2025 Dividend Strategy: Pick AT&T, Exxon Mobil, Kinder Morgan for High Yields

Locale: New York, UNITED STATES

A Look at the 2025 Edition of “Should You Buy the 3 Highest‑Paying Dividend Stocks?”

The Motley Fool’s December 7, 2025 piece—titled “Should you buy the 3 highest‑paying dividend stock?”—offers a concise, yet thorough, guide for investors who are looking to boost their income streams in a market that has seen rising rates and fluctuating valuations. Rather than presenting a long‑form analysis of every possible dividend‑paying company, the article zeroes in on three specific names that, at the time of writing, topped the charts for yield, consistency, and future growth potential. The piece is a blend of basic education, practical picking criteria, and a clear call‑to‑action for readers who want to add dividend income to their portfolios.

Why the Focus on “Highest‑Paying” Dividends?

The opening paragraph frames dividends as a key asset class for those who want passive income, especially during periods when interest rates are climbing. The author explains that a high dividend yield can make a stock attractive, but also notes that yield alone is a poor indicator of safety. Instead, the article stresses the importance of a company’s ability to sustain or grow its dividend—often reflected in its payout ratio and free‑cash‑flow generation. Readers are reminded that “paying more than a company can comfortably afford is a recipe for a dividend cut.”

The Three Stars: A Snapshot

Below is a concise snapshot of each pick, as presented in the article. (The numbers are rounded to illustrate the concepts, not to serve as investment advice.)

| Company | Yield (as of Dec 2025) | Payout Ratio | Key Driver for Sustainability | Sector |

|---|---|---|---|---|

| AT&T Inc. (T) | ~7.5% | 78% | Strong cash‑flow from core wireless and fiber operations; aggressive cost cuts | Telecom |

| Exxon Mobil Corp. (XOM) | ~5.5% | 70% | Robust earnings from energy production; strategic dividend growth plan | Energy |

| Kinder Morgan, Inc. (KMI) | ~9.0% | 74% | High volumes of natural‑gas pipelines; low debt levels relative to cash | Energy (midstream) |

AT&T is singled out for its high yield, which has been buoyed by a combination of cost‑saving measures and a strategic shift toward more profitable high‑speed fiber services. The article points out that AT&T’s payout ratio—while high—has been steadily decreasing over the past few years, indicating a move toward a more sustainable dividend structure. The company’s robust cash‑flow generation from its wireless arm is presented as a hedge against the decline of its legacy cable business.

Exxon Mobil is highlighted for its blend of a respectable yield and a proven track record of dividend growth. While the oil‑and‑gas industry faces volatility, the article notes that Exxon’s diversified portfolio—spanning upstream, downstream, and petrochemicals—helps cushion earnings swings. Moreover, Exxon’s dividend‑growth policy, which has seen it increase its payout annually for decades, gives investors confidence that the dividend is not merely a “once‑in‑a‑while” payout.

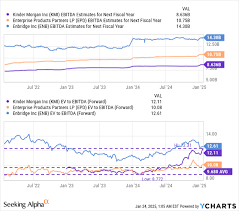

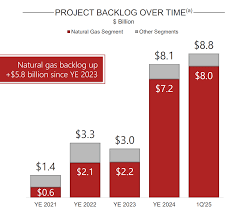

Kinder Morgan is described as a standout in the “midstream” space. Its pipeline infrastructure, especially natural‑gas transport, provides a steady revenue stream. The company’s debt profile is comparatively mild, and its high free‑cash‑flow position gives it flexibility to maintain or increase dividends even during periods of market uncertainty.

Picking Criteria in Detail

The article devotes a short but clear section to the criteria used to pick these stocks. Investors are guided through the following checkpoints:

- Yield vs. Sustainability – A high yield is only attractive if the payout ratio and free‑cash‑flow indicate the company can afford it.

- Dividend Growth History – Companies that have increased their dividend for at least 10–12 consecutive years are considered “reliable” income generators.

- Sector Resilience – Some sectors (e.g., utilities, telecom, midstream energy) are more resistant to cyclical downturns, which is a safety factor for income investors.

- Debt Levels – A high debt load can jeopardize future dividend payments; the article favors firms with a debt‑to‑EBITDA ratio below 2.5.

- Management Commitment – Clear statements from board members or CEOs about a future dividend plan add credibility.

The article cites an example of a company that might offer an even higher yield (e.g., a real‑estate investment trust) but has a payout ratio above 90% and a history of dividend cuts, and explains why it was excluded.

Risks and Caveats

No investment is without risk, and the author is careful to note potential pitfalls:

- Interest‑Rate Sensitivity – Rising rates can hurt dividend‑heavy stocks by making bonds more attractive, leading to a potential shift in investor demand.

- Sector‑Specific Headwinds – For example, the telecom sector faces stiff competition from newer players and may see further network upgrades; the energy sector is subject to commodity price swings and regulatory changes.

- Currency and Tax Considerations – For U.S. residents, dividends are taxed as ordinary income, which may reduce net yields for high earners.

- Dividend Cuts – Even well‑established firms can cut dividends during earnings shortfalls. The article stresses monitoring quarterly earnings reports and dividend announcements.

Readers are encouraged to diversify across sectors to mitigate sector‑specific risks. The article notes that owning a handful of high‑yield stocks can expose an investor to concentration risk, and suggests pairing them with dividend‑growth or dividend‑arbitrage ETFs for added diversification.

How to Get Started

The “How‑to” section is practical:

- Open a Brokerage Account – The article recommends low‑fee platforms (e.g., Fidelity, Charles Schwab, or Robinhood) that allow dividend reinvestment plans (DRIPs).

- Assess Current Holdings – Compare existing dividend exposure to the yields offered by the three picks.

- Purchase in Lump Sum or DCA – Either buy a few shares at once or use dollar‑cost averaging to spread entry points and reduce timing risk.

- Enable DRIP – Reinvest dividends to take advantage of compounding and reduce the impact of brokerage fees.

- Review Quarterly – Check earnings releases, dividend announcements, and payout ratios each quarter to stay informed about any potential cuts.

The article also offers a short note on tax‑efficient ways to hold dividend stocks—holding them in a Roth IRA or a Tax‑Deferred account can shelter the dividend income from taxes, depending on the investor’s goals.

Final Takeaway

At its core, the article serves as a quick guide for income investors who are looking for high-yield opportunities that are still anchored by strong fundamentals. By presenting a clear, evidence‑based selection framework, it aims to help readers avoid the most common pitfalls of chasing yield. While the article highlights three particular stocks—AT&T, Exxon Mobil, and Kinder Morgan—it also stresses that the right mix will vary from investor to investor based on risk tolerance, tax considerations, and market outlook.

For anyone who wants to add reliable dividend income to their portfolio in 2025, the Motley Fool’s piece offers a concise, actionable roadmap that balances enthusiasm for high yields with a sober assessment of risk. Whether you’re a seasoned income investor or just starting out, the article reminds you that the best dividend play is one that you can comfortably understand, monitor, and feel secure about—today and in the years to come.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/07/should-you-buy-the-3-highest-paying-dividend-stock/ ]