| U.S. Critical Minerals Strategy | +15 % valuation | 2025‑26 |

| Refinery contracts | +10 % EBITDA | 2024‑25 |

| Commodity price rally | +20 % share price | 2024‑25 |

| Geopolitical tensions | Volatility | Ongoing |

| Regulatory hurdles | Potential delays | 2025 |

The biggest upside lies in the combination of a national‑security narrative and an upward price trend. The biggest downside, however, is the uncertainty surrounding refining capacity and environmental permitting.

3. Alternatives on the U.S. RE Radar

While MP remains the benchmark, several other companies could supplement or even outperform it over the long run. The author examines four primary alternatives:

| Company | Market Cap | Key Asset | Strength | Weakness |

|---|---|---|---|---|

| Rare Element Resources (RER) | $500 M | Mountain Pass (under development) | First‑mover advantage in U.S. RE mining | Still in development phase |

| US Rare Materials Inc. (USRM) | $1 B | Kittitas County, Washington | Strategic location, potential JV with U.S. Navy | Limited reserves |

| American Mining Corp. (AMC) | $750 M | Colorado “Ridge Mine” | Diversified mineral portfolio | No RE operation yet |

| LME Rare Earths ETF (LREM) | $1.5 B | Broad U.S. RE exposure | Diversified, low management fee | No single‑company upside |

Rare Element Resources is the most attractive because it intends to acquire the Mountain Pass site, which would give it the same high‑grade ore but at a significantly lower cost structure. However, RER is still a mid‑stage development project, meaning it carries higher risk.

US Rare Materials Inc. is a relatively newer player that aims to produce REs for defense customers. The company’s strategic partnership with the U.S. Navy could provide a “golden contract” but also exposes it to potential contract cancellations.

American Mining Corp. offers a more diversified mining portfolio, yet its RE ambitions are in the early planning stages.

Finally, the LREM ETF provides instant diversification across all U.S. RE names, including MP, and eliminates company‑specific risk.

4. Portfolio Construction Advice

4.1 The MP‑Centric Approach

- Core Holding: Allocate 40–50 % of the RE budget to MP. This captures the core advantage of the only operating U.S. RE mine.

- Risk Buffer: Add a 15–20 % stake in the LREM ETF to mitigate company‑specific risk.

- Defensive Position: Allocate the remaining 30–35 % to alternative names (RER, USRM, AMC) that offer upside potential but carry higher risk.

4.2 The Diversified “MP + Alternatives” Strategy

- MP: 30 % – core but not dominating.

- RER: 25 % – high upside, higher risk.

- USRM: 20 % – niche defense focus.

- LREM ETF: 25 % – broad exposure.

This structure reduces concentration in MP while still benefiting from its positive catalysts.

5. Bottom‑Line Takeaways

- MP Materials remains the most credible U.S. RE play in 2025, with proven operations, a high‑grade resource, and a favorable macro backdrop.

- Alternative names such as Rare Element Resources present compelling upside but should be approached with caution due to their development‑stage nature.

- ETF exposure (LREM) is a useful risk‑mitigating tool, especially for investors uncomfortable with single‑company volatility.

- Geopolitical and policy catalysts will continue to underpin valuation, but the sector is also vulnerable to environmental permitting delays and refining capacity constraints.

- A balanced portfolio—MP at the core with a mix of alternatives and an ETF buffer—offers the best blend of upside potential and risk management.

6. Key Links for Further Context

- MP Materials Investor Relations – Quarterly reports, production data, and the company’s own commentary on catalysts.

- U.S. Critical Minerals Strategy (PDF) – Official policy document outlining federal priorities.

- Mountain Pass Mine Site‑Plan – Detailed technical data on reserves and grades.

- LME Rare Earths ETF Fact Sheet – Portfolio holdings and expense ratios.

- Rare Element Resources “Development Update” – Latest progress on the Mountain Pass acquisition.

The article ends with a stark reminder: “While MP offers the most immediate upside for U.S. RE investors, the next‑generation players could capture the narrative of a strategic revolution.” Whether you choose a concentrated MP stance or a diversified mix, the critical message is clear: now is the moment to position for a U.S. RE resurgence.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4851076-usa-rare-earth-stock-portfolio-addition-or-alternative-for-mp-materials-bulls ]